Mid-week market update: As the S&P 500 tests the lows for 2022, the question for investors and traders is whether support will hold. The analysis of the large-cap S&P 500, the mid-cap S&P 400, and the small-cap Russell 2000 presents a mixed picture. While large and mid-caps appear to be holding support, small-caps look wobbly.

A violation of support would open up considerable downside potential and this is the equivalent of the bulls’ goal-line stand. Will they be successful?

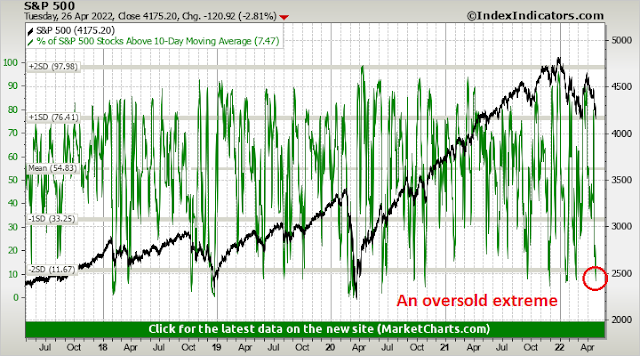

An oversold extreme

Notwithstanding the market nervousness over individual large-cap tech stock earnings, there is ample evidence that a short-term bottom is forming. The market was very oversold based on yesterday’s apparent panicked market action.

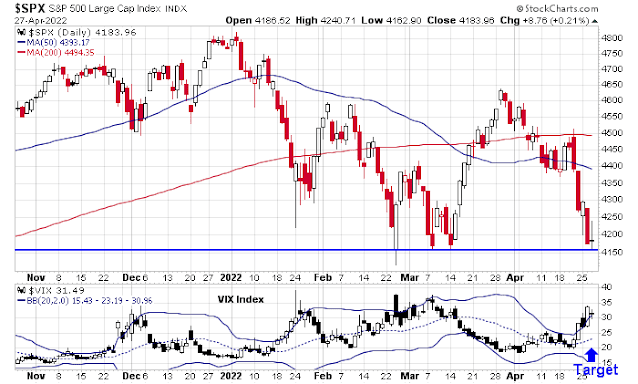

Three of the four components of my bottom spotting models flashed buy signals Tuesday, which is a signal that a bounce is on the horizon. The VIX Index has maintained its position above its upper Bollinger Band, the term structure of the VIX is inverted, and the NYSE McClellan Oscillator reached -65.7, which is an oversold condition.

The Zweig Breadth Thrust Indicator confirmed the market’s oversold condition by exhibiting an oversold reading as well.

Breadth indicators, while negative, appear helpful for the bulls. Even as the S&P 500 tests support, breadth indicators are showing positive divergences, which is constructive.

Market Charts observed that over 30% of S&P 500 stocks are now trading below their lower Bollinger band. A backtest of these conditions in the last 10 years shows that the index was up an average of 2.79% after 20 trading days with a 86% positive return success rate.

The bears are still in control

Before you get all excited, you should regard any relief rally as a counter-trend move in a downtrend. The bears are still in control of the tape, as evidenced by the relative uptrend exhibited by defensive sectors. While some sectors, such as consumer staples and real estate, appear a little extended and due for a pause, this chart shows that the intermediate trend is still down.

Jeff Hirsch at Trader’s Almanac also pointed out that we are entering the weak spot of the four-year election cycle. This is a time for investors to be extra cautious with their equity commitments.

In short, traders should prepare for a relief rally, but don’t overstay the party. My inner trader is tactically long the market. He doesn’t have a specific upside target for the S&P 500, but he is waiting for the VIX Index to return to its 20 dma from its position above the upper BB as a take profit signal.

Disclosure: Long SPXL

Another clear sign of Winter is junk bond spreads. The rally in them has ended and if the spreads break out to new highs, forget about market charts patterns, the market gods will be pulling the rug out from under everyone. Here is the link to the chart.

https://fred.stlouisfed.org/graph/?graph_id=582384&rn=562

Keep it. It updates nightly. BTW best to reduce the chart to one year for best effect.

Updated weekly, from the Chicago Fed: https://fred.stlouisfed.org/graph/?g=MD9R

The spread is not exhibiting signs of financial stress. It has widened but in normal range. Is this a leading, coincident or a lagging indicator?

Yes. Gotta watch them. So far, the spreads seem around average if you look over the last 10-20 years.

Cam, is the10-30% downside you have previously mentioned an intermediate term target and was it from the previous all time high? I am looking at some hedges and it would be helpful to know the downside intermediate term target range. Thanks

A goal line stand is a great analogy.

I’ve been hearing comments all week about how market crashes always begin from oversold conditions.

Love this tweet from Michael Santoli:

https://twitter.com/michaelsantoli/status/1519412331645702158

‘Admittedly out of my depth here, but strikes me that we’ve had days like today – early rally attempt from near YTD lows, intraday fade, then a close near the day’s low – before prior rebounds.

‘Checks out, pretty much. (Closing levels circled)

‘For whatever it might be worth…’

Bonds pulling back a bit but stocks killing it today. What’s the most unlikely scenario – a ZBT buy signal? Then I’ll be looking for one.

How about the shrink of the economy? Are we in a good entry point for IEF or TLT?

With peak earnings anxiety possibly behind us (surely earnings could have been better, but then they could have been worse) – we may have to look at the bond market and start wondering if the worst of multiple compression is behind us. A fast trip to neutral is projected, but how high is neutral?

Bonds retesting recent lows this morning, which may offer good entry points.

Wow – that buying opp disappeared in the blink of an eye!

AAPL green.

SPY/QQQ pulling back modestly. VT holding up well – perhaps on sharp spikes higher in FXI/EEM.

Diversification often helps on days like this. With SPY/QQQ off -2.5%/-3%, VT outperforms @ -1.4%.

The market needs to clear sellers that want out at these levels. That’s how the train ride works every time. They will be reboarding at higher levels.

Absolutely slaughtered today on all positions. Well, with the exception of my cash position.

Asset allocations helped, however. Which is what they’re meant to do. Relative to declines in SPY/QQQ of -3.7%/-4.5%, VT closed off -2.58%. Bonds all closed down, albeit with much lower percentage losses.

Another perspective that helps on days like this.

I may have been slaughtered on all positions today (bonds and stocks). No way around that.

However, relative to Tuesday’s close (April 26), my portfolio (absent the allocation to cash) is down just ~-0.4%. And that’s because yesterday I participated in some serious gains. No way around that either!

Meanwhile the simple SPX short strategy is still showing who is in charge in 2022, showing a +28% return YTD and sitting on a +3.25% gain which will cover on Monday 2022-05-02 on close. Short strategies have a way of coming in and out of favor and you can’t assume they will work throughout the year.

https://ibi.sandisk.com/action/share/b3d6c364-652f-450b-9ee5-a8eb8ed60f5f

Another Friday down >2.5%. So soon after last Friday?

Again, due to the high price negative momentum (<-7.5 for SPY) if it closed at current levels, this should NOT be a candidate for going long. Other variations on this strategy suggest you could go long after a delay of 3 trading days.

Weekly summation indices of S&P and Naz action similar to the Dec 2018 (another mid term election year) sharp drop which took out previous weekly gap up levels of 2018. Now the weekly summation indices shows a second week of sharp drop which in on track to close the weekly gap up from 2021-04-02 at $SPX 4020 level.

https://ibi.sandisk.com/action/share/d992c2cb-6c31-4806-a647-fb43176ad0be

Looks like today was the metaphorical version of a bear QB plunge for the TD?

The Bears were blitzed for a -10-yard loss yesterday, and completed a nice 15-yard pass play today.

Third down and goal to go.