I believe this is just the start of a secular bull cycle for gold prices, based on a secular Sell America investment cycle.

Sell America = Gold Tailwind

The recent market embrace of the Sell America investment theme has given gold prices a significant secular tailwind. That’s because Trump’s abrupt pivot to an isolationist policy has shaken confidence in the status of American geopolitical leadership and the status of the USD “exorbitant privilege”. In late March, I wrote (see Uncharted Investor Waters: From Soft to Hard Power).

Trump’s ultimate game plan is to reshore manufacturing by reversing the effects of globalization. He has implemented an approach of harvesting the goodwill from U.S. alliances since the end of World War II, and through the implementation of trade barriers and economic pro-growth policies.

The long-term costs of these policies are the probable stall in productivity, and an increase in the cost of capital to U.S. companies through the removal of the USD’s “exorbitant privilege” as a reserve currency.

- Deficits are projected to grow as entitlement spending rises and revenue stays flat.

- Ongoing fiscal deficits are exacerbating a supply-demand imbalance in Treasuries.

- The inflationary effects of the trade war could see a hawkish Fed against a dovish backdrop by other major central banks, which will reduce the relative growth potential of the U.S. economy against the rest of the world.

- Possible U.S. policy changes will see investors demand a higher premium for U.S. Treasury debt in the face of increasingly unfriendly tax treatment and rising uncertainty.

Do Deficits Matter?

President Trump and the Republican-controlled Congress have been operating under the age-old assumption that deficits don’t matter. I would add that “deficits don’t matter – until the day they do”.

A Penn Wharton budget analysis of the budget proposals, as presented, would increase the deficit by $3.3 trillion over 10 years. However, some of the provisions of the budget expire in 2029. If those provisions were to be extended, an alternative analysis shows a deficit of $4.8 trillion over the same time frame.

The projections depend on two key assumptions: 1) Stable debt costs, which would spike the overall deficit as interest rates rise; and 2) the absence of a recession, which would crater tax revenue and spike the deficit.

Here is why deficits may start to matter as Treasury supply-demand imbalances become evident. Brad Setser documented how official demand for Treasuries have been falling.

In general, bond inflows have also been falling. Setser rhetorically asked if the flows can return to the $1-trillion annual pace, which would sustain a 4% of GDP funding level, or stay at the $500 billion level. Setser concluded, “I do think it is fair to note that increasing a 6.5% of GDP fiscal deficit into…waning foreign demand for coupons is a well, somewhat bold, move”.

Jens Nordvig, the CEO of Exante Data, had an even more alarming observation. U.S. real yields are spiking even as economic growth expectations are falling. These are indications that the market is losing confidence in the U.S. and U.S. exceptionalism.

The Fed Policy Wildcard

Meanwhile, over at the Federal Reserve, policy makers have adopted a cautious approach to monetary policy. While falling inflation indicators would ordinarily warrant interest cuts in the near future, the uncertain effects of the new tariff regime on inflation has resulted in a go-slow and wait for the data approach to interest rate policy.

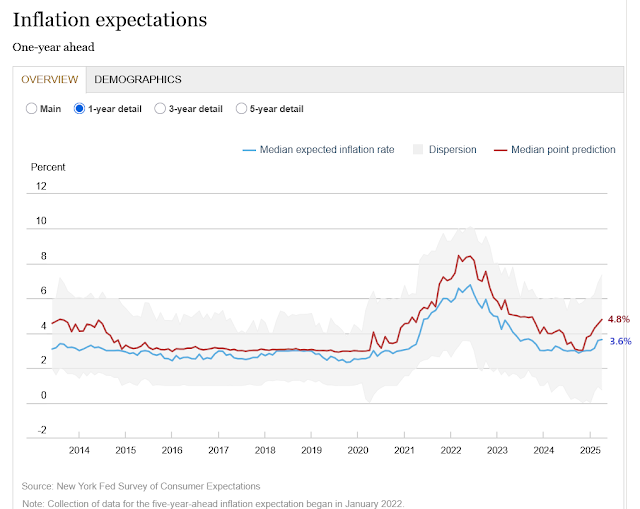

As well, Robin Brooks highlighted a growing divergence between the bond market’s inflation expectations in the U.S. and eurozone. While eurozone expectations have been largely flat, U.S. expectations are rising. This will lead to a divergence in monetary policy. The European Central Bank (and other central banks) will ease, while the Fed stays tight. The glass half-full interpretation is that interest rate differentials should boost the value of the USD, while the glass half-empty interpretation is a perceived economic growth differential between the U.S. and the rest of the world, which is bearish for the USD and U.S. assets.

Other Policy Risks

As well, two policy initiatives considered by the Trump Administration have the effect of either reducing demand for USD assets or causing investors to require a higher yield for holding Treasury paper. In addition to putting upward pressure on yields, these policies would put downward pressure on the USD.

One proposed provision of the new tax bill, Section 899, increases the tax rate on countries that “unfairly target and burden U.S. businesses and individuals operating abroad” based on the imposition of an “unfair foreign tax”, such as a tax on digital services and a global minimum tax. It raises the U.S. federal tax rate by 5% to 20% on tax residents of offending countries and has language that overrides existing tax treaties. The new rates would apply to passive U.S. source income such as dividends, interest, royalties and rents, as well as active U.S. operating income.

The next Fed Chair is likely to bring a more dovish perspective to monetary policy, especially if a Republican is in the White House. Leading candidates like Kevin Warsh and Judy Shelton fit this template perfectly.

Already, the market’s inflation expectations have staged an upside breakout. The potential combination of a stimulative fiscal and monetary policy has the potential to really rattle markets.

Bullish on Gold

In conclusion, the Sell America investment theme is becoming a dominant market narrative, and it’s bearish for USD assets and therefore bullish for gold. It is driven by the combination of rising deficits, shaky bond markets, an increasingly hawkish Fed and policy uncertainty.

As well, global family office allocations to gold and precious metals in 2025 was only 2%. Market tops don’t look like this.

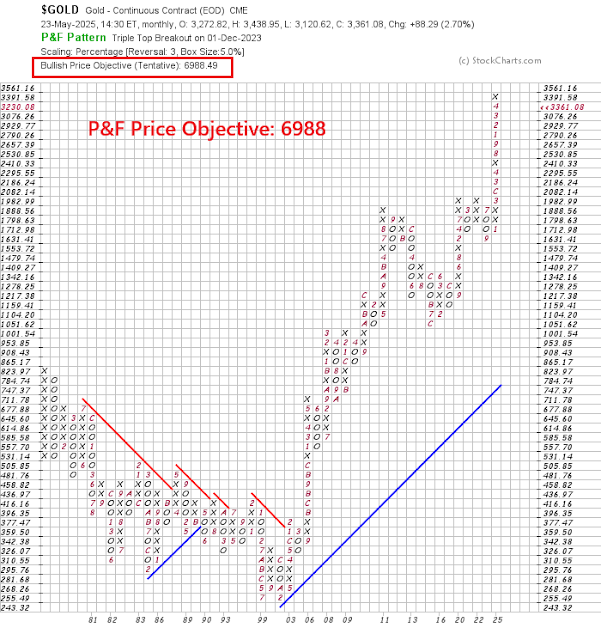

For a long-term perspective of the upside potential in gold, a point-and-figure chart of monthly gold prices, using a 5% box size and 3-box reversal, shows a measured objective of almost $7,000. I interpret this as an indication that the gold bull is only starting and it has several years to go before it reaches a final top.

Tactically, the gold mining stocks staged an upside breakout from a bull flag, which is a continuation pattern, after its 14-day RSI neared the 40 level, which is where it bottomed in the recent past. Market internals, such as the gold miner to gold ratio and percentage bullish, are showing neutral readings. These are indications of further short-term upside potential.

There is a once in a lifetime very possible investing moment coming. The last couple of weeks, I virtually attended the Mauldin Strategic Investment Conference where forty or so top experts give presentations on their various areas of expertise. Several gave an equally dire analysis of US debt and interest rates similar to Cam’s above. Actually Cam’s is more sophisticated than theirs.

The question is what happens when the bond vigilantes come and US government bond yields spike. The negative result on stocks, bonds, home prices and the economy would be devastating. Therefore a couple of the experts said the Treasury and Fed would initiate “Yield Curve Control”. as has been done by Japan for recent decades and the US in the early 1950’s. They overnight, simply cap long rates at a given level, let’s say 3% and tell the market they will buy all seller’s bonds at that price. It is a different name for QE.

The market impact would be instantaneous and positive. It is massively stimulative and inflationary. Gold would fly, dollar fall, stocks lift-off.

This would only be done during a crisis atmosphere so many investors will be confused. I think back to April of 2020 after the Covid Crash in March. The economy was in an instant depression with nobody in Times Square or L.A. freeways and the stock market bottomed and soar after just a one month 30% bear market. Later, we found the Fed and Treasury was massively flooding the economy with printed cash. The propeller-heads in the Fed had been preparing since 2008 GFC for any monetary problem and instantly put their well-researched pandemic plan into action. Result, veteran investors (like me) didn’t buy the crash. My salvation was I bought the hell out of the Covid Vaccine Day kick-off of a bull market in stocks and bear market in bonds.

So be rest assured that the propeller heads at the Treasury and Fed, have a “Truss moment. bond vigilante crisis game plan” ready. Maybe with rates on the 30 year spiking to 7%, they cap rates at 5% and they say, that’s not inflationary. Or capping at 4% or 3%, what then?

I sure as hell hope that Cam isn’t retired at that point. For those prepared, it will be nirvana, especially for gold. Fixed income investors will be pillaged.

Wouldn’t fixed income rally? That would be the time to sell fixed income holdings and buy stocks with both hands with the proceeds?

Day one long bonds soar. Then…….

The world is already dramatically different. No one is going to hold bonds for long term. It is not even hedge against equity volatility anymore. There is just too much debt floating around the whole world. It does not matter selling america or not. Othere countries are even worse, just meaningless capital moving around without any sound logic. Right now and in the future, whenever there is a big drop in equities, people would sell bonds and buy shares of best companies. This is the new thinking. Shares of best companies are the best inflation hedge.

Cam, in some future article it would be instructive to see gold bullion charts in other currencies, As the US dollar falls, the price in other currencies goes up less.

Here you are: https://x.com/HumbleStudent/status/1926615776678535544

Dear Cam

You are an excellent analyst and I would sincerely urge you to keep writing. Perhaps you may publish once a month. You have a great penchant for analysis and explaining it in plain English and excellent graphs which illustrate your case very well.

I Second that request.