I had been meaning to write about this, but I got distracted by the latest bout of market volatility. With the debt ceiling problem defused, but no sign of a DACA deal, the issue of immigration is a worthwhile issue to consider for investors.

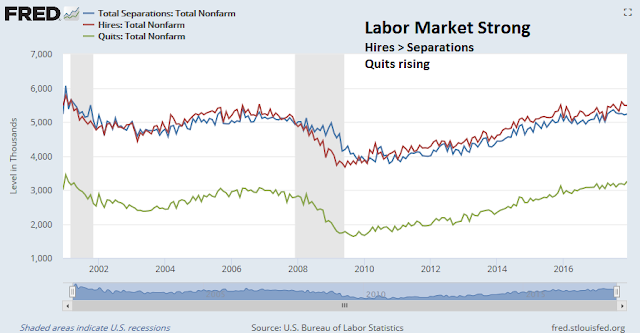

As I analyzed the latest JOLTS report and last week’s January Jobs Report, I reflect upon how Trump’s immigration policy may affect labor markets, and the secondary effects on monetary policy. The latest JOLTS report shows that hires remain ahead of separations, and the quits rate is rising, which are indicative of a strong labor market.

Immigration is a politicized issue and it is beyond my pay grade to express an opinion on the correct approach. Nevertheless, I can still estimate the likely effects of any policy, and its market effects.

Donald Trump’s philosophy to immigration is clear. Build a Wall to keep them out. Deport the illegals, starting with the DREAMers, or DACA eligible individuals residing in the United States.

Deporting the DREAMers

Imagine if all DACA eligible residents were to be deported tomorrow. What would be the labor market effects?

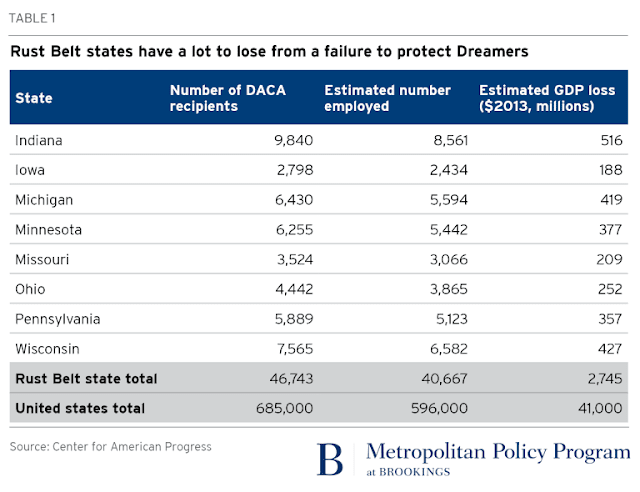

Let’s dive into the numbers. The Migration Policy Institute (MPI) estimates that there are 1.9 million people who are potentially eligible for DACA, and 1.3 million who are immediately eligible. John C. Austin at Brookings believes that deporting DREAMers would be a blow to the rust belt states, as immigrants have been the only source of population and business growth. Notwithstanding Austin’s opinions, we can calculate a DREAMer employment rate of 87% (=596K/685K) from his statistics.

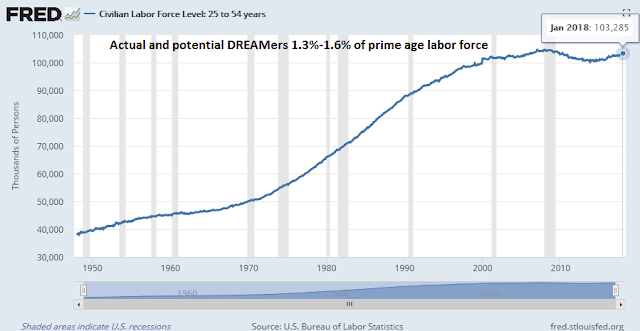

FRED shows that the prime age civilian labor force, which is the age demographic that DREAMers fall into, is 103 million. Therefore DREAMers represents the labor force 1.3% to 1.6% of the prime age labor force after applying their employment rate (87%) to the total number of potential DREAMers (1.3 to 1.9 million) in the US.

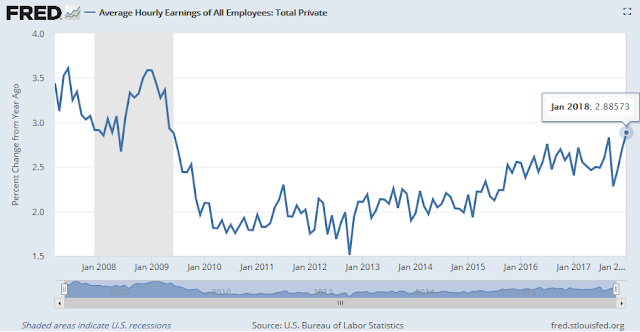

The January headline unemployment rate print was at 4.1%. Removing all of the DREAMers would crater the unemployment rate to a sub-3% level. Sure, such a policy would create more opportunities for locally born Americans, but the market was already freaking out when Average Hourly Earnings rose to 2.9%. What would a 2-handle on the unemployment rate do to Fed policy, inflation expectations, and interest rates?

Rising labor shortages

Notwithstanding the Trump administration’s policy toward DREAMers, or DACA recipients, Michael Cembalist of JP Morgan Asset and Wealth Management voiced concerns over looming labor shortages over another facet of immigration policy.

The Administration has chosen to end the Temporary Protected Status program for El Salvador, Honduras and Haiti. As shown in the map, the highest concentrations of such people live in California, Texas and Florida, states which are in the process of rebuilding following Hurricane Harvey, Hurricane Irma and a series of wildfires. According to the National Association of Homebuilders, there are substantial labor shortages and project backlogs in Florida and Texas, where more than 30% of construction workers are foreign-born. Bottom line: ending the TPS program could exacerbate backlogs further, and result in higher wage inflation and/or a slower pace of economic recovery.

Similarly, the end of TPS status for El Salvador, Honduras and Haiti would create more opportunities for locally born Americans, but what are the likely effects on Fed policy?

Don`t forget one of the key causes of the Crash of 1987 was a series of staccato rate hikes that eventually tanked the stock market.

If you are convinced that the Fed will act, consider that even uber-dove Charlie “don’t raise until you see the whites of inflation’s eyes” Evans of the Chicago Fed stated in a recent speech that:

In contrast, suppose inflation picks up more assuredly, as many expect. Then, we still could easily raise rates another three or even four times in 2018 if that were necessary. And I would support such a faster pace if the data point convincingly in this direction.

The corporate response to labor market conditions

While I understand the philosophy behind Trump’s immigration policy, which is to keep them out and create more job opportunities for locals, how well would it actually work? What are the likely responses by employers, and the Federal Reserve?

I have already demonstrated that restricting labor supply in the current environment would likely result in a hawkish monetary policy response in the face of rising labor cost and cost-push inflation. How would employers respond? As Cembalist pointed out, such a policy would create labor shortages and push up wage rates in sectors where labor could not be offshored, such as construction. How would such a policy affect the corporate sector?

Even before the onset of these immigration proposals, the corporate sector had already responded with the formation of labor monopsonies. Marshall Steinbaum (see paper) found a high degree of monopsony concentration by federal antitrust standards.

Then there is the globalization effect to consider. Branko Milanovic has pointed out in his “elephant graph”, the last few decades of globalization has seen strong wage growth in the emerging market economies as jobs have gone offshore, and the top 1% have also won as they reaped the fruits of improved margins from globalized supply chains. The losers have been the middle class in the developed economies, and members of subsistence economies who could not participate in the globalization wave.

Could Trump’s immigration policy reverse the effects of globalization? As this chart of the global partners of the Boeing 777 shows, the parts of the aircraft are assembled all over the world.

As multi-nationals have supply chains that stretch around the world, it would be difficult to believe that rising wage rates and tight labor markets in the US would provide a significant net benefit to the suppliers of American labor. Still, these policies are likely to have the following effects that would be equity bearish:

- A more hawkish monetary policy from the Federal Reserve;

- Rising inflation and inflation expectations, which would put downward pressure on the USD;

- Margin squeeze from higher labor costs; which may be partially offset by

- Rising wages and higher household consumption; and

- More offshoring.

The net effect would see higher interest rates, lower operating margins for domestically exposed industries, and P/E compression because of the competition from higher rates.

More, not less offshoring??