The Zweig Breadth Thrust (ZBT) is a variant of the IBD Follow-Through day pattern, but on steroids. Steven Achelis at Metastock explained the indicator this way [emphasis added]:

A “Breadth Thrust” occurs when, during a 10-day period, the Breadth Thrust indicator rises from below 40% to above 61.5%. A “Thrust” indicates that the stock market has rapidly changed from an oversold condition to one of strength, but has not yet become overbought.

According to Dr. Zweig, there have only been fourteen Breadth Thrusts since 1945. The average gain following these fourteen Thrusts was 24.6% in an average time-frame of eleven months. Dr. Zweig also points out that most bull markets begin with a Breadth Thrust.

Monday’s strong NYSE breadth has pushed the ZBT Indicator into buy signal territory. Call this a “what’s the limit on my credit card” buy signal for investors, though not necessarily traders.

Here is how the market has behaved after ZBT buy signals.

The history of ZBT buy signals

The chart below shows the history of ZBT buy signal in the last 20 years.

Even though the sample size was small (N=4), we can make the following observations:

- The market was always higher a year later, which is consistent with Marty Zweig’s original observation

- The market came back down to re-test and undercut the lows after the ZBT buy signal in three (60%) of the instances.

Here are the histories of the individual buy signals. Here is the one from May 14, 2004. Tactically, the market weakened for two days after the buy signal. It proceed to rally, and then pulled back to test and undercut the previous low three months later.

The ZBT buy signal of March 18, 2009 was the best performing signal of the last 20 years. The market still saw a three day tactical pullback and consolidation after the signal.

The buy signal of October 14, 2011 only saw a brief one day pullback after the buy signal. However, the market did weaken and correct within two months.

The buy signal of October 18, 2013 was one of the strongest momentum thrusts of the ZBT buy signals in the last 20 years. The market kept rising and never looked back. When the corrective pullback occurred 3 1/2 months later, the decline did not weaken sufficiently to test the previous low.

The buy signal of October 8, 2015 was the weakest of the ZBT signals in the last 20 years. The market consolidated and pulled back within a week, rallied, and weakened again to undercut the previous lows within a three month period.

In conclusion, the ZBT buy signal is a rare display of bullish positive momentum. While investors have to be prepared for some short-term setbacks, the odds favor higher stock prices in a 12-month time frame.

The short-term outlook for traders is a bit more challenging. While the breadth thrust does signal positive momentum, stock market indices have risen into resistance zones where the rally may stall.

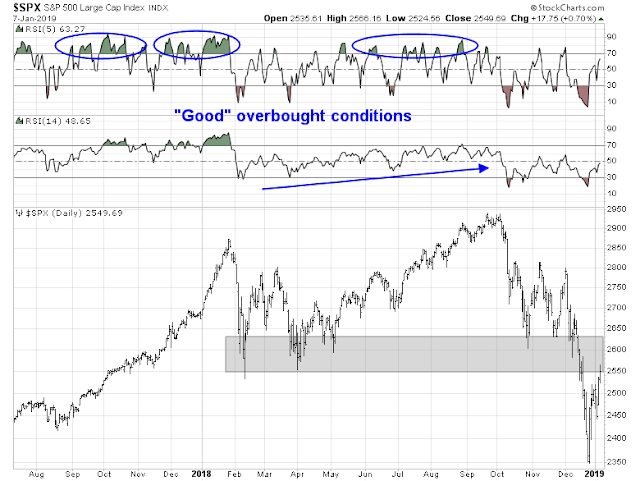

The challenge for the bulls is to push the market into overbought territory and keeping it there. In the past, such “good overbought” conditions has led to sustained advances. The one constructive condition is the market isn’t even overbought on the 5-day RSI yet.

Disclosure: Long SPXL

Thanks for the update, Cam. Is your ‘inner investor’ starting to build up long positions, following this ZBT buy signal? How is this consistent with a coming recession?

Inner investor drawing up a buy list here. I was too busy today to go through everything and execute.

As a point of clarification, when I referred to “undercutting”, I meant a pullback to the ZBT buy signal level, which occurred in 2011, though the market did not decline enough to test the old lows then.

ZBT is like flip coin https://www.mcoscillator.com/learning_center/weekly_chart/zweig_breadth_thrust_signal/

Negative things, NYMO and CPC.

Cam, does this change the ‘trend model’ signal from sell to buy?

I’ll have to spend some time looking at where the markets were in terms of forward P/E, CAPE, etc. when prior ZBT signals occurred. At least a few were when markets were very cheap, which is great, but markets aren’t so cheap at the moment. I guess I’m saying given the small sample size and even smaller sample of signals at moderate P/E levels, it’s hard to want to trust the signal. Feels a lot like data mining. Even if we do believe it, why not wait until a retest (March maybe) to load up?

Thanks Cam – please let us know if the trend and long term signal is back to bullish.

The trend model is now neutral.

The Ultimate Market Timing model isn’t going to turn bullish until the market starts crossing some moving averages. Remember that this is a long term asset allocation model that doesn’t change direction for years.

Here is one reasonable scenario:

1. spx to 2600 would move RSI5 to 70, overbought.

2. vix gets below 200DMA, so we can get to series of overbought RSI5. If vix does not help. It is hard to get a series of overbought RSI5.

3. A series of overbought RSI5 would get us to spx 2800. This number is widely known as the current Elliott Wave mid target.

4. Then depends on all factors, we could consolidate between 2600-2800. This range would be consistent with 2018 whole year’s range.

5. If coming earnings season produces bad forecast or no Sino-American deal, then next level would be spx 2100-2200. This is current Elliott Wave bottom number. I just report here.

6. Positives: HYG back in range.

7. Negative: NYMO from -109 to 95 in a very short period of time and out of BB.

7. Wildcard: vix falling but stalled today right below 50DMA. It needs to continue to fall below 200DMA for spx to move up.

8. Fundamentals negative: spx in 2600-2800 to push PE ratio back up, in conflict with falling forward estimate.

Overall looks like a trading range in the future. If bad things happen, then get used to seeing it ramp down.

I really appreciate the heads up, Cam, but I am not prepared to bet the house (or my credit card limit) based on the ZBT buy signal.

Four positives in six decades does not a 95% reliable signal make, IMO. Simple statistics and such.

Another example: Chris Ciovacco recently pointed out that 2018 was an outlier — two 10%+ corrections in a year almost never happens. But to base an unhedged investment on this never happening is to be LTCM, or like picking pennies in front of a steamroller.

@ Hagan, @Matthew, @Ingjiunn, and @Martin,

Excellent points brought up by all you guys as counter points to ZWT as pointed out by Cam.

I agree, P/E, Earnings, Trade war, Brexit, are all in the future still. Though we might feel getting left out, with all the other fundamentals when taken into account, I think us Investors can have a slight wait-and-see attitude.

Ken, has pointed out some great things for being bullish, but like he said, he is “Chicken bull with tight stops.”. I am not sure if the conviction is there in the market for it to go higher. Of course as Cam always says, “overbought markets can become more overbought.”

I think Q1 will hopefully make things clearer. Especially, when the earnings estimate start coming down.

Just my $0.02

I agree. The ZBT is only one dimension of analysis. While technical analysis like ZBT signals capture much about market psychology, it doesn’t capture everything about the markets. There are a lot of other moving parts, such as earnings season, the trade war, credit market deterioration, and politics – starting with a possible declaration of a State of Emergency by Trump over Wall funding.

Contrarian comment here….listen to the bearishness…people are afraid…me too lol which is why I am placing small option bets….my gut says we have not seen the high but it may be a bumpy grind

Hi Cam, today I rather sold 2/3 of my portfolio (in CFD) most of US ETF are not available for EU citizens :-(, due to high NYMO. It was mentioned by Urban Carmel (tweets). Thank you if you mention it in your Wednesday post. GJ. Petr