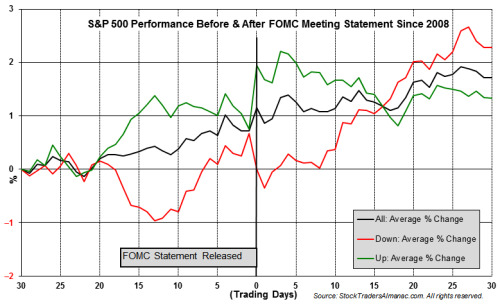

Mid-week market update: I am writing my mid-week market update one day early. FOMC announcement days can be volatile and it’s virtually impossible to make many comments about the technical condition of the market as directional reversals are common the next day. Mark Hulbert suggested to wait 30 minutes after the FOMC announcement, and then bet on the opposite direction of the reaction. For what it’s worth, Historical studies from Jeff Hirsch of Almanac Trader indicated that FOMC announcement days has shown a bullish bias and the day after a bearish one.

The Fed has signaled that a June rate hike is a virtual certainty. The only question for the market is the tone of the accompanying statement. Will it be a dovish or hawkish rate hike?

The case for a hawkish hike

Despite expectations that the Fed may tone down its language because of tame inflation statistics, there is a case to be made for a hawkish rate hike. Tim Duy thinks that the Fed will be mainly focused on employment, rather than inflation, in setting monetary policy:

The recent inflation data doesn’t exactly support the Federal Reserve’s monetary tightening plans. Chair Janet Yellen and her colleagues will surely take note of the weakness at this week’s Federal Open Market Committee meeting, but they will downplay any such concerns as transitory. At the moment, low unemployment remains the focus. Add to that loosening financial conditions and you get a central bank that is more likely than not to stay the course on its plan to hike interest rates.

FOMC participants will follow the logic of San Francisco Federal Reserve Bank President John Williams and attribute recent inflation trends to “special factors,” notably the decline in cellular service prices as measured by the Bureau of Labor Statistics. With this explanation in hand, they will hold firm to their medium term projections that anticipate inflation will soon return to target. The stability of those forecasts is more important for the anticipated course of policy than recent inflation deviations.

Matt Busigin observed that average inflation is already above the Fed’s 2% target (though core PCE, the Fed’s preferred inflation metric, remains muted).

Across the Curve highlighted analysis from Chris Low of FTN Financial, who pointed out that the Fed is likely to stay on its three rate hike path for this year because the Goldman Sachs Financial Condition Index is signaling easier credit conditions even as the Fed has tightened:

The front page Fed-vs-the-financial markets article in today’s WSJ dives into what ought to be the most controversial reason the Fed is raising rates this year: They have decided stocks are overvalued and they can’t stand when long-term interest rates fall when they raise short rates. The paper notes the Goldman Sachs Financial Conditions Index, which has fallen considerably since December, suggesting markets have eased more than the Fed has tightened. The GSFCI is just exactly the sort of thing the Fed loves to watch while tightening because it allows FOMC participants to ignore the economic damage they are doing to real world economic activity.

Low went on to criticize the construction methodology of the GSFCI and thinks its readings are misleading:

The GSFCI falls when the Fed tightens because it fails to recognize a flat yield curve as a sign of tight financial conditions. In the index, the drop in long yields offsets the rise in short rates. The GSFCI was very low in 2007, for instance, a year in which millions of borrowers were driven into default. And the Fed, watching things like the GSFCI instead of real-life activity in the financial sector – you know, like lending and borrowing activity – failed to recognize how tight financial conditions were in 2006-07. In fact, they did not just fail to recognize it at the time, FOMC participants failed to admit excessive tightening even three years later, in the aftermath of the worst credit crunch since the Great Depression.

Notwithstanding any problems with GSFCI, both the St. Louis Fed Financial Stress Index (blue line), and the Chicago Fed National Financial Conditions Index (red line) have eased even as Fed Funds (black line) rose.

Low went on to forecast a more hawkish tone from the Fed:

As far as predicting what the Fed will do, the drop in the GSFCI significantly raises the odds of more aggressive behavior. After all, NY Fed President Bill Dudley cited the GSFCI two weeks ago, right before the Fed’s communications blackout, saying there is no reason to think the Fed has tightened too much if financial conditions are easing. Dudley is the Fed’s go-to financial-markets guy.

What to watch for

I don`t know if the reasoning for a hawkish hike will turn out to be right, but the hypothesis sounds plausible. Here is what I am watching after the announcement:

- What happens to the dot plot? The “dot plot” is an interest rate projection of each individual member of the FOMC based on their own beliefs of how the economy is likely to evolve. If the dot plot edges down, then that is a signal that a group within the FOMC thinks the Fed should pause its normalization program.

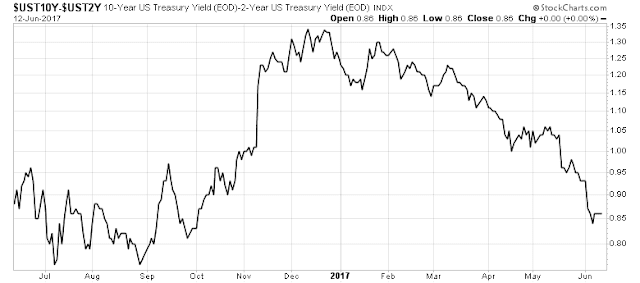

- How does the yield curve react? Assuming that the Fed hikes by a quarter-point, will the long end rise, or fall? A flattening yield curve would reflect the credit market’s expectation of decelerating growth. The 2/10 yield curve has been flattening and stands at 0.84%, and it is approaching the lows set last fall.

Watch this space. Just keep in mind that Warren Buffett stated in a recent CNBC interview that interest rates are the biggest factor in stock market returns: “If these rates were guaranteed to stay low for 10, 15 or 20 years, then ‘the stock market is dirt cheap now’.”

Cam, with much respect rather than the “all due respect” (a backhanded compliment), and FYI you are one of my two “main men” for divining what the tea leaves mean, these “well maybe this and maybe that” missives of yours are mostly skipped over by me (and I suspect many others) because they don’t help me figure out WHAT TO DO with my money. I don’t expect a missive from you 3 times a week or on the occasion of every twitch in politics. And I don’t expect you to tell me explicitly WHAT TO DO. I do want to know when you think the market WILL DO SUCH AND SUCH.

Again, much respect.

Joe Conroy

Sorry, I was being overly subtle. The market is starting to discount a dovish hike because of tame inflation statistics, but I was trying to make the point that the odds of a hawkish hike is higher than the market thinks, which will be equity bearish.

Cam

Just wanted to let you know how much I have come to enjoy the analysis that you post. I have learnt a lot, and look forward to every article you post. Keep it up. Much appreciated.

I echo what D.V. wrote. I have learnt a lot and enjoy reading old posts and new alike.

When the Fed starts selling it’s hoard of Treasury bonds, it could easily move long term interest rates up. This would artificially steepen the yield curve without investors help. A key to watch tomorrow is their plan to run down their bond holdings.

It’s my feeling that there won’t be a big downswing in stocks until long term rates are high enough to provide an attractive enough alternative.

With one exception I believe you are correct Ken. As a retiree my personal financial plan only requires a 6% yield which up until recent years was easy to find on 3-5 year investment grade corporate bonds. When that went away I was pushed into equities. So a target for you to watch might be a 6% yield on a 3 year investment grade corporate bond. Currently BBB 3 year corporate bonds are yielding just over 3%.

Ken, the “exception” I noted is that the Fed’s bleeding off of its balance sheet doesn’t “artificially steepen the yield curve”. It was first artificially flattened by the Fed’s ZIRP, stimulus and quantitative easing. Removing those artificial impediments to the market is actually normalizing the markets.

Cam–In light of Ken’s remarks: The Fed starting to sell its vast holdings of treasuries, even if carefully and slowly, sending a 2nd tightening signal to the markets. As this will take place over a longish period–it establishes a new trend that the markets must recognize and absorb, what adjustments are most likely? It would seem that the 10 year reverses and begins to rise in rates thus steepening the yield curve. Say we go to 3% on the 10 year and 1.5% FFR. What gets hurt in the process? Presumably good for financials. Bob Millman

Correction: The Fed will not sell its Treasury holdings. They will at first let them mature and allow them to roll off the balance sheet. As the Fed`s holding mature, they just won`t reinvest them.

That`s how balance sheet reduction will work.