Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)

- Trading model: Neutral (Last changed from “bullish” on 23-May-2024)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A case of bad breadth

Anxiety has been increasing among the technical analysis community over the blatant instances of narrow market leadership and negative breadth divergence. Even as the S&P 500 rose to new all-time highs, the Advance-Decline Line, regardless of how it is measured, is exhibiting a series of negative divergences.

Even though these breadth divergences are concerning, they are not necessarily bearish signals. Here’s why.

Persistent divergences

Here is a monthly chart of the NYSE, S&P 500 and S&P 600 Advance-Decline Lines for a long-term perspective. The most notable negative divergence began in 1998 but the S&P 500 didn’t peak until March 2000, a span of two years. A shorter lead-lag relationship can be seen at the 2007 top and the 2021 top. In the two latter cases, the negative A-D Line divergences persisted for several months among both large and small caps.

We can see a similar pattern of a persistent warning signal from the BoA Global Manager Survey, which showed that institutions had cash at historically low levels, which should be contrarian bearish. In all cases, cash didn’t outperform until the condition persisted for several months.

In other words, breadth divergences are conditional warnings and they are not automatic and actionable sell signals.

A question of leadership

Technical analysts have largely focused on the narrowing leadership of the market. This 10-year chart shows that the relative performances of the equal-weighted S&P 500 and Russell 2000 have been abysmal. Even as the S&P 500 rose to all-time highs, relative breadth indicators were nosediving to all-time lows.

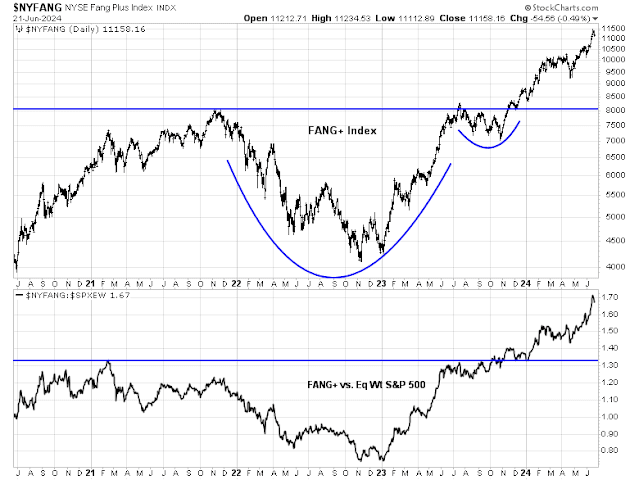

The flip side of the narrow leadership coin is the persistent strength in megacap technology stocks. The NYSE FANG Plus Index staged an upside breakout from a multi-year cup and handle formation in Q4 2023. Both absolute and relative performance is strong.

I would prefer to wait for a trading sell signal. One possible candidate is an excessively low put/call ratio, indicating a crowded long, which is contrarian bearish.

Other sentiment models are also flashing warning signs. Marketwatch reported that PMorgan analyst Nikolaos Panigirtzoglou found that short interest on SPY and QQQ had evaporated and fallen to a new low.

Bear in mind, however, that sentiment is a condition model that can warn of an extreme condition, but it can’t be relied upon as a tactical sell signal.

On the other hand, while the S&P 500 appears extended, what’s the downside risk if the NYSE McClellan Oscillator (NYMO) and the NASDAQ McClellan Oscillator are near oversold?

As well, the usually reliable S&P 500 Intermediate Term Breadth Momentum Oscillator (ITBM) just flashed a tactical buy signal when its 14-day RSI recycled from oversold to neutral.

The week ahead

Looking to the week ahead, stock prices will be facing some liquidity headwind. The U.S. Treasury will have $211 billion in notes for sale. ON RRP is likely to rise as RRP rates are higher the then 1-month T-Bill rate, which would drain liquidity from the banking system.

Initial S&P 500 support can be found at the gap at 5370-5400, which represents a downside potential of less than -2%. The challenge for the bulls is to hold the line at that level. That’s when investors will find out whether the pullback will be deep or shallow.

In conclusion, while the conventional bearish view of negative breadth divergences is bearish, it isn’t necessarily correct. The bearish consequences of a negative breadth divergence can take over a year to be realized. Instead, they are warnings of bearish conditions than actionable tactical sell signals. I interpret current market conditions as highly extended that can pull back at any time, but investors should also recognize that the situation could resolve itself in a benign manner.

https://x.com/SamRo/status/1804170533241512343

Anyone wants to comment on this metric (Price to Free cash flow)? Thanks.

Sam Ro picked the most glaring difference between then and now, FCF. So it is self-evident. One factor people don’t talk about is devaluation of USD. It is worth a lot less today so naturally every item price has to rise nominally to reflect that. And there are more products and services people spend money on. It is also very amazing today. With all the huge buybacks today the P/FCF ratio did not go parabolic. That shows you how profitable companies are.

Hi Cam,

It is probably also worth noting that breadth has actually improved over the last week. For example the percentage of stocks in the SP-500 above their 20 Day MA has increased from 32.4% to 55.3% and the number above the 50 Day MA has increased from 42.3% to 52.1%. Anything above 50% I interpret as a positive bias.

Also on the Nasdaq-100 the percentage of stocks above their 50 Day MA has gone from 53.3% to 66.3%.