Mid-week market update: Subscribers received an email update of the tactically fragile environment for US equities on Monday. There are plenty of reasons to be cautious.

Trade Followers observed that the Twitter breadth of all sectors are bullish, and such conditions are reflective of overbought market conditions:

Last week, sector sentiment gleaned from the Twitter stream had every sector positive. When this occurs a short term market top materializes usually within the following week. Once in a while, the sectors will paint another week with all of them in positive territory, then the top comes. Basically, when every sector is being bought aggressively it signals that the market is overbought.

That`s the just first warning. There are others.

Fear and Greed overbought

The Fear and Greed Index hit 81 yesterday, but retreated to 79 today. In the past, the market has either consolidated for a few weeks or weakened from these levels. As a reminder, the corrective action that began in late 2016 began when this index peaked in the high 70`s.

Good results, “meh” guidance

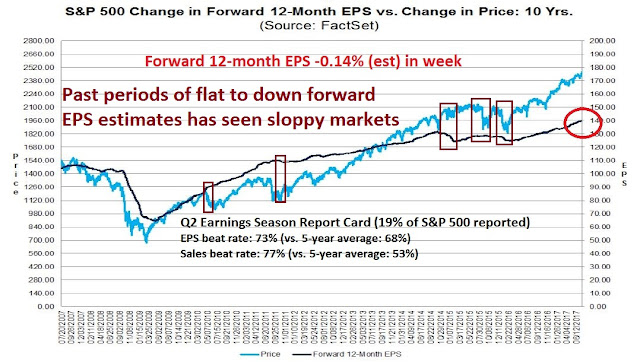

I wrote on the weekend that I was seeing the unusual condition where Q2 EPS and sales beat rates were well ahead of historical averages, but forward 12-month estimate revisions was falling. I then questioned if the negative revision was a data blip (see What would a contrarian do?).

Savita Subramanian at BAML confirmed my observation of negative revisions with a report entitled, “Good results, ‘meh’ guidance’. She found that Q3 2017 guidance was well below the historical average.

As a result, Q3 estimates are falling much faster compared to the past few quarters.

Should this trend continue, history shows that similar episodes of flat to down forward 12-month EPS has seen sloppy stock markets.

Disclosure: Long SPXU