In my last post, I suggested that the odds favored a hawkish rate hike (see A dovish or hawkish rate hike?) and I turned out to be correct. However, some of the market reaction was puzzling, as much of the policy direction had already been well telegraphed.

As an example, the Fed released an addendum to the Policy Normalization Principles and Plans, which should not have been a surprise to the market:

The Committee intends to gradually reduce the Federal Reserve’s securities holdings by decreasing its reinvestment of the principal payments it receives from securities held in the System Open Market Account. Specifically, such payments will be reinvested only to the extent that they exceed gradually rising caps.

- For payments of principal that the Federal Reserve receives from maturing Treasury securities, the Committee anticipates that the cap will be $6 billion per month initially and will increase in steps of $6 billion at three-month intervals over 12 months until it reaches $30 billion per month.

- For payments of principal that the Federal Reserve receives from its holdings of agency debt and mortgage-backed securities, the Committee anticipates that the cap will be $4 billion per month initially and will increase in steps of $4 billion at three-month intervals over 12 months until it reaches $20 billion per month.

- The Committee also anticipates that the caps will remain in place once they reach their respective maximums so that the Federal Reserve’s securities holdings will continue to decline in a gradual and predictable manner until the Committee judges that the Federal Reserve is holding no more securities than necessary to implement monetary policy efficiently and effectively.

These steps were discussed in length in separate speeches made by Fed Governors Jerome Powell and Lael Brainard:

Under the subordinated balance sheet approach, once the change in reinvestment policy is triggered, the balance sheet would essentially be set on autopilot to shrink passively until it reaches a neutral level, expanding in line with the demand for currency thereafter. I favor an approach that would gradually and predictably increase the maximum amount of securities the market will be required to absorb each month, while avoiding spikes. Thus, in an abundance of caution, I prefer to cap monthly redemptions at a pace that gradually increases over a fixed period. In addition, I would be inclined to follow a similar approach in managing the reduction of the holdings of Treasury securities and mortgage-backed securities (MBS), calibrated according to their particular characteristics.

The only details that were missing were the exact numbers of the caps. Further, there are no discussions about active sales from the Fed’s holdings, which was also not a surprise.

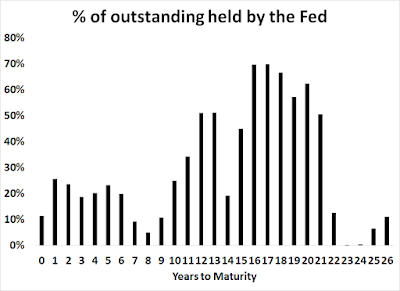

The Fed’s gradual approach of allowing securities to mature and roll off the balance sheet means that investors who are watching the shape of the yield curve will not have to worry too much about Fed actions in the long end that might distort market signals. This chart, which I made from data via Global Macro Monitor, shows that the Fed holds an extraordinary amount of the outstanding Treasury issues once the maturity goes out 10-15 years.

These facts are all well known to the public and therefore the Fed’s plans for normalizing the balance sheet should not be a big surprise.

Waiting for Marvin

The bigger surprise that is not in the market are the views of Marvin Goodfriend, who is rumored to be a nominee for a post on the Fed’s Board of Governors. Reading between the lines, as there are three board vacancies, three rumored nominees, and historical experience has shown that new Fed chairs are already Fed governors at the time they are nominated, that means Trump will either keep Yellen as Fed chair in February, or her replacement will come from the new crop of new governors. The most likely candidate is Marvin Goodfriend.

This recent video of Marvin Goodfriend is highly revealing of his views (use this link if the video is not visible).

In the video, Goodfriend reviewed his Jackson Hole paper that advocated negative interest rates when interest rates fall below zero. He believes that the Fed can drive rates to significantly negative levels by breaking the link between the value of money in the banking system and paper currency. The Fed could take steps to either restrict or refuse the issuance of paper currency, e.g. $100 bills. It could also encourage banks to charge customers a service charge if a depositor withdraws money in paper currency. Those steps would discourage customers from asking for currency and coins, and therefore remove the arbitrage between balances earning negative interest rates in a bank and taking the money out and putting it under a mattress.

Goodfriend has also made it clear that he is no fan of balance sheet policies, otherwise known as quantitative easing, in response to interest rates at the zero lower bound. Here is the key quote [which is visible at about the 25:00 mark]: “Inflation is financial anarchy…Resorting to higher inflation to get away from this [zero bound] problem to me is the equivalent to appeasement in international affairs.”

It is clear that Goodfriend is a traditional monetarist in philosophy and he would push monetary policy in a much more hawkish direction. As this hawkish outcome has not been discounted by the market, the market would freak out once the news of his nomination hits the tape.

Cam – If the Fed becomes more hawkish would that precipitate a precious metals rally?

Precious metals tend to perform well when real rates are low. A hawkish Fed will raise real rates, which is bearish for PMs.

An overtly restrictive fed that pushes “real” interest rates high, and depending on the speed of such intervention would cause a recession. Such a recession would then cause reversal of fed policies, with unleashing of liquidity into the system, even if it meant negative interest rates (see above). Such an event would cause rise in PMs. We have experienced similar conditions in the past decade or so.

If real interest rates do go higher, yes, PMs may come down in nominal price and this may be a good entry point for long term buyers.

A parallel example is recent rise in bitcoin value. Bitcoins have limited supply (much like gold/PMs) and recent rise can be attributed to bitcoins being allowed as currency by non US governments especially Japan. Gold also has limited physical supply globally and has attributes like bitcoins which have limited supply.

So PMs have to crash before they rally? The same could be said of stock prices, I suppose.

The Fed can only pretend to be hawkish. The amount of debt that it has caused to be built up in the financial system is unsustainable at high real interest rates. Any attempt to be genuinely hawkish, as D.V. pointed out, would cause a financial collapse, and would be very quickly reversed.

The thing to keep in mind is that the Fed has absolutely no idea what it has done, or is doing now. The complexity of the financial system is way above the ability of any group of people, PhD academics especially, to comprehend and control.

So, in response to Rick’s comments, let us examine the mandate of the US Federal reserve. I quote:

“The U.S. Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve’s dual mandate.

Federal Reserve System – Wikipedia

https://en.wikipedia.org/wiki/Federal_Reserve_System”

I would like to focus on the idea of “price stability” mandate. What does it really mean? Let us turn our attention to circa 2008, when the US housing market collapsed and banks were becoming insolvent. As an example, General Electric shares were trading at 5$ per share around the year 2009 (they peaked around 65$ give or take). Lehman brothers shares were around 90$ give or take around 2007 and last I remember traded around 2$ circa 2009. It is precisely at this time that Henry Paulsen, secretary of US treasury started to open the spigots of liquidity. We know the rest of the story.

Let us now to turn our attention to circa 2000-2005. House prices appreciated by 70-80% (Case Shiller). Here is a chart:

http://wolfstreet.com/wp-content/uploads/2015/01/US-homeownership-v-home-price_StLouisFed.png

Alan Greenspan, the then Federal Reserve announced that there is no housing bubble despite a massive rise in house prices in a mere 5 years.

Based on the above facts, I have come to the conclusion that the US federal reserve looks the other way when asset prices form bubbles. It does not act to contain asset bubbles. However, when assets fall in value, they will support collapsing prices, even if it means negative interest rates or other heroic measures like buying impaired bonds at par (CMBS etc.), QE etc.

In 1994, Congress killed the Super conducting super collider project in Texas for want of 1 billion$ (Smithsonian). However, US federal reserve bailed Long term Capital management to the tune of 100 billion US $ (this is an estimate), in year 1998 (from the book When Genius failed). Ten years later, it raised 40 times the capital (4 Trillion $) and bailed a failing US banking system. I wait to see what happens now in 2018. I do not have a crystal ball better than anyone else reading this. That said, I remain very concerned that systemic risks in the US remain unresolved since the banking crisis of 2008. See the numbers? 1 billion, 100 billion, 4000 billion every ten years or so, give or take? As an example, current student debt is 1 Trillion$.

As an aside, parts of Canadian housing markets are in a bubble as I write this, perhaps like the US housing market of 2008 (I do not have specific knowledge of Canadian house prices). Global bonds are in a bubble sphere by historic standards (see the EM debt spread (https://fred.stlouisfed.org/series/BAMLEMCBPIOAS). One could only speculate what would cause the next crisis and the magnitude of money required to support asset prices.

It depends on how ideological the new Fed chair, if there is a new Fed chair, is. If he or she comes from a hard-money audit-the-Fed mold, then the view may be that the economy needs a dose of hard money reality in order for the Fed to remain credible in its price stability mandate.

BTW, should the Fed adopt a hard-money philosophy, then gold prices will get depressed. Remember that gold is a hedge against inflation and the loss of the Fed’s inflation fighting credibility. Once it’s credible, then the need for insurance declines.

Gold is a classic hedge against inflation. Stocks are also a hedge against inflation.

That said, as severe deflation set in circa last decade, gold performed very well. Prior to the last decade, gold also did well between 2000-07, without significant inflation (significant=beyond average). Similar conditions existed between 1929-38 also. As assets fell in value, gold gained against $ by about 75%.

Gold remains an enigma to me, as it appears to do well in deflation as well as inflation. Perhaps loss of confidence (and the fed as Cam says) in the fiat system of currency is the biggest driver of gold prices.