Mid-week market update: My last post (see OK, I’m calling it) in which I called a recession received a lot of attention. As recessions tend to be bull market killers, the challenge for investors and traders is to manage their investments during a recessionary bear market.

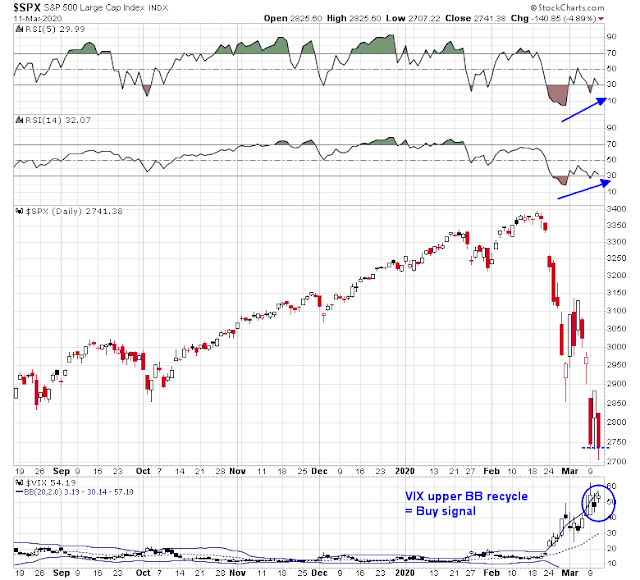

In the short run, the SPX is testing the lows set on Monday, while constructively flashing positive RSI divergences. As well, the VIX Index recycled below its upper Bollinger Band Tuesday, which is a tactical buy signal, and it stayed there today despite the support test.

Ripe for a rally

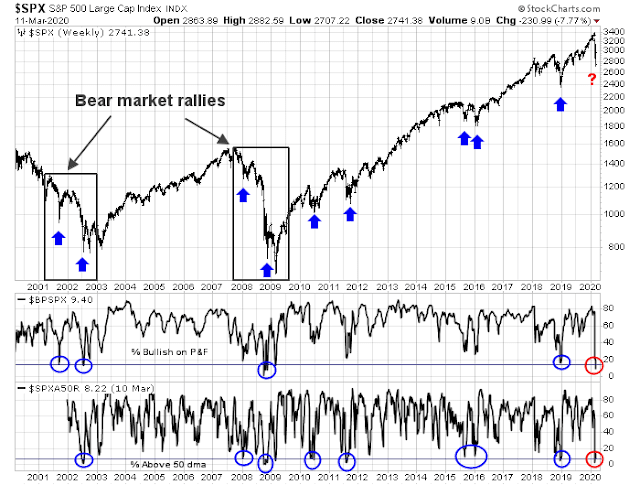

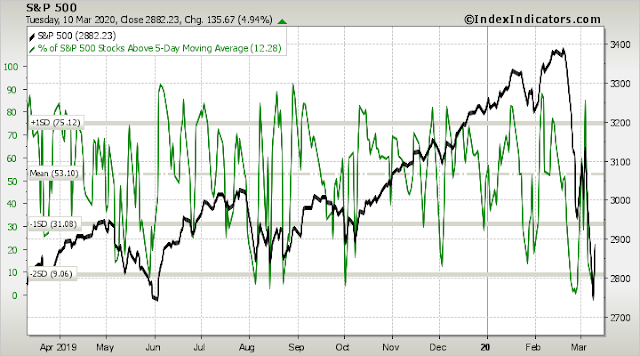

The market is wildly oversold by historical standards. If history is any guide, the readings for % bullish and % of stocks above their 50 day moving average (dma) are consistent with short-term bottoms.

Even in bear markets, similar oversold rebounds in the last 20 years have seen advances of 5-10% that last anywhere from three weeks to three months. Such bear market rallies have either failed and gone on to make new lows, or retraced the rally to the the previous low.

The stock market is ripe for an intermediate term rally. The relative performance of stocks to bonds, as measured by the SPY to TLT ratio, is testing a key relative support zone. During the last major bear market of 2007-2009, the market’s initial fall was also arrested by similar zone of relative support. Count on a bounce, followed by some choppiness.

Another sign of a bottom can be found in TLT, the long Treasury bond ETF. TLT is tracing what my former Merrill colleague Fred Meissner dubbed the “Prussian helmet” formation, which is an indication of buyer exhaustion. Now the price is reversing itself, the logical support zone is the breakout level at roughly 147.50. Since bond prices have been inversely correlated with stock prices, this is a sign that stocks are poised to rise.

Tactically constructive

The tactical outlook remains constructive for the bulls, short-term breadth was oversold despite yesterday’s advance. Readings from last night’s close indicate that readings were still in oversold territory, and it will be even more stretched after today’s market action.

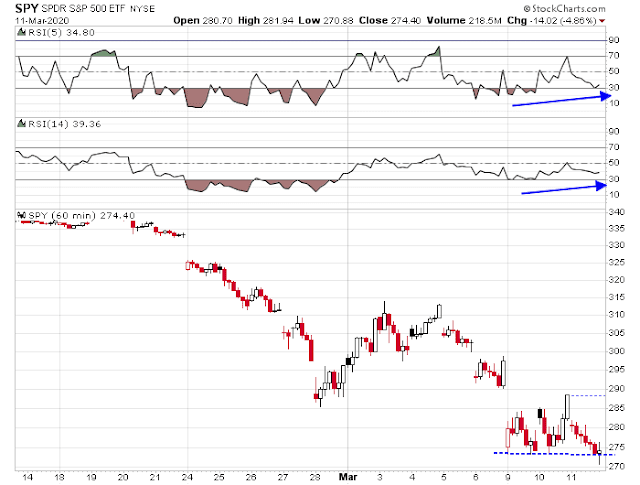

The hourly SPY chart also constructively shows a test of support while exhibiting positive RSI divergences.

My inner investor is at a position of maximum defensiveness. My inner trader is still long the market, but he has set a stop level just slightly below today’s support levels.

Disclosure: Long SPXL

RSI divergence smell test –

(a) Pertains to monotonic momentum (ripple excluded)

(b) Visual validation

‘Testing the lows’: fail (not monotonic)

‘Tactically constructive’: fail (not monotonic)

The divergence test results have no bearing on whether the market goes up or down.

I noted that the PHLX Semiconductor index failed to break the low of the last two days. Some charts are showing that it did but my tick data shows it did not. That is a minor bullish divergence.

Thank you, Cam. So your inner trader’s stop slightly below support today – about 270 for SPY? How did you choose that level? Would you apply that at future closes only, or intraday? Best Regards, mk

Re Hulbert’s Monday ‘we’re not there yet’ article:

https://www.marketwatch.com/story/the-stock-markets-wall-of-worry-still-isnt-high-enough-to-signal-a-buying-opportunity-2020-03-09?mod=mark-hulbert

Now we’re there. Desolation Row. -16.89%. Close enough to the -24.4% seen in December 2018. Or to borrow a phrase from Buffett – ‘Better to be approximately right than to be precisely wrong.’

I would truly, truly love to believe that we will return to normal soon but when I stand back and survey the situation it appears that the Grand Central Banker Monetary Experiment is done, finished kaput.

The theory that you make the risk-free rate absurdly low to bid up asset prices to give a wealth effect boost to retail spending was flawed at the beginning and it just got more crazy until we are now at crazy town. The unintended consequences is a corporate and sovereign debt bubble as corporate players borrowed free money to buy their stocks back rather than invest in their businesses. The group- think of the wealth effect has caused the wealth divide between stock holding rich households and non-stock holding poorer folks. On average things look good. In reality you get social unrest, nationalism and anti-globalization. You can drown in a lake that is on average three feet deep.

We now have much of the high yield debt market no bid on trading desks. The bid ask spread on short term government debt has ballooned to more than the yield. The trading desks don’t want to carry inventory.

Let me to you as a person who deals with average investors, clients don’t want to hold all this risky higher yield debt. They have been forced into owning it by these absurd low interest rate Central Bank Experiment. They aren’t comfortable with sales lines on products that talk about guru fund managers safely navigating the junk world with their hard earned life savings. They are going to bail on corporate debt when current spreads don’t compensate for the defaults that are heading our way. Who will buy the tsunami of corporate debt when the public bails. My desire and hope that we return to normal doesn’t match what the future holds here.

Another normal that will end in America and elsewhere is low corporate taxes and rich people taxes that cause huge deficits. The deficits will be needed for real people not the one percent or the corporations that the one percent hold in their portfolios. If social support and infrastructure spending needs a trillion bucks of government support the deficit will not go to two trillion and keep the low corporate taxes. No it will be at a trillion with no corporate tax breaks. That old normal is gone.

Because of low rates, people own more stocks than they really want. When the current shake out gets really nasty, I expect a lot of folks will swear off stocks just like Japanese investors did. We readers of Cam’s newsletter are experienced investors that are comfortable and knowledgeable about the ups and downs. When you go towards negative interest rates and the markets swing 20% in a couple of weeks the world is too weird for a lot of folks to risk their life savings.

Last year the S&P earning were down. This year they are likely down again. Two years with no growth. Last year was a crazy good market on no earning but Central Bank maxinum pumping. Are we going g to return to that with crazy good markets with no earnings growth and maximum easing. I doubt it. That train of believers has left the station.

So, standing back, I don’t think we will return to the normal of 2019 because that wasn’t a normal at all. It was the ending of a great monetary experiment with a now exploding set of unintended consequences ignited by a black swan virus that has ended things earlier than it would have without it.

Will we see a bottom soon?

I must agree with Ken. This seems like the end not only of the 2009 bull market rise but of the entire QE enterprise. Markets will have to return to more fundamental valuations. The QE support will not work again. The Covd-19 Virus just makes it that much worse. Could we have a 1932 style melt down again? rdmill

trading 4.5% lower AH

FYI in evening trading Oil is down on the European travel ban and the S&P futures are down over 100.

The issue seems to me to be uncertainty over how governments will address the consequences of the corona virus. Lowering interest rates or relief for payroll taxes, for example, does not address those issues.

What investors need to know is what the emergency medical process will look like, how will sick leave and unemployment support work? Will we – must we – go into a lock down like Italy and China to get over this? if so, how does that work and for how long?

I think that until these and similar questions get definitive answers, the turmoil on the exchanges will continue.

The speech tonight by the US President did nothing to answer these questions. You only have to look at the futures markets to see that.

The proposed legislation from the US House seems to be providing some relief.

Tomorrow will tell.

This is a serious situation. The President needs to take drastic actions to maintain social order at any cost.

First: close exchanges, no trading, even for dark pools, indefinitely until things improve.

Second: temporarily nationalize certain industries to manufacture and provide medical resources and daily living needs.

Third: helicopter money until things improve.

Absolutely no anarchy is allowed. Shoot to kill to maintain order like in Katrina hurricane situation.

Treat this situation like fighting a war. No other way around. Time for Americans to shape up.

There is a lot of pessimism I gleam in the above posts. The only thing I can say here is to quote our Master, Cam, Corona virus type events are usually limited episodes, but policy response will usually outlast such events (the verbiage is mine, but the idea is Cam’s).

The speed of this has been incredible. The effect on markets and business and activity (in the Bay Area) has been abrupt. Soon we will follow Seattle and close schools and all stay at home. The only questions now are how deep it goes and how long it lasts.

Thank you Cam for giving me the advice I needed to get ultra conservative, it truly is helping me sleep as good as I can right now.

It’s going to be hard to identify the panic bottom since every day sees such huge moves. Maybe we will see an afternoon when the trading breakers don’t apply and we see the Dow down 5,000 to 10,000 on the day. We may need to see more closings and virus spread first. I still think this summer will be a reprieve and we’ll see a rally even if it only lasts a month. As Cam says, rallies will be sharp, violent affairs.

This market turmoil is no longer about a recession, coronavirus or even the oil war. It is the market pricing the odds of Trump victory in Nov. A Democratic win implies reversal of corporate tax cuts, hikes in taxes for high income earners, and more corporate regulations.

https://www.predictit.org/markets/detail/3698/Who-will-win-the-2020-US-presidential-election

Joe Biden is senile. He won’t get elected.

If you look at the PredictIt chart for the last 24 hours, the odds began to decline 10 hours coincide – shortly after the speech.

The virus won’t go away for at least 1-2 months (best case scenario) and the memory of virus and this crash will still be fresh in mind. The election may become a referendum on the administration’s handling of the crisis.

Of course, we are still more than 6 months away. So, who knows! But the PredictIt chart is quite telling.

Most of the serious GOP strategists thought that Trump was a clown during the 2016 primary season, but here we are.

I have no idea what will happen.

What happens if the US goes in a lock down and closes stock exchanges until the dust settles for a few weeks and mobilizes national guard to limit travel, closes restaurants, schools and public gatherings nationwide?

They may leave a few essential options and futures markets open. Essential services would be left open.

If this were to happen should it not be prudent to go long as I write this, expecting a huge rally when the markets eventually open?

Just thinking in a non linear manner.

I think it has already gathering space at the level of state and local governments, and in the private sector. It may accelerate more in coming days and weeks.

The fed govt is clearly behind. For the sake of all of us, I hope they catch up soon.

I think we’ll know by end of month if we’re going to be going the way of Italy.

Reports from China, Korea, Italy show that the infection rates doubles every day.

Here are some important S&P 500 lows that you might want to keep in mind as we head lower:

Low/Close TODAY: 2352.60

Dec. 2018: 2346.58 We are basically here again.

Jan. 2016: 1812.29

Oct. 2011: 1074.17

Jan. 2009: 666.79

Opps. I mistakenly entered the amount the Dow was down instead of the S&P Low/Close for today. It should read. 2480.64 Not 2352.60.

In Czechia we are in state of emergency. Government close the borders with Germany and Austria – for trains and buses. Schools and Universities were closed yesterday. … I hope for the relief rally and for the victory over the virus. Please share some positive news if you have any:-).

Geez. The President of Brazil has tested positive for the Coronavirus. He may have passed it to President Trump this week! News conference on the virus at 3 PM EDT.

Brazilian president Jair Bolsonaro denies testing positive. Probably a rumor started by Adam Schiff.

https://www.foxnews.com/world/brazil-bolsonaro-tests-positive-coronavirus

So, I was hoping that CV will be gone with the arrival of warm weather in the northern sphere. I am not sure anymore. India suspended most of the visas. The number of cases even in Brazil are rising. Even the Brazilian President caught the disease allegedly.

We live, work, shop, drive, enjoy and commute in air-conditioned environment. The temperatures are in in late-60s/low70s everywhere inside in the most developed countries. Will the transmission of virus really slow in spring and summer?

This is just an opinion, and not grounded in fact – but is it possible that in fact millions of asymptomatic people are infected with the virus? With drive-through testing sites opening soon, we may discover that both the incidence of symptomatic infection and the fatality rate are far lower than currently estimated. I recall reading reports that up to 5 million residents/visitors left Wuhan prior to the lockdown – many of whom were likely infected. It’s also human nature that many of those infected and also symptomatic will hide or downplay their symptoms in order to continue working. So I think widespread testing is crucial – if only to reveal the true extent of the problem.