Mid-week market update: As stock prices have recovered strongly off the Brexit panic bottom to make a new all-time high, there are numerous signs that the market is ready to take a breather. In all likelihood, a period of sideways consolidation or minor pullback is on the horizon.

Traders in a crowded long

Short-term sentiment measures have moved from extreme pessimism to a wildly bullish, though intermediate term sentiment is still supportive of further highs. Mark Hulbert reported that his survey of NASDAQ stock market timers (HNNSI) jumped from -55.6% (a net short reading) after the surprise Brexit result to 77.8%, which is an astounding change of 130% in the space of only three weeks.

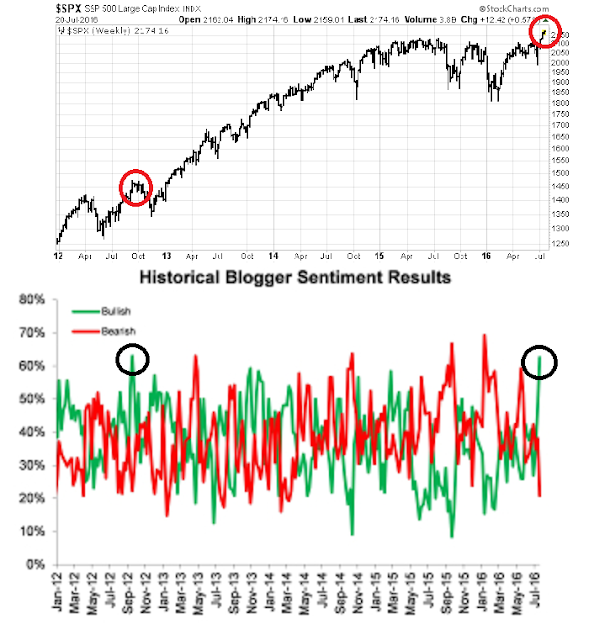

The latest TickerSense Blogger Sentiment Survey is also reflective of this turnaround in trader sentiment. Bullish sentiment has surged to highs not seen since October 2012.

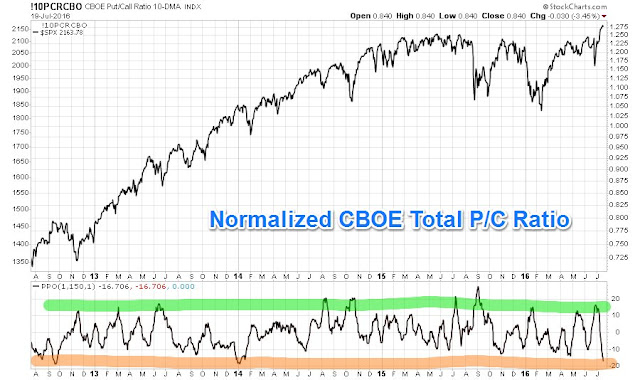

I have tended to discount the value of opinion polls because opinions can change very quickly and I have place greater weight on sentiment metrics where traders are playing with real money. Data from the option market, where hedgers and speculators are putting actual money on the line, confirms the crowded long narrative. Babak, aka Trader’s Narrative, highlighted a normalized CBOE put/call ratio measure, which is also showing a high level of complacency.

As well, the term structure of the VIX Index, where the 1-month VIX (VIX) is showing a substantial discount to the 3-month VIX (VXV) is also telling a similar story of bullish complacency.

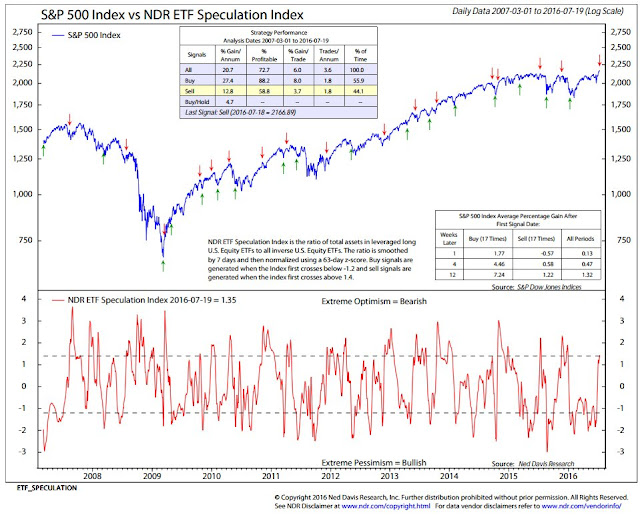

In addition, the Ned Davis Research ETF Speculation Index, which measures the ratio of leveraged long ETFs to short ETFs, recently flashed a sell signal. While sell signals have historically been not to be as effective as buy signals, this is another sign that the risk-reward ratio is not skewed in favor of the bulls.

Wobbly breadth

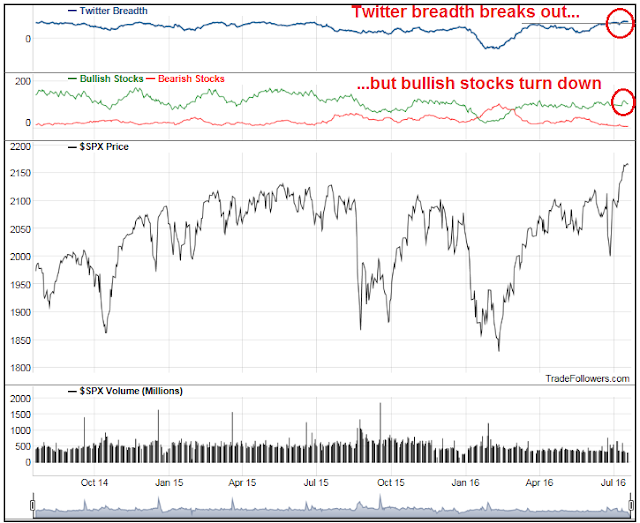

Putting it all together, sentiment models are pointing to a period of near-term market weakness or consolidation. For me, the clincher came from Trader Followers, who monitors Twitter breadth. As the chart below shows, Twitter breadth (top panel) has staged an upside breakout, which is intermediate term bullish. However, the bullish stock breadth (green line, second panel) is starting to roll over, which is a warning sign that momentum is petering out.

My inner trader remains in cash. He is waiting to see how the likely period of consolidation or pullback, which should be shallow, to play out before going long.

Disclosure: No trading positions

In my opinion, watching the S&P 500 index is fruitless. In a Moonless world, industry subsectors have their own business and stock market cycles although influenced occasionally by extremes of general investor sentiment. We have a surge of general optimism now, just as we had a surge of general pessimism last February.

Success lies in correctly analyzing subsector dynamics not the general market. In my mind, there are two major positive subsector cycles now.

The first is commodities that bottomed on January 20th after completing multiyear bear market downtrends and industry-wide fundamental shakeouts. They are in industry-wide healing modes. But this will not be a V bottom like past cycles where Central Bankers (the Moon) offer massive stimulus at the bottom of a business cycle. This will be a slow healing with ample supply of commodity production that will ramp up quickly when the price of a given commodity recovers. Witness the recent turning up of the oil rig count in the U.S. There is a technology revolution happening in commodity production. This keeps a cap on prices and slows the profit recovery of the companies. The stock prices in this subsector will likely pull back, regroup before another much slower and selective new upleg.

The second powerful subgroup is quality dividend stocks. The shock of bond interest rates falling dramatically after the the first Fed rate hike in eight years rather than going up towards some ‘normal’ has sparked buying in quality dividend names. Investors are realizing that rates will stay ‘lower for longer’. This makes dividend ETFs extremely attractive compared to bonds. The Select Dividend ETF (DVY) yields 3.8% and growing with the long term treasury bond a little over 2%. and fixed. As millions and millions of investors, especially yield-hungry retiring Boomers, come to believe in ‘lower for longer’, this subsector will continue to rise. The trend is new and will have staying power. Waiting for a pullback in prices will lead to frustration and missing it.

Let me describe how the ETF structure changes the nature of dividend investing profoundly and will power the shift from bonds to dividend stocks in dividend ETFs. In the past, portfolio investors would buy a selection of high dividend stocks, a few utilities, energy shares, telcos, drug makers and banks. You get the picture. Each of the names has its own industry and individual fundamentals. Utility stocks have a high PE compared to history right now. The energy industry has an uncertain future. Each industry is risky in its own right. Now look at a dividend ETF like DVY. It has 95 stocks who AS A GROUP have increased dividends regularly and have AS A GROUP strong earnings that cover current dividends and offer promise of future increases. The group in a dividend ETF offers a better alternative than a fixed interest income alternative. The buying of dividend ETFs by investors appreciating its group dynamic will in turn cause massive buying in the underlying stocks. We experienced investors will cringe when we see utility stocks at 25 times earnings in the future but ETF investors will be ignorant of our distress and just enjoy the growing dividends the companies provide and buy more. Will this become a bubble? Possibly in a few years but these are not hot money investors. These are long term investors looking for growing income to own for the rest of their lives.

Ken,

That was intended to be a tactical comment on trading the S&P 500. While I recognize that alpha comes in many forms and with different time horizons, you have to acknowledge that there are people who have a short term trading focus.

While I also understand the benefits of your quality dividend growth strategy, you are doing a disservice by advocating it without pointing out the risks involved.

Sorry, yes yours was tactical and I am spouting medium and longer term ideas. That is my focus as a portfolio manager. Where my comments might be helpful on a tactical basis is that the normal tactical swings in the market might currently be softened by the consistent upward pressure on the general index due to strong buying of quality dividend stocks.

As far as risk goes, I believe dividend ETFs have less risk than the general market. That might change in future if dividend stocks get too popular and interest rates start rising meaningfully.

One of the key questions in the manager due diligence process is “Under what circumstances would your strategy fail?”

If the manager can’t answer that question, then it raises cautionary flags as it suggests that the manager hasn’t fully thought through his investment thesis. Off the top of my head, here are some circumstances where I think that a quality dividend growth strategy fails:

Absolute failure (negative returns)

Rising rates: We have a nascent bubble going on in the bond market. There is a substantial portion of global government bonds with negative yields and pension funds are piling into long duration assets in order to hedge their liabilities. If and when that unwinds, a yield strategy, even if it involves quality growing dividends, is going to get caught.

Relative (underperformance)

Higher growth and rising yields: If growth ticks up and the Fed raises rates in response, but the stock market holds up because of better perceived growth, a yield strategy will likely experience some underperformance.

Value ascendance: Growth has been outperforming Value for some time. A quality growth strategy may not do that well if Value stocks become dominant.

Hyper-growth: In a world where hyper-growth, e.g. Tech bubble, FANG mania, where investors value capital gains over income, a yield strategy will lag.

Change in tax regime: Companies can return value to shareholders with their cash flows either through dividends or share buybacks. If the tax regime changes to favor buybacks over dividends, this kind of strategy may not do so well.

Not all of these scenarios are high probability events, but it is always useful to think about the big picture risks involved with any investment strategy. Such an exercise also focuses the mind on the risk-return tradeoff with a strategy in order to make an assessment as to its value.

Disclaimer: The above was just an exercise and not intended to be neither an endorsement nor a repudiation of the quality dividend growth strategy.

I hear you. All are valid dangers worth watching for. Several you mention will show up in the momentum work I do (relative strength). The key is to be flexible and not dogmatic. All my greatest mistakes have happened when I dug in my heels stubbornly when trends moved against me.

I believe as James Bullard is saying at the Federal Reserve Bank of St. Louis’ new research that we are in a stable, slow growth ‘regime’ with low interest rates and no recession for the foreseeable future. That is a perfect environment for ‘lower for longer’.

Cam, as you have been saying for a while now, there is a huge disbelief in this market uptrend. For example, there has been enormous selling of equity mutual funds since the market bottomed in February and strangely, put option buying was often higher than calls until very recently. I believe those investors stubbornly denying this strong trend are making a mistake.

Let me add my two cents to this discussion. First of all there are a lot of people including me who trade the various indexes: SPXL, TNA, TQQQ and I find Cam’s work to be very invaluable. Even though I may disagree with his conclusions, it yet gives me a reason to question my line of thinking. Therefore, I would humbly request that Cam not change the format of the letter.

As far as dividend paying stocks are concerned it is a personal preference of the individual investor/money manger. Dividends in regular accounts are taxed and therefore the rate of return is less than perceived. Also, I feel that there is a black swan out there that is going to make the Bond market reject the policies of the various Central Banks. Let us not forget that the world we live in is extremely unusual. 50 year and 10 year Swiss and German Bonds providing negative rates are not normal. In a rising interest rate environment the stocks will go down even if the dividends are safe. Secondly, one has to consider the nature of the stock selected. Oil stocks which are historically high dividend paying stocks got cut in half when Crude dropped. In most cases when an investment idea is a “sure” bet it normally is the end of the fad. Maybe, Ken is nimble enough to get out at the “top”. If that is the case he should also discuss the downside of his investment thesis with the normal caveats for all people that cannot.

Keep up the good work Cam. I hope you had a good vacation. Europe this time of the year is wonderful.

Cam offers short term trading ideas and medium term ones as well. I love it. His turn to longer term bullish on commodities in mid January was key in my doing the same. It was a world class call. Bravo.

If my work adds anything to the discourse it is that stock markets are no longer synchronized in a business and stock market cycle driven by Central Banks. They are out of the picture. They were the Moon causing cyclical tides and now we are in a Moonless world where industrial sectors develop their own business and stock market cycles. So we can have in 2014-15, a recession/depression in energy at the same time as a continuing strong business cycle in consumer discretionary. In the past when oil prices fell it was a sign of economic distress or general recession. In those times, consumer discretionary would be hitting hard times as well. But in a Moonless world, each can have its own cycle.

This has a huge impact on the S&P 500. Investors see the index hovering near highs and refusing to have a bear market after 7 years of bull market. They look at the long term chart and see the index picture at a mountain top just like 2000 and 2007 and decide they won’t be suckered into holding while the indexes fall to the next valley like 2003 and 2009. But those were caused by Central Bankers (the Moon) who engineered a synchronized recession and bear market in all industry sectors.

In a Moonless world profits in many industries will keep growing. Interest rates will not be ramped up like the past to cool out an overheating economy. Last year, non-cyclical industry sectors like staples, retail, healthcare and utilities kept doing well earningswise at the same time resources companies went from profits to losses. So the general index profits were flat but stock prices in the growing industries kept rising. The index stayed near its high except for moments of panic when experienced investors and the great unwashed public both felt the markets were rolling over into a long overdue bear market. That was the pattern one could see in the long term charts. But this was now a Moonless world and a general synchronized bear market wouldn’t happen.

So all I can say in regards to short term trading, is that in a Moonless world, expect less of a correction in the general indexes when we have our periodic pullbacks. Expect interest rates to be tame and dividend stocks to rise as yield hungry investors switch from bonds. Better to use more vulnerable subindexes to short or buy puts in that don’t include quality dividend stocks. Expect new highs in the market and a gradual acceptance that this is okay and not a new peak with a dangerous cliff just over the horizon.

Yes, love these comments and Cam’s technical analysis. All thing being equal (alluding to Cam’s comments above), presuming the Moon (central banks) keep pedal to the metal, one would have to conclude, KEEP CALM AND CARRY LONG!

More seriously though, central banks are unlikely to give up on a hard fought victory against global deflation. That is the implicit message they are sending. Longer the low interest rates, lower the interest rates (read more negative interest rates) higher the asset prices. Supporting the same bullish argument (on a mid to longer term time frame; not short term), small investors keep selling out of stocks. Recent surveys still show very high percentage of cash in individual portfolios, which should be music to stock market investors. Ken’s point is well taken, find money printing machines (Apple, Coke are good examples and I am sure there are many others). and one can create portfolios that are safe(r) than index investing. Add to that mix high growth scrips (say biotech as an example), and one can create a barbell portfolio of growth and income. Add to that a judicious mix destructive technologies like AMZN, that are a giant cash sucking machine, FB and GOOGL are in the same mix. As an example, AMZN is sucking out the lifeblood out of bricks and mortar retailers. FB is strangling TWTR and pretty much has become the defacto social media platform. As societies age, GSK, RBBY, SNY, GILD, ABT, Baxter, PFE, BIIB, CELG, AMGN, etc. are likely to enjoy high profit growth (unless liberal politicians force them to provide their products at a discount). Yes, as the political rhetoric ramps up in the US, healthcare could be the gift horse, we may be peering at.