Reasons to be bullish

Equity market internals are looking more constructive as leadership is broadening out from the narrow megacap technology leadership. The performance of large-cap growth sectors has begun to go sideways, but the S&P 500 remains in an uptrend.

As growth leadership stalled, the relative performance of the cyclically sensitive value sectors have begun to turn up.

A similar pattern can be seen in the relative returns of small-cap value sectors, which are not burdened by the performance of megacap growth stocks in comparing performance. The relative uptrend in small-cap industrial stocks is particularly impressive.

These charts are supportive of the bullish soft landing and cyclical rebound scenario.

Reasons to be skeptical

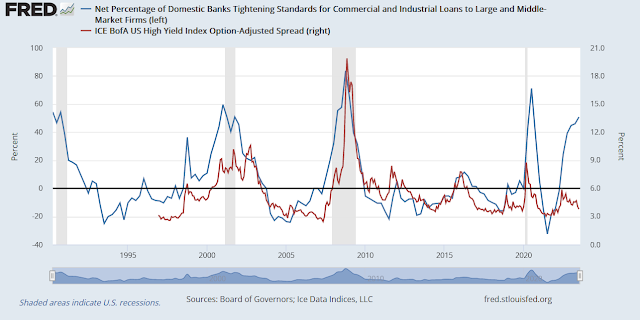

One maxim of good investing is to look for reasons to be skeptical of your investment posture as a way of avoiding confirmation bias. Here’s what’s keeping me awake at night. The possibility of a credit event that derails the bull (see Could A Credit Event Derail the Equity Bull?) and weakness in employment that plunges the economy into recession.

Regarding loans to businesses, survey respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the second quarter. Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

For loans to households, banks reported that lending standards tightened across all categories of residential real estate (RRE) loans, especially for RRE loans other than government-sponsored enterprise (GSE)-eligible and government loans. Meanwhile, demand weakened for all RRE loan categories. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Furthermore, standards tightened for all consumer loan categories; demand weakened for auto and other consumer loans, while it remained basically unchanged for credit card loans.

The employment puzzle

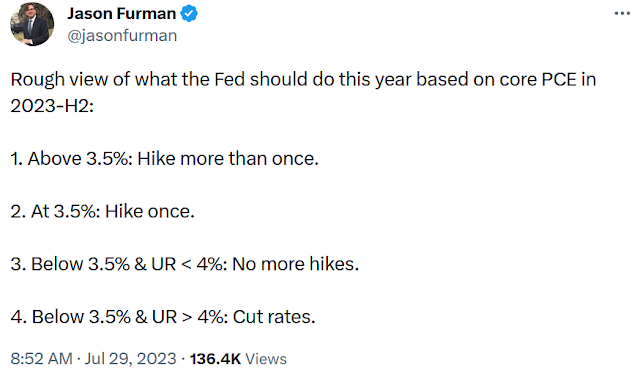

The Fed announced after its July FOMC meeting that it was raising rates by a quarter-point and the Committee would be watching incoming data in order to make further decisions about the direction of monetary policy. Fed Chair Powell was repeatedly asked about the Fed’s reaction function to data, but he deflected all questions and declined to give further forward guidance, other than to say that upside and downside risks were relatively balanced.

I’d say it this way, it’s really a question of how do you balance the two risks, the risk of doing too much or doing too little? And, you know, I would say that we’re coming to a place where there really are risks on both sides. It’s hard to say exactly whether they’re in balance or not. But as our stances become more restrictive and inflation moderates, we do increasingly face that risk. But, you know, we need to see that inflation is durably down that far.”

The labour market is cooling, but it’s not cool enough. The latest JOLTS report shows that both the job openings/hires and quits/layoffs ratios are falling, which is a sign of a cooling jobs market. However, levels are still above pre-pandemic levels. There are still 1.6 job openings for each person hired, indicating wage pressure. But more drops in vacancies will mean higher unemployment and a slowing economy.

The July Jobs Report serves as window of this problem. Headline employment growth and average weekly hours were softer than expected, indicating decelerating economic growth. But average hourly earnings was higher than expectations, indicating wage pressure.

While Fed Chair Powell deflected questions about the Fed’s reaction function, the former Obama CEA Chair outlined his estimate in a recent tweet (UR=unemployment rate), which he claims to be roughly consistent with the reaction embedded in the last SEP.

In summary, investors are faced with another situation where the technical and macro indicators disagree. The price charts are screaming “cyclical recovery and new bull”, while macro indicators are calling for caution. Investors are advised to trust the bull, but verify there’s no potential credit event or recession ahead.

You cannot have a recession when the government deficit spending of 6.3% of GDP, plain and simple.

Einstein did not embrace quantum theory but appreciated it. I expect Keynes would not embrace the economist community’s focus on Fed policy (Bernanke’s propeller heads in action) but would appreciate how it operates at the margin on the economy. His basic thrust was the rise and fall of government spending to stimulate or rein in the economy.

The Fitch Fed debt downgrade has outed the government’s massive fiscal deficit spending of 6.3% of GDP this year when the economy is fine and labor are running hot. That kind of spending boost should be kept for digging out from a recession not avoiding one. The government is offsetting the Fed’s interest rate actions to quell inflation.

When Bernanke started his QE manipulations in 2011, they were needed since the Tea Party GOP had restricted Obama’s government spending and unemployment was 9.1% with the economy struggling to dig itself out of the GFC where a depression was narrowly missed

If government spending would have been used to get us out of the shadow of the GFC, rather than artificially lowering interest rates and juicing monetary liquidity, the current, cheap money unintended consequences wouldn’t be upon us now.

The COVID related combination of massive Fed stimulus combined with Trump/Biden massive deficit spending (that continues) has made a recession impossible.

In Keynes’s day, he watched FDR reduce his New Deal big government spending after he was re-elected in 1936. The stock market fell 50% and the Depression returned. FDR listened to all the economists that thought his New Deal was inflationary and would ruin to the country. But the economy needed continuing fiscal support.

The debt ceiling deal has baked in huge deficits through 2024. Either party winning in 2024 will reduce the deficit big time. The GOP with slashing spending with no tax increases. That will kill the stock market ala, 1937. A Dem sweep (which I predict) will maintain or boost spending with huge tax increases to balance the budget. That will lead to strong stock markets.

If you doubt the power of government deficits on stock markets just look at the charts of the Argentina or Turkish stock indexes. They go up almost every week and lead the world with their economies in crisis. But stocks going up 100% when your currency falls in half (or more) means no gain in real terms.

Because deficits were relatively stable since the GFC, investors focused on Fed policy to forecast stock markets and the economy. The amazing rise in policy rates this past year signaled a 100% probability of a recession with these indicators. But the shocking surprise is the 2020-2021-2022 and now 2023 and 2024 have deficits the new overriding factor. They were desperately needed in 2020 and 2021 during Covid lockdowns. 2022 and onward, not needed and very inflationary leading to high interest rates and economic strength that will have unintended consequences down the road, especially in 2025 post-election.

So, we enjoy a deficit financed weird bull market until we pay the piper post-election.

What is worse, the gains we get based on inflation will get taxed and what’s left after is less.

But, if the public spends less because of PHE ending and the student loans paybacks restarting and decreased credit because of banks tightening and credit costs discouraging HELOCs etc, this can all translate to decreased earnings, or ugly guidance. Don’t forget sentiment and outside factors like China etc.

As Elmer Fudd might say “Be vewy vewy careful”

David Hunter says the SPY could go to 6000, 7000 because that’s how bull markets end, and then drop 80% .

I guess the facts look different based on one’s political persuasions. But the effects of the actions are more dependent on execution. The trillion dollar stimulus during GFC was by and large wasted by lack of meaningful activity. Roads to nowhere were not unheard of.

The initial stimulus in 2020 was essential and sent to people directly as opposed to the government spending. The stimulus in 2021 of another 3 trillion was not needed. I remember Dr. Summers testifying to its inflationary implications. On the othe hand were forty Nobel laureates led by Dr. Krugman and Janet Yellen who wrote about its non inflationary impact.

And we got more in 2022 through bipartisan bills.

Chair Powell is right to stay at higher rates for longer. Wage growth is still too high for durable 2% inflation.

The macro has changed in fundamental ways which we don’t understand. Yet, our tools to analyse remain the same.

The only free lunch is diversification and rebalancing.

MACD and divergences. One of the things that has always bugged me is the time frame. What works on a weekly chart is absent on a daily, or hourly, whatever.

So, for example, the SPY on a quarterly chart showed a cross recently for 2022, it crossed back to the upside after 2 quarters. So there is an issue of scale. There was no time for a bullish RSI divergence because it was only 2 periods in duration.

As an aside , sometimes one sees squiggles in these lines and the first crossing is a harbinger.

I think that inflation is the key to this with the caveat that macro can take a loooooong time to manifest. I think that’s where the lump things into the lagging category.

Anyways, is inflation going down? Friedman says it’s about money. But money is affected in many ways, gov’t printing and spending via deficits, but banks cutting back on credit slows money growth, and credit defaults send money to money heaven.

Without debt, can there be defaults? What about high debt and rising rates and tightening standards? So we are at risk of decreasing money on that front.

If gov’t deficits continue, what will that do to the dollar?

The junk bond market is it a secondary market being quoted or the primary one as things get issued?

So a credit crunch should reduce money supply short term, but long term the gov’t will spend if it can which is inflationary.

The big question is about when the capitulation happens and rates go down because the cost of interest is way too high and to hell with inflation.

Maybe this is why the market keeps going up, because it is discounting an era of future high inflation.

I still don’t buy it….there is way too much crap out there, rising rates, yield curve inversions, expensive markets, record debt levels public and private. We are not climbing the “wall of worry” but to quote the Princess Bride the “cliffs of insanity”

Yield curve inversion is very reliable and it is counter to the monthly buy signal. We shall see by year end which one is right.