The global economy seems to be setting up for a strong recovery. We are seeing a combination of easy monetary policy, slimmed-down supply chains, and a rebound in consumer confidence.

The cyclical and reflation trade is becoming the consensus view. However, there may still be time to board that train. Futures positioning in the reflation trade is rising, but levels are not excessive.

What are the bull and bear cases?

The bull case

The bull case is relatively easy to make. The global economy is showing signs of recovery after the COVID Crash of 2020. Economic momentum is rising, but levels are not overheated.

Commodity prices are recovering, both on a liquidity-weighted and on an equal-weighted basis. The cyclically sensitive copper price rallied to a new recovery high.

The equal-weighted ratio of consumer discretionary to consumer staples stocks, which reduces the market cap distortion from Amazon, is rising steadily. This ratio is both an indicator of cyclical strength, and equity risk appetite.

Full speed ahead! What could possibly go wrong?

Key risks

There are a number of key risks to the cyclical and reflation thesis.

- Another wave of COVID-19 infections;

- A loss of economic recovery momentum;

- The uncertainty of additional fiscal stimulus; and

- The effects of rising inflationary expectations on Fed policy.

First, the global cyclical rebound is showing signs of stalling. Regional Citigroup Economic Surprise Indices, which measure whether economic data is beating or missing expectations, are all turning down after initial surges indicating a recovery.

Additional COVID-19 Waves

Another risk is the threat posed by additional waves of COVID-19 outbreaks. Europe is rapidly experiencing a second wave, and the US is seeing a third wave. The pandemic will not be globally controlled until it is suppressed or eradicated everywhere. Otherwise there will always be reservoirs of the virus that will spark periodic outbreaks.

The European outbreak is a sign that the virus thrives in colder weather, and the situation is spiraling out of control. Germany’s daily case count has reached record highs. Ireland, Wales, and the Czech Republic have announced full lockdowns, and Ireland’s measures are expected to throw 150,000 people out of work.

In other words, people are afraid. The IMF found that the voluntary component is far more persistent than any government mandates or guidelines.

Even with a highly successful vaccine rollout—the bull case—the public will still be wearing masks, maintaining distance, and avoiding crowds for many months after regulatory authorization. In fact, the public will likely be taking these precautions into the second half of 2021 or longer. Testing, tracing, and continuing efforts to reduce the severity of the disease with therapeutics will also remain crucial. If the rollout is less successful—the base and bear cases—such interventions could stay in place for 15 more months or longer.

Waiting for fiscal stimulus

In the US, negotiations between House Democrats, the White House, and Senate Republicans over a fiscal stimulus package have broken down. Even if House Speaker Nancy Pelosi and the White House were to come to an agreement, it is unclear whether the bill would receive sufficient support in the Senate for passage.

Fed Governor Lael Brainard made another plea for additional fiscal support in a speech to the Society of Professional Economists Annual Online Conference on October 21, 2020:

Apart from the course of the virus itself, the most significant downside risk to my outlook would be the failure of additional fiscal support to materialize. Too little support would lead to a slower and weaker recovery. Premature withdrawal of fiscal support would risk allowing recessionary dynamics to become entrenched, holding back employment and spending, increasing scarring from extended unemployment spells, leading more businesses to shutter, and ultimately harming productive capacity.

In the last few weeks, the market has pivoted to a consensus view that the Democrats would sweep the election in a Blue Wave by capturing control of the White House, Senate, and the House of Representatives. However, recent polling has seen the race tighten, and the odds of a Democratic sweep at PredictIt has plunged.

Should the election be resolved with a divided government, such as a Biden Presidency and a Republican-controlled Senate, fiscal austerity becomes the most likely outcome. In the absence of additional spending, can the cyclical rebound continue?

Rising inflationary expectations

The last risk facing the cyclical and reflation trade is the idea of “catastrophic success”. What if the cyclical upturn is too successful? How would the market react?

Already, we are seeing inflationary pressures rise. Gold prices are consolidating at the metal’s long-term breakout level, and the bond market’s inflationary expectations have staged an upside breakout through a falling trend line.

In addition, the yield curve is steepening, and bond yields are rising. The 10-year Treasury yield has decisively breached the 0.80% level and surged to 0.86%. The 30-year Treasury yield has risen above its 200 day moving average.

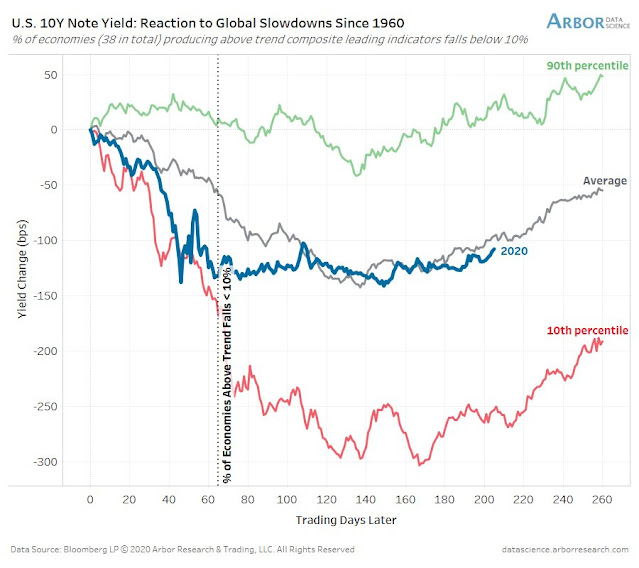

If history is any guide, the 10-year Treasury yield is poised to rise even further. It is following the same path as past global slowdowns.

These conditions beg a number of important questions. What’s the Fed’s reaction function to rising inflationary expectations? The 10-year yield has decisively breached the 0.80% level. In light of the Fed’s commitment to hold short rates down almost indefinitely, will it tolerate a 1.2% rate? What about 1.5%? At what point do rising yields act to significantly restrain the economic rebound?

Resolving the risks

In light of the bullish potential of a cyclical rebound, and all of the risks, how should investors position themselves?

My Trend Asset Allocation Model readings are in neutral, but they are on the verge of turning bullish. The model was created based on the belief that real-time market prices are the best indicator of future expectations, and the application of trend following principles is the best way of capturing long-lasting economic changes. The model is picking up in the shift in consensus thinking, that the global economy is shifting from recession to recovery, as shown by the latest BoA Global Fund Manager Survey. If that consensus assessment is correct, further sustained returns lie ahead for investors who adopt a risk-on position.

By design, the Trend Model has a single-dimensional focus, and knows nothing about risk. Plenty has to go right for the bullish scenario to be realized.

- The momentum of economic recovery has to be sustained.

- The pandemic has to come under control in the face of a second wave infection in Europe and a third wave in the US, both of which could crater growth.

- The US electoral outcome is unknown, which will affect the path of fiscal policy, the likelihood of additional stimulus, and therefore the growth outlook.

- Investors have to grapple with the Fed’s reaction function to rising growth and inflationary expectations.

Under these circumstances, investors need to recognize that the sources of alpha are multi-dimensional, and so is risk. While we can always hope for the best, bad outcomes are very possible in these conditions. It is important to repeat the adage that the only free lunch in investing is diversification, and only a diversified portfolio can weather this diverse array of risks. As well, investors can creatively conduct scenario analysis in order to mitigate any risks specific to their investment objectives, situation, and investment capability.

As an example of a creative approach, Bloomberg reported that Boaz Weinstein of Saba Capital is arbitrating the spread in equity and bond market volatility:

Never in his 22-year career has Boaz Weinstein seen such a disconnect between the complacency of credit investors and the anxiety of equity investors, and he predicts it could unravel in an “incredible move” around the Nov. 3 U.S. election.

While the stock market is pricing in turmoil with the CBOE Volatility Index close to 30, corporate bond spreads have almost recovered to pre-pandemic levels. To Weinstein, the founder of Saba Capital Management and one of the biggest winners in the pandemic selloff in March, something has to give. He’s anticipating a new bout of credit chaos and hoping to add to the 80% return through September in his flagship hedge fund.

“It’s like a calm before the storm,” he said in a Bloomberg Front Row interview. “Equity volatility is almost inescapably high. Is that a good form of insurance? The payoff profiles are nothing like they were back in January. Whereas in credit, we’re almost back to where we were in January.”

What does the color coding indicate in the graph from Arbor data science? Thanks.

Blue = current path

Others are averages and top and bottom percentiles

Thanks. Interesting graphic.

I have come to the logical conclusion that we are in an unprecedented investing environment. Unprecedented means never happening before. That means experience is no help and likely more dangerous than not. Forecasting today is just wistful thinking. A great quote from the past, ” If you aren’t confused, you simply don’t know what’s going on.”

How do we invest in this unprecedented world? Momentum, pure and simple. It reveals the complex interrelationships of Central Banks, politicians, consumers, medical science and investors to profit from positive trends and avoid the negative.

We have a Fed and other Central Banks that are very compassionate (witness the Brainard quote above) in democracies where politicians appeal to voters with empathy either genuinely or not (no names mentioned). This gooses up the liquidity and asset prices to unprecedented (that word again) levels.

Let me give you an extreme example of an expert forecaster going amazingly wrong. The head of CMHA in Canada (government agency that guarantees our mortgages) forecast a few months ago that Canadian home prices would fall 9-19% over the next year. He reaffirmed that forecast again recently. He is a top expert on housing. Home prices continue to surge. September was the biggest gain on record up 1%. We are running at an 8% rate. This with unemployment extremely high and businesses shut down. This is the power of our Central Bank pumping liquidity into money supply and dropping rates and hence mortgage rates. Plus our government giving incredible support (bless them) to people effected by the pandemic.

This expert is looking like he will be off by 15-25% with a short term forecast by not understanding the power of Central Banks.

So on November 3rd, I am going to rebase the prices of the 81 sector ETFs (Industry, Country, Region, Factor) I track and own the ones that outperform going forward (yes, even China and Asia), with diversification and a range of low and high volatility sectors in a portfolio plan.

I admit it, “I’m confused and I DO know what’s going on.”

We are in a “Grand Reshuffle” of industries, countries and societies compressed into a short period of time. Give me any industry and I will offer you a forecast of good or bad stock market outcomes. Any could be a winner or loser from FAANGs to airlines. When we look back in five years (or one!), we will be shocked.

Many people think the next decade will have low investment returns. No way! One has to be on the right side of the winners and losers. A couple of months ago, I bought the Clean Energy ETF after Europe committed to green spending and Biden started to surge in the polls with his $2 Trillion green plan. It was a momentum leader with a logical narrative and it’s outperformed the market by 20% in a short time.

Don’t get me wrong, this has not been a great year for performance. I’ve sat on way too much cash worrying about pandemics, politics and valuations. I got my clients out two days after the peak in February and then they traded boredom, by being mostly out in a terrifying world, for performance since then. I should add for complete honesty, they had a dose of frustration as things soared and they didn’t participate as much as hoped.

My factor and momentum work would have (yes, would-have, could-have) been incredible if I just used my objective research. Out Feb. 24 (done) and back in March 24 with my Twist signal (not done) and then using momentum to own best momentum things since then (technology, NASDAQ etc). The possibility was amazing.

My commitment now it to do just that with momentum, just like in my book, while still using my tools to exit when necessary and stop looking back at the unprecedented past year of lost possibilities.

Excellent post.

Ken excellent post. To that I add:

“I always say that you could publish trading rules in the newspaper and no one would follow them. The key is consistency and discipline. Almost anybody can make up a list of rules that are 80 percent as good as what we taught people. What they couldn’t do is give them the confidence to stick to those rules even when things are going bad”.

Richard Dennis

Here Here!

Just like in the wedding ceremony, you promise to be loyal and faithful and taking care of each other, during health and sickness, and high and low, and rich and poor, for as long as you shall live.

Very simple vow. Yet the divorce rate is sky high.

Having failed miserably in timing the market in earlier bouts of extreme volatility, our approach has been to stay invested with two major changes. Enough liquidity to ride out the downturn and most importantly to focus on ideas and themes that are emerging such as clean energy, 5G, WFH, online shopping, cloud computing etc. Major shifts occur during and post recession, I believe. The idea of investing in SP500 is becoming less appealing.

I am intrigued by the ideas above. How does one explore them further?

I agree that index investing is no longer appealing not just less. I came into 2019 focused on simply buying the best performing Factor (Growth, Value, Low Vol) rather than industries, countries or subindustries. because I thought the markets were crazy and would either be crazy-good like 2019 or crazy-bad if it unwound when we would have to exit quickly. The crazy-bad happened with Covid and I exited cleanly and well.

Now we have the opposite, a ‘Grand Reshuffling’ of the economy (and even prosperity in different regions of the globe) to unknown outcomes for the parts. The overall indexes like S&P 500 or NASDAQ are not the answer because sectors will become winners or losers and trend accordingly even if the general index does poorly. Trends = momentum = investment success.

Momentum works poorly when trends are short lived, flashes that burn out quickly. What leads to success is a systemic, long term change that the masses are skeptical of that roll on and on and quietly become part of our lives.

An example might be digital remote medicine where in twenty years few people visit doctors face-to-face but rather are screened first by triage nurses from the patient’s home that have full room video capabilities and then on to doctors again remotely if necessary. The total requirement of technologies and hardware (medical communities and general population) could creep into society gradually. This could all be starting now with ‘work from home’ new technologies being invented and embraced. Skeptical investors who shun adopting new things will keep new industries undervalued and trending higher for decades.

Ravindra, I thought you had been to one of my web meetings showing my factor and momentum work. Email Cam and I’m sure he’ll forward your contact info to me to show you.

Anyone else that is interested in momentum and factor style investing is welcome as well.

‘We are in this together’ is my motto.

Ken,

I did not attend a meeting earlier. Our interest has increased due to the success of our approach this year. It is difficult for us to identify the trends earlier in the trajectory.

Cam has graciously shared your email. I will write to you.

> What leads to success is a systemic, long term change that the masses are skeptical of that roll on and on and quietly become part of our lives.

So bitcoin then?

Very possibly

As long as it trends higher that is.

Hi Cam,

historically speaking, when there is divergence between credit market and equity market as you alluded to towards the end, which one has the track record being right?

or it is close to flipping coins?

¯\_(ツ)_/¯