Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)

- Trading model: Neutral (Last changed from “bullish” on 17-Jan-2025)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

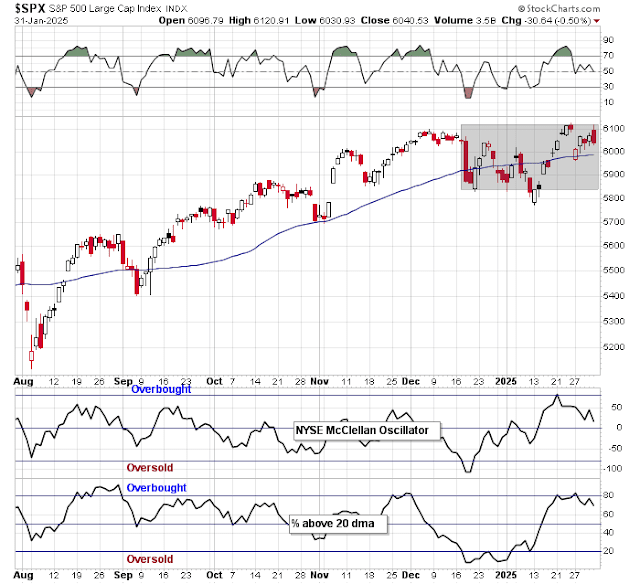

A high volatility regime

I told you there would be volatility. In the past week, investors have seen a fright over how advances in artificial intelligence may affect the AI ecosystem, Federal Reserve and European Central Bank interest rate decisions, earnings reports from Magnificent Seven companies such as Apple, Meta, Microsoft and Tesla, and a raft of Trump policy announcements and executive orders that surprised the market.

Global economic policy uncertainty has spiked. Is it any wonder that market volatility follows suit?

Trend? What trend?

As a consequence, it’s a tough time for trend followers because apparent established trends can quickly reverse themselves in this environment.

As an example, the relative returns of price momentum ETFs, which seek exposure to stocks that have gone up the most in the recent past, have gone on roller coaster rides.

Policy implementation fumbles

The Trump White House’s rookie mistakes in policy implementation isn’t helping either. As an example, the Executive Order (EO) on the federal aid freeze had to be reversed, much in the way the travel ban had to be reversed when Trump first took office in 2017. The Trump team drafted the EO without consulting the agencies involved for reasons of secrecy. The result was an order that was badly written, unclear in its objectives, and lacked guidance to agencies in implementation and the specifics of different cases. As a consequence, it had to be withdrawn.

Consider the implementation difficulties of another of Trump’s initiatives, the denial of birthright citizenship to people born in the U.S. to non-citizen parents. Even if it were to survive a constitutional challenge, how does an American born in the U.S. prove citizenship? The conventional method of a birth certificate won’t work anymore. You would need your parents’ birth certificates or naturalization papers, and who has those kinds of records? What if you were born to a single mother and the father is unknown? Even if the government determined that someone is not entitled to citizenship under those provisions, that person could potentially become stateless. Where would you deport someone like that to?

As for the latest announced tariffs of 25% on Canada and Mexico, we believe they were imposed to virtue signal and likely to be reversed in the near future as their costs are too high for all parties involved. It’s unclear what Trump is trying to accomplish with the tariffs on Canada and Mexico. An analysis of trade deficits shows that the lion’s share of the trade deficits are attributable to China and Asia, not Canada and Mexico.

The headline reasoning for the tariffs is the amount of fentanyl crossing U.S. borders. While the amount of fentanyl seized at the Mexican border is considerable, the amount seized at the Canadian border in 2024 was only 43 pounds.

A recent

Bank of Canada study which modeled the effects of a 25% tariff on Canada projected a -6% growth effect on GDP, which amounts to a deep recession. Trade within the USMCA bloc in 2020 accounts for 29% of Canadian GDP, 40% of Mexican GDP and 10% of U.S. GDP. Undoubtedly the effects of a 25% tariff on Mexican goods would be the same order of magnitude or worse. Slowdowns of that magnitude in Canada and Mexico would crater the U.S. growth outlook expectations and probably plunge the U.S. economy into recession as well, which is an outcome that Trump is unlikely to want to risk if his intention is to virtue signal.

Canada’s

Globe and Mail reported about a different study by the Canadian Chamber of Commerce’s Business Data Lab which estimated Canadian GDP would fall -2.6% and U.S. GDP by -1.6%, which would be recessionary. In addition, many U.S. companies with cross-border supply chains will be affected, which will result in significant U.S. job losses.

Expect the stock market vigilantes to force a further face-saving backtrack in the near future.

Trust the Trump Put

The current environment suggests that traders should adopt a strategy of “buy the dip and sell the rips”. The combination of negative surprises during earnings season and potential bearish policy announcements when the market is overbought will put downward pressure on stock prices. On the other hand, investors should trust the stock market vigilantes to activate the Trump Put in the event of a market downdraft, as he judges his own performance by the stock market. In the absence of a severe bearish catalyst, expect stock prices to bounce when the market becomes oversold.

So where does that leave us today? The S&P 500 is near overbought and sentiment, as measured by put/call ratio, is showing signs of froth, which argues for light bearish positioning for trading accounts.

As well, the relative volume of the NASDAQ to NYSE (blue line) is turning down, which is often a sign of impending weakness in the NASDAQ 100. The key question for traders is whether the S&P 500 can hold up if the Magnificent Seven were to falter.

Finally, the Citi Panic/Euphoria Model is off-the-charts euphoric, though it’s not very predictive of equity returns of time horizons of less than a year.

In conclusion, traders should adopt a strategy of “buy the dip and sell the rips”. Lighten or short positions when the market is overbought. On the other hand, investors should trust the stock market vigilantes to activate the Trump Put in the event of a market downdraft.

Consider trading NVDA, now at 200MA support. Current year rev is revised much higher the last 6 months. DeepSeek style of software optimization in training/inference is going to add a lot of AI demand on premise and at the edge, in addition to increased usage at the data centers. There is not much more you can do with software optimization so the addition of GPU is the route to go.

Progress in Argentia is steady. So it remains a good target.