Are you getting nervous about the FANG stocks? The debut of the FANG+ futures contract may mark a top for this group, as it presents an easy vehicle for hedgers to short these high beta stocks. But don’t despair, consider this chart of the relative performance of a high beta group that is washed-out, and may present an opportunity for investors and traders who missed out on the FANG move.

Would you buy this?

Thought about Biotechs lately?

The mystery chart is the relative performance of Biotech stocks (IBB) against the market. As the chart shows, the group is testing a key relative support zone when compared to the market. Unless the outlook deteriorates significantly, relative downside risk appears to be limited.

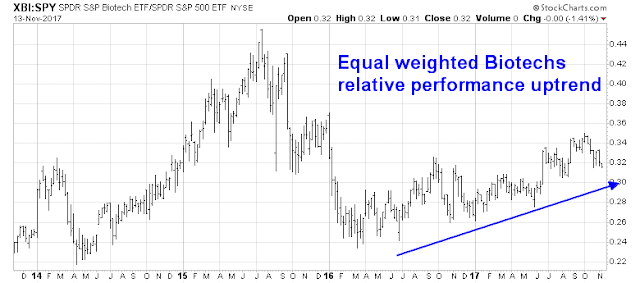

There are a couple of reasons to consider the Biotech stocks. First, the group is experiencing a bullish breadth divergence. IBB is a cap weighted ETF, which means that the largest capitalization stocks dominate the performance of that security. By contrast, the equal weight XBI Biotech ETF is performing much better.

There is also fundamental support for this group. The Morningstar fair value estimate shows that Biotech stocks are about 9% undervalued.

In conclusion, here is a high-beta group that is undervalued and washed-out. What more could anyone ask for?

Great insight!

Debt. Debt. Debt. Cam is this China’s way of extending their runway? Will it work?

http://www.scmp.com/business/banking-finance/article/2119300/china-ease-ownership-limits-foreign-joint-ventures-finance

http://www.zerohedge.com/news/2017-11-07/perpetual-notes-chinas-new-way-hide-debt-call-it-equity

Thought you might want to update us on China.

That’s one way. The Chinese are inviting foreigners to buy into their banking system, but I have no idea why anyone in their right mind would want to given the large amount of unreported non-performing loans that are on the books.