Mid-week market update: In light of the recent market turmoil, I thought I would publish my mid-week market update early. The Shanghai Index moved into bear market territory by declining 20% on a peak-to-trough basis overnight. The SPX is testing its 50 day moving average (dma). Europe is struggling as both the FTSE 100 and Euro STOXX 50 have violated near-term support levels.

Is this a warning that the bull is dying?

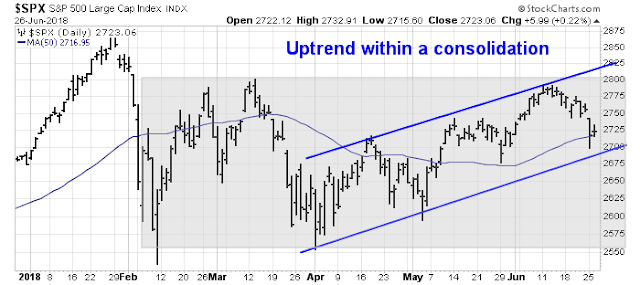

I have some good news and bad news. The good news is the bull market is still alive. The SPX is undergoing a correction, but it remains in an uptrend within a range-bound consolidation that began in February.

The bad news is traders need to expect more short-term pain.

Market internals still bullish

In addition to the above chart showing the SPX in an uptrend, a number of market internals indicate that the bears have not gained control of the tape. Consider, for example, the relative performance of defensive sectors. Consumer Staples stocks are still in a multi-year downtrend relative to the market, and Utilities appear to be trying to be bottom, but they have not shown any inclination to stage a relative breakout beyond their consolidation band.

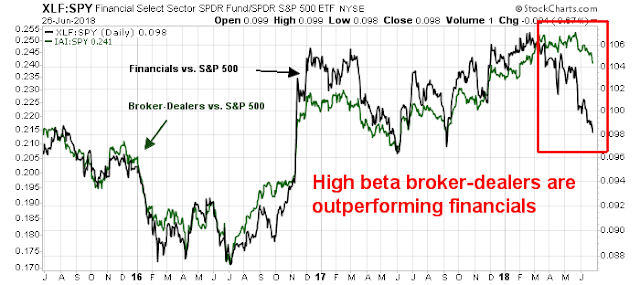

One other clue about market direction comes from the performances of Financial stocks. The sector has been lagging the market lately, but why are the high-beta broker-dealers beating the sector? Broker-dealer stocks have historically tracked the returns of the sector in general, and in a bear phase, you would expect them to show greater weakness. Instead, they are outperforming.

In short, these charts indicate that the intermediate term outlook for US equities remain bullish.

Bottoming, but not THE BOTTOM

Here is the bad news. Monday’s selloff created too much technical damage for the market to make a V-shaped bottom. In particular, market leadership such as large cap NASDAQ stocks are rolling over. The NASDAQ 100 has breached an uptrend on both an absolute basis and relative to the market.

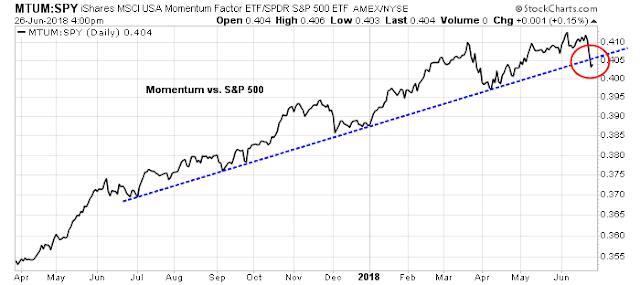

Equally serious is the breach of the relative uptrend by the price momentum factor. Assuming that the bull run were to continue, we will have to see a transition from Tech and momentum to another market leader.

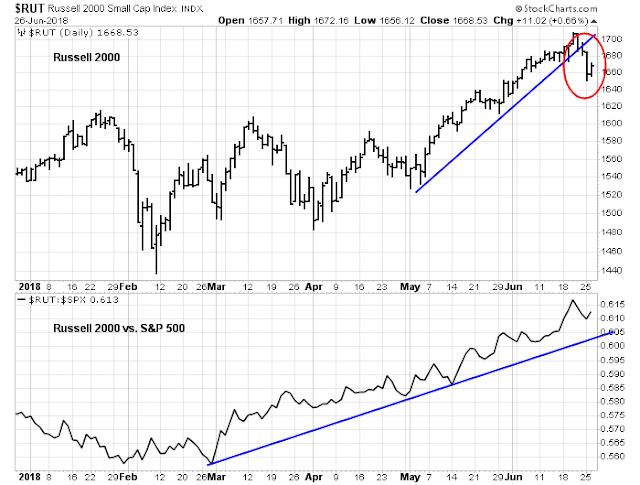

One candidate for continued leadership are small caps. The performance of small cap stocks, which have also been market leaders, is more constructive. The Russell 2000 violated an uptrend line on an absolute basis, but its relative uptrend remains intact. However, small caps comprise a tiny weight off the overall market, and they cannot carry the rally by themselves.

While the intermediate term structure is still bullish, these trend violations have created sufficient technical damage that cannot be fixed with a simple V-shaped bottom. The most likely scenario is the market undergoes several days of choppiness that end with a second test of the previous bottom before it can stage a sustainable rally.

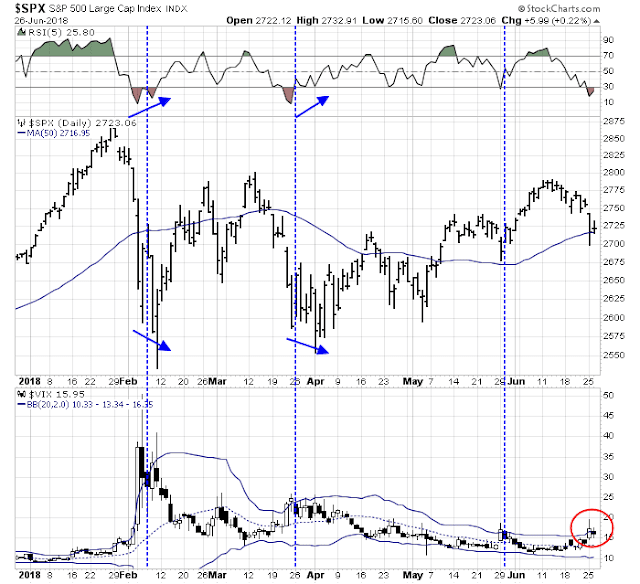

I tweeted the signs of a setup for a buy signal on Monday when the VIX Index rose above its upper Bollinger Band (BB). Past reversions of the VIX below its BB have been good trading buy signals. I would also point out that in two of the three past instances when these signals have occurred in the last six months, the market weakened after the buy signal to retest the previous lows before rallying. The retests were accompanied by positive divergence on RSI-5.

The combination of bullish intermediate backdrop, high levels of technical damage, and short-term oversold readings all point to a similar pattern of rally and retest of the lows.

Subscribers received an email alert that my inner trader had covered all of his shorts and taken an initial (small) long position. He will be waiting for the retest in the next few days to add to his long positions.

One possibility for the timing of a retest of the lows could occur this coming Monday. In the past, the stock market has weakened on days when the Fed has conducted its Quantitative Tightening programs when securities were allowed to mature and roll off its balance sheet (see Offbeat Thursday and Friday forecasts). According to the New York Fed, the next big QT day is June 30, 2018, when over $30b of Treasury securities will be maturing. As June 30 is a Saturday, the market effect would not be seen until the next trading day, which is Monday.

My inner trader has taken profits on his shorts and taken a long position, but the commitment is not large.

Disclosure: Long SPXL

Cam, I’m confused about why the Fed retiring the loan doesn’t result in less money on the street. If a guy didn’t roll over his note with a bank, doesn’t the bank have to get the money from someone else ? Doesn’t the government, also, when the Fed doesn’t repurchase ?

I am also somewhat perplexed about the mechanism for down markets on QT days, but empirically it has been happening this year.

The maturing Collaterised assets/bonds of the US Federal reserve, are not held in the accounts of banks, but the Fed’s balance sheet, as I understand.

The Fed is simply letting these notes mature and not use the proceeds to buy more bonds.

2. You are right, the US government will need to find a buyer to sell more of its debt, as the US Fed steps away. For the next year, projections are of about 1 Trillion $ of new paper that will come on the markets, for which the Fed is not a buyer. This will, down the line, raise yields (or sell off in the bond markets) on US bonds; a day of reckoning is very likely coming in the bond market.

The charts are not comforting. You are saying the bull is alive because we cannot prove him dead yet.

The emerging markets have crashed; I am told the global yield curve has inverted. Can the US escape?

What is new this week is Trump increasing his anti-global rhetoric as he campaigns for GOP candidates. Chances on him backtracking to a more business friendly policy message is just about zero from here to November.

Yesterday he said that all international buyers of Iranian crude must reduce that to zero by November or face retaliation. That is a broad group of countries that include Europe and Japan, supposed allies not just China and Asia. This is sending oil prices higher which raises gasoline which is like a tax on American consumers who can spend less on other things.

The unintended economic consequences of his actions are building.

Thanks for the answers concerning the QT effect. I’m persuaded that the effect is probably caused by the government needing to replace this money quickly.

Anyone planning to use the effect to time a trade should be aware that the government already knows the Fed won’t be rolling over, so beware that the timing should allow for this. I’m saying it could be Friday or Monday.

Cam; you will notify us when you add to the starter long position. yes?