Ed Yardeni may have top-ticked large cap growth stocks last week by postulating that a melt-up may be underway, led by the FAANG names. As the chart below shows, FAANG as a percentage of SPX market cap has been rising steadily for the last few years and now account for 11.9% of SPX market cap.

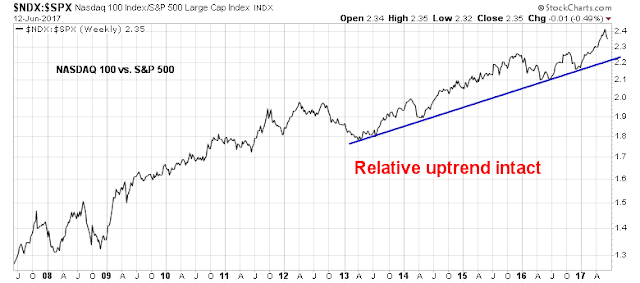

Despite the air pocket that these stocks hit on Friday, the relative market performance of the NASDAQ 100 still looks like a blip in an uptrend.

The relative performance of the Russell 1000 Growth Index compared to the Russell 1000 Value shows a higher degree of technical damage, but the relative uptrend of growth over value stocks also remains intact.

Looking into the remainder of 2017, however, there is a potential threat to earnings growth that investors should keep an eye on.

Are expectations too high?

Ed Clissold at Ned Davis Research highlighted a possible threat to equity prices from 4Q 2017 earnings expectations. He noted that the current earnings rebound is real, as measured by earnings quality and the diminished level of buybacks, 4Q earnings expectations have been rising dramatically and therefore prone to disappointment.

Here is what is unusual about the upward revision in 4Q estimates. Historically, Street analysts have tended to estimate high and drop them as time passed. That`s why I have normalized estimates by using forward 12-month EPS to calculate forward P/E ratios.

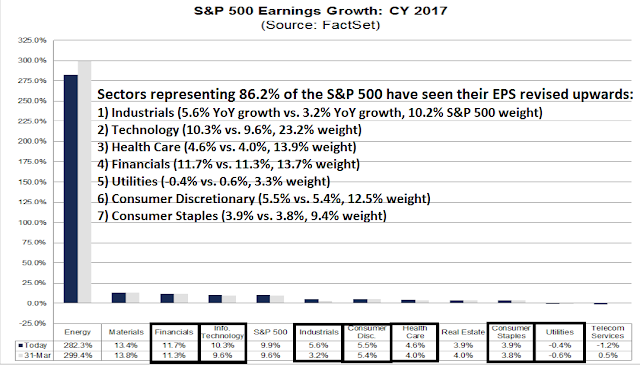

As Ed Clissold indicated in his analysis, 4Q EPS estimates bucked the historical trend by rising instead of falling. This chart from FactSet shows that the upward revisions in 2017 EPS from March to today have been broad based, and represent seven sectors with 86.2% of index weight. (Note that while the Energy sector is projected to have the greatest YoY growth, they were revised downwards).

EPS growth expectations are high for 4Q 2017 earnings. With growth stocks getting hammered Friday and today, it will be useful to keep the possibility of disappointment in mind, and not just for the high flying Technology glamour stocks.

Ken,

I always enjoy, and look forward to, your perspective in the comments section. Also, I have made some investment decisions based on your “Lower for longer” strategy, which are looking pretty good so far. So, please continue to contribute, and I for can definitely say, you are not just blowing your own horn. =)

Thanks again.

to Ken-

same as Mohit – thanks