Mid-week market update: I reiterate my belief that while seasonality is informative of climate, it is not a forecast of the weather ahead. 2024 was a difficult year based on seasonal patterns, as depicted by

Jeffrey Hirsch of Almanac Trader.

Instead, the stock market was weak in the second half of December and small caps leadership did not emerge during that period. That said, the S&P 500 ended to year right at trend line support and the NASDAQ 100 ended the year at 50 dma support.

Positive divergences

I can find several silver linings in the dark cloud of market correction. First, the market achieved a severely oversold condition reminiscent of the October 2023 bottom and the COVID Crash. While a V-shaped recovery did not appear as expected, subsequent weakness revealed a series of positive divergences as the S&P 500 tested its recent lows, such as this one from the Fear & Greed Index.

As well, small cap relative performance started to turn up in the last few days, which is a constructive development indicating broadening breadth.

We can see the a similar effect in the value and growth relationship. Value rebounded against growth across all market bands in late December.

Historical studies

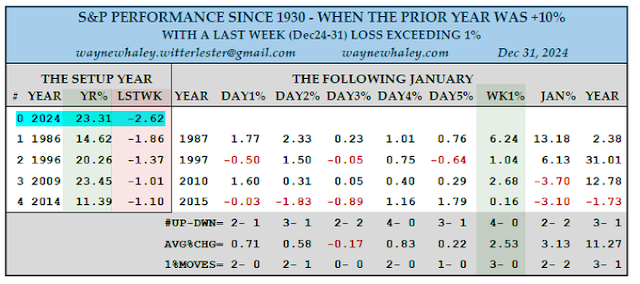

I hate to bring up historical studies of similar episodes because of their small sample sizes. Wayne Whaley highlighted that 2024 was the worst last week of December since 1937. He found that there weren’t many cases of a double digit year finishing with a 1% last week loss. In those four cases, the following week in January was resolved in strong rebounds, though January returns were lacklustre.

Ryan Detrick found only five cases of three consecutive down days to end the year. In all cases, the market rebounded strongly 100% of the time.

It’s difficult to forecast what 2025 will look like for investors. However, I am reasonably constructive that the stock market is poised for a short-term rebound. The S&P 500 Intermediate-Term Breadth Momentum Oscillator is on a buy signal setup, and the buy signal will trigger once its 14-day RSI recycles from oversold to neutral. As well, the percentage of S&P 500 above its 20 dma remains highly oversold. While oversold markets can become more oversold, I haven’t seen any fundamental catalyst to spark another downleg. I therefore conclude that the odds favour an upside move in the near future.

My inner trader is holding on to his long S&P 500 position. The usual disclaimers apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXL

Happy new year!

Is anyone concerned about the credit card default peak?

In theory I and most Stategists are panicked by the possibility of a Bond Vigilante sideswipe, killing the bull market. I watch the CCC Bond spread chart from the St. Louis Fed every day (get on mailing list). It is extremely tame. It will be soaring when the vigilantes come over the hill. Run to your safe place when that happens. Until then keep rationally optimistic like Yardeni and Cam.

Seasonality is a bit like the year ending with say a 5 which is supposed to be a good year, or the presidential cycle etc.

If you look at the chart on the S&P, it is still showing higher highs and higher lows which is good.

So many are talking about meltups or crashes, this is a mixed sentiment, not euphoria.

Most importantly is federal deficits. They are running at about 2 trillion a year. Where does that money go? It ends up somewhere after cycling through many hands. Some of that ends up in equities. People are quick to say that the covid stimulus of 5 trillion led to the market surge, but does it matter if the trillions were spent because of covid or some other reason?

So when federal deficits end, this will be a drag on the market. Will that ever happen?

My thoughts are that a recession, earnings decline due to consumer exhaustion will lead to a decline in equities.

A surge in inflation would likely cause rates to go up, and deglobalization should be inflationary unless the factories are so high tech that few humans are needed.

A strong dollar attracts money until it starts trending down, and also helps with inflation. But the dollar cannot keep going up forever.

One thing I heard that makes sense to me is to stay long until it is pretty clear on the charts that we are past the peak. That doesn’t mean not to take profits on the way up, but since we don’t know where the peak is, getting out too early means missing the melt up.

The wall of worry.

I am watching the 2 year and the 10 year. As of now they bounced of support. 22-23 times earnings is not cheap. Throw in Trumps voodoo tariffs and his propensity to grand stand anything can happen. The greatest surprise will be no surprise next year.

Thank you all

Things are normal for the most part. And this makes investors anxious. They are conditioned to seeing things either very smooth or very volatile. Could not live with normal conditions. It is funny in a weird sense. Short term markets are very oversold. After the rebound indices most likely bounce around and end the year essentially flat. So stock picking and more trading will be required to generate alpha. Some people may be nervous about Trump’s style but after his 47th this 49th won’t shock most people by much. I believe many people are in a wait-n-see regarding how Trump will govern, but generally the confidence level is higher than before the election. So that’s the default mode today. Let’s observe data in the time series while it is unfolding into the new year and try to make sense out of it.