Mid-week market update: A number of major averages hit fresh all-time highs this week. For traders and investors, the question is whether the market is likely to continue to grind upwards while flashing a series of “good overbought” signals, or will it pull back?

Here are the bull and bear cases.

Fresh highs are not bearish

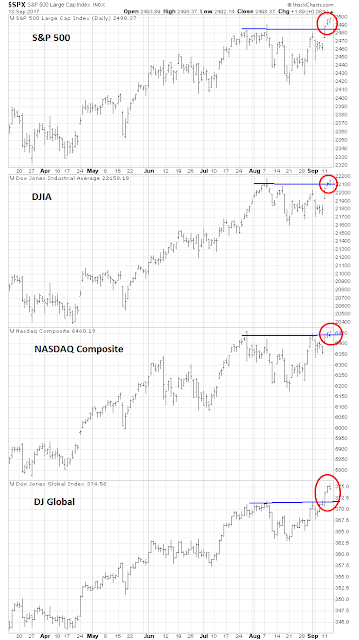

The most convincing bull case is “fresh highs are not bearish”. Major market indices hitting new highs include the SPX, DJIA, NASDAQ Composite, and DJ Global Index.

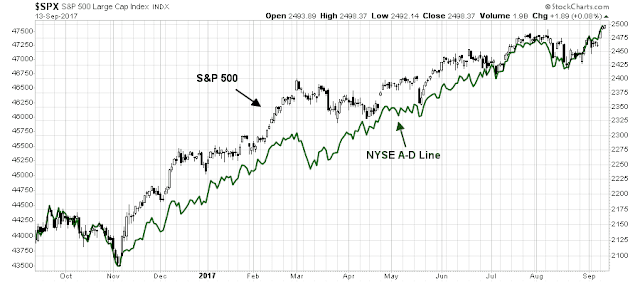

Moreover, the all-time highs in the SPX has been confirmed by the action of the NYSE Advance-Decline Line.

Bearish non-confirmation

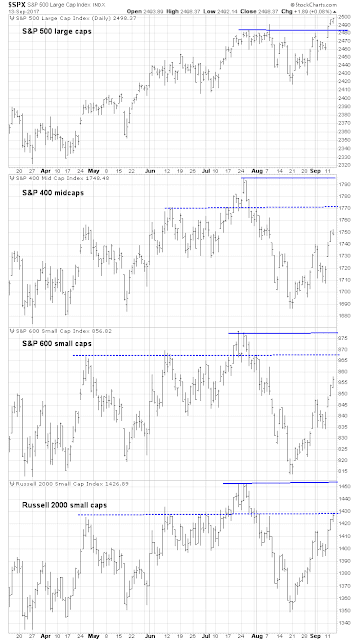

On the other hand, other indicators of breadth and risk appetite have not confirmed the fresh highs. While the large cap SPX has made new highs, the mid and small cap indices are lagging, which is a cautionary message about the generals leading but the troops not following the charge.

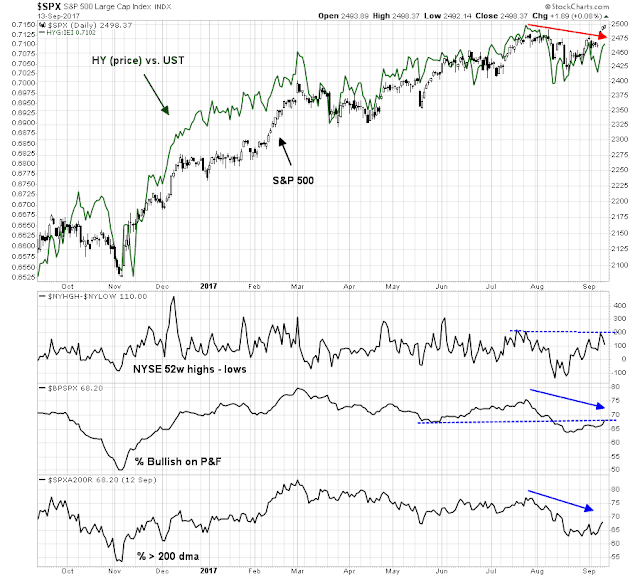

There are also negative divergences in credit market risk appetite, as measured by the relative performance of junk bonds, as well as net NYSE highs-lows, % bullish and % above 200 dma indicators.

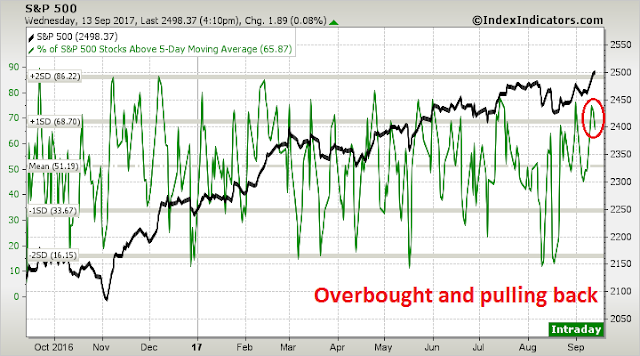

These breadth indicators from Index Indicators also show that the market was overbought on multiple time frames and begun to pull back. Here is % above 5 dma (1-2 day time frame).

The % above 10 dma indicator (2-5 day time frame) is telling a similar story.

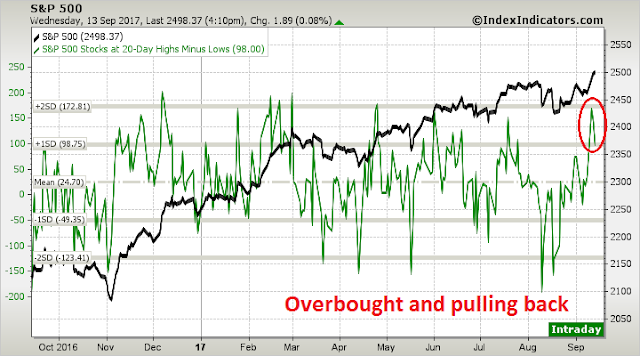

So is the net 20 day highs – lows.

These readings suggest to me that the market’s assault on the new highs is likely to fail in the short term. The market action in the last few weeks is that of a defined uptrend changing into a trading range. This is evidence of a period of consolidation. The next key test will occur in the likely pullback. Will it make a lower high, or will it weaken to test the August lows?

Wait for Mr. Market to give us an answer.

Disclosure: Long SPXU

” Will it make a lower high, or will it weaken to test the August lows?”

I think you mean a higher low not a lower high or maybe it doesnt matter…

POTUS is making deals with democrats, without the GOP, that may eventually open the door for tax reforms. Whether the democrats cooperate, is yet to be seen. This may go down as “the art of the deal” if successful. If tax reforms become a success, market may advance by 10-20% in the next 6-12 months. What I have written here has a different time frame than Cam’s missive here.