The risk of catastrophic success

The first risk is the risk of catastrophic success. The June core CPI came in at 4.9%. What if it were to fall, say, another 1% by year-end?

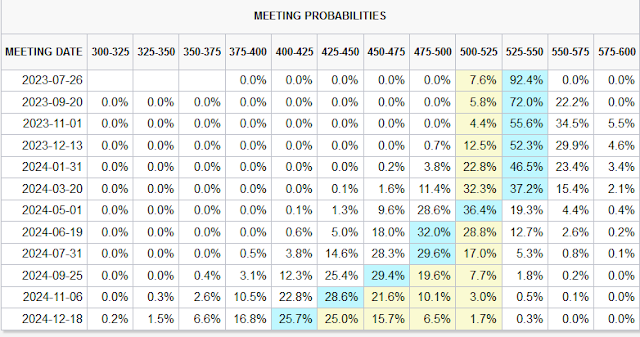

Consider what the consensus expectations are for the Fed Funds rate. A quarter-point rate increase is baked-in for the July FOMC meeting. The market expects no more hikes and probable cuts in early to mid-2024.

From a policy perspective, the Fed’s tightening policy relies on falling inflation to do most of the heavy lifting. If it were to hold rates steady for several months and the inflation rate falls, the real Fed Funds rate rises, which amounts to a de facto tightening. If core CPI declines 1% by year-end, the real Fed Funds rate would rise to about 1.5%. Can the economy cope with real rates at that level without going into recession?

The last mile inflation problem

While some strategists have turned bullish in response to falling inflation, others have worried about the so-called last-mile inflation problem. One prominent macro voice in the last-mile camp is Bridgewater Co-CIO Bob Prince, who voiced his concerns in an FT interview.

“Inflation has come down but it is still too high, and it is probably going to level out where it is — we’re likely to be stuck around this level of inflation,” Prince said. “The big risk right now is that you get a bounce in energy prices when wages are still strong”, which could drive a rebound in inflation, he added.

Prince believes the Fed’s policy levers are too blunt to achieve its objectives.

“Current levels of spending are being financed by income, not a credit expansion,” Prince said. “So inflation is really hard to bring down.”

In a separate Bloomberg podcast that was taped before the FT interview, Bridgewater co-CIO Greg Jensen echoed Prince’s remarks and laid out a scenario of disappointing growth and upside surprises in inflation. Such an environment would be unfriendly to both stocks and bonds.

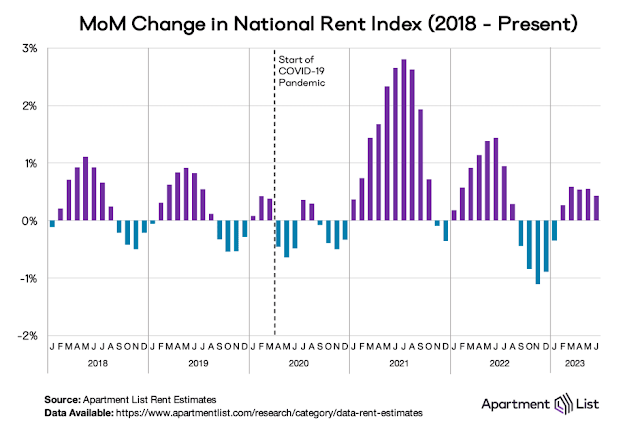

Another key component of the inflation rate is shelter. Apartment List tracks rents, which leads the Owners Equivalent Rent component of CPI. The Apartment List Rent Index has been falling on a year-over-year basis, which is a positive sign for disinflation.

However, the analysis of monthly changes in the same data series shows that deflationary effects of rents are behind us and rents have been rising for several consecutive months. All else being equal, base effects will see the shelter component of inflation stabilize and rise again in the near future.

What about the recession?

A third risk is the risk of an imminent recession. New Deal democrat, who monitors the economy using the discipline of coincident, short-leading and long-leading indicators, recently pushed back against the soft-landing narrative in his weekly update. The bad news is a recession appears imminent. The good news is any slowdown should be relatively shallow.

- The high-frequency weekly indicators suggest that a recession is imminent, with all three primary systems indicating a near-term economic downturn.

- Consumer spending and tax withholding are of particular importance; both consumer spending measures (Redbook and OpenTable) were negative this week, and if tax withholding turns negative as well it would signal the start of a contraction.

- However, the continued improvement in the short-leading indicators suggests that any recession is likely to be either short or not very deep.

Since the publication of that note, the weekly Redbook series printed a second consecutive year-over-year reading indicating a weakening consumer.

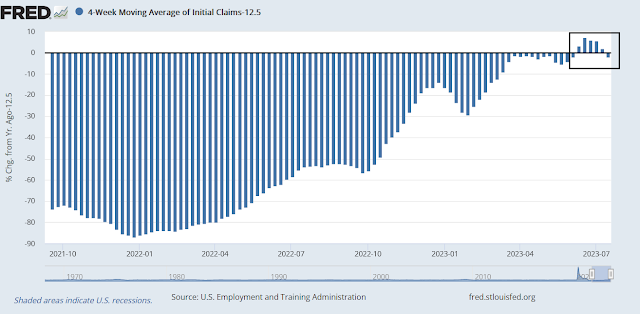

NDD has argued that consumer spending leads employment. However, initial jobless claims improved last week and the year-over-year increase in the 4-week average fell below the 12.5% recession warning mark after five consecutive weeks of recessionary warning conditions. This is a noisy data series. Is this a data blip?

I apologize if this question has been asked or is too basic for this forum. But I’d like to know the source of the “consensus expectations for the Fed Funds rate” depicted in the Meeting Probabilities table. Thanks!

I believe the makers of that chart have a network of hundreds (or even thousands) of economists and market strategists that are polled on a regular basis as to their predictions of where Fed Funds will be every month from now to end of 2024.

I prefer to watch the Fed Funds Futures. The December 2023 is at 5.38% and the Dec. 2024 is 4.12%. So a drop of over 1% in 2024. The folks that use this futures contract are VERY professional.

Thank you!

Actually it’s a bond math calculation of Fed Funds futures. By deriving the difference in levels in each month, you can calculate the expected Fed Funds rate each month and therefore the market pricing of probabilities.

Thanks Cam.

One can go down the conspiracy theories rabbit hole, but usually there is no bunny.

I try to think in terms of ecology and niches, or as they say “nature abhors a vacuum”.

So for example when we had ZIRP or almost ZIRP, and QE, this created a new environment and unicorns abounded.

So now rates have undergone a seismic change and it’s a new world.

Why should the Fed change course? The market has not crashed, unemployment is still low, inflation is not at 2%.

Remember that there is also the issue of saving face and also that pesky unknowable future.

Perhaps just like where there are bull markets and bear markets that go on for years (the secular ones, not the cyclicals) we may be in an inflationary cycle.

If you look at interest rate cycles, they run for decades, so rates could be going higher for a long time. For the bond bulls it’s been great ever since 1982. Maybe things have changed, but if the Fed pivots, pauses, whatever and inflation comes back, how will they look?

I think they will choose to fight the most recent battle which is inflation until another dragon approaches.

2022 July to December monthly inflation was very tame so YOY comparisons will be much tougher. June was the easiest comparison with 2022 at 1.4% if I remember correctly. Going forward, any hot monthly number will have a big negative surprise.

Key to a positive outlook is the US banking industry not falling into a bad space with deposit leaving, tighter lending standards and a recession causing loan losses. That is the hard landing case.

What is happening is very different. All corporate yield spreads from investment grade to CCC have been falling to new recovery lows. Earnings announcements have been better than expected. Sentimentrader.com did a study on bank insider buying which has been very high lately and found a 100% positive rates of return from three months to a year going forward when insider buying was this high.

Lastly, I got another TWIST in the Financials Index this week.

A nasty bear market needs the Banks to be weak. They are the lifeblood of the economy. But the outlook is not continued weakness. Banking executive Insiders are voting by buying their own company shares. The Fed and Treasury seem to have stopped the dominoes from falling.

I read that a lot of companies refinanced when rates were really low, so now the have a positive carry because the interest on the borrowed money is less than what they get for the unspent borrowings that are in money markets….but that will end some day, and more refinancing will have to happen….this might mean that the lag effect of rising rates to hit the market will take longer. I’m still concerned.

I also read that the airlines reported that cargo traffic was down a lot. Whether this is a short term blip or something more substantial, time will tell.

We will continue to manage debt with more debt, until we cannot…then what?

Stock prices may still go up in an inflationary depression, but it’s still a depression.

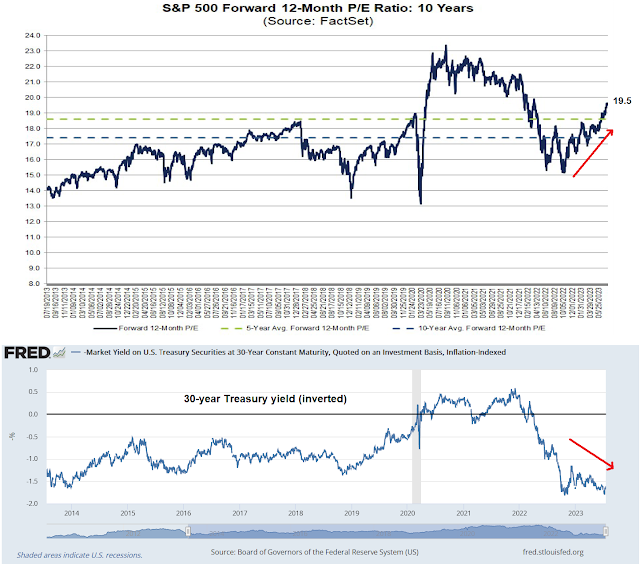

That’s where I think the definition of a bull or bear market is not totally right. Cresmont says we are in a bear since 2000 because of the PEs. I take it as “what kind of return do you expect over the next 12 years?”. This is what Hussman says also. The market may go higher but we might make a long trip sideways. Unless earnings go up can we expect prices to go much higher on expansion of multiples?

With a de-globalizing world can we have ZIRP without inflation? I dunno.

We’ll see what happens on the 26th for starters.

You’re right. We won’t get much of a recession stock market downdraft unless we get a credit event.

I am watching the evolution of stresses in the banking system. A lot of banks and financials, e.g. Amex, is provisioning for more loan losses and tightening lending criteria. If employment cracks here, it’s game over.

Maybe they are buying their shares because they suspect rates will stay high so they will be more profitable, but high rates won’t help us pay off our debts.

Something big is soon going to be in the air – a DEM/Biden sweep in 2024.

Look at what’s happening in the economy. Inflation falling with investors celebrating. The recession outlook has gone from bad to shallow to maybe none! Employment is very strong. The stock market is up huge. Foreign policy is America strong with China confronted and on its heels and NATO strong against Russia/Putin. Likely by the election Russia will have lost the war.

All of these big issues are going perfectly for the Biden/Dems.

Meanwhile GOP candidates are fixated on cultural issues. Desantis ‘s big issues are public school teaching of racial history and gayness and wokeness in the armed forces. They fixate on closing the border and limiting even skilled immigration when America is short of workers. The GOP real issues are cutting government spending and keeping taxes low. That must include nasty changes in Social Security and Medical benefits which are toxic election issues. So, they are just painting the DEMs as evil socialists without announcing an economic platform.

A GOP victory would be the end of the stock market party with government spending slashed and taxes low. Maybe, that would be a good thing. Government borrowing is out of control. Reagan, did that and everything went well.

The other HUGE thing is Climate Change. The weather this year everywhere is extreme to levels that are catastrophic. Fire/smoke/dangerous heat/floods/droughts. DEMs want to attack the problem. The GOP are looking the other way. They are saying NOTHING about how they will save the planet that is OBVIOUSLY now very sick.

The DEMs in a sweep, will raise taxes big time to control/balance the budget but spending will continue. DEMs always have better stock markets.

The victory over Russia will lead to military budgets slashed. Global peace with strong alliances will be here again. Green Revolution spending will be in full force. Stock markets will fly.

D sweep unlikely. Electoral math stacked against Ds in the Senate. Rs are likely to take control of the Senate. The House is another mater…

My bet is that this will be a shocker. The second election of FDR in 1936, all the thinking was that that inflation spending, Socialist/Communist FDR was going to lose in a landslide. Well he won in a landslide.

That would be like the Federal Liberals sweeping Alberta and Saskatchewan in the next election. Technically possible, but don’t bet on it.