Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

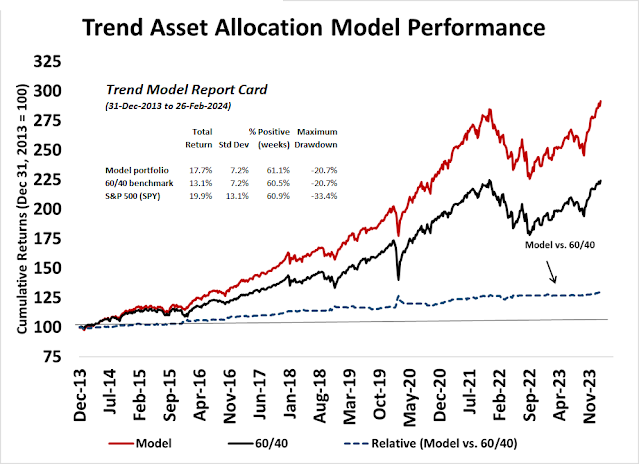

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)

- Trading model: Bearish (Last changed from “neutral” on 25-Mar-2024)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Market structure review

This week I present a review of the overall market structure, starting from a long-term perspective and gradually shortening the time horizon.

I am bullish on stock prices, as evidenced by the positive MACD histogram of the NYSE Composite that acts as a buy signal. In the past, such buy signals are long lasting and the bull run can stretch into years.

Momentum begets momentum

While most technical analysts use the put/call ratio as a contrarian indicator, option sentiment can also be utilized as a momentum indicator as well. The top panel of the accompanying chart depicts the 50 and 200 dma of the equity call/put (not put/call) ratio. In the past, bullish crossovers where the 50 dma rises above the 200 dma have been signals of bullish price momentum that can be long lasting.

Even though the long-term outlook is bullish for the overall market, previously leading NASDAQ stocks are starting to stumble. The NASDAQ 100 has violated a rising relative trend line and relative trend indicators (bottom two panels) are weakening.

While the analysis of the equity call/put ratio shows a pattern of strong momentum, the analysis of the relative volume of the NASDAQ against NYSE shows relative weakness. Relative volume has not been confirming the NASDAQ 100 advance.

That said, the artificial intelligence bull is real. We will all be using AI assistants in the near future that will be productivity boosting. However, the AI rally will undergo fits and starts. Should the 12-month normalized performance (black line) pull back to the grey oversold zone, it will be a strong buying opportunity for NASDAQ stocks. This is just a relative correction in an uptrend for AI-related plays.

Japan is outperforming US by 230 basis points YTD. The tailwinds are there with inflation, interest rates, wages and economic growth, not to mention structural corporate governance reforms.

JPMorgan projects Euro Large Cap to lead this year.

Tactically, waiting to add to AI positions on a pull back. Some have corrected already.

$$HYIOAS is also dropping which is a good sign.

Hard to believe, but I think the election year and continuing fiscal deficits will keep stoking the markets.

I monitor high and low momentum in the 11 GICS, (industry groups) as well a major country indexes. There is an internal correction occurring in them since the beginning of the year. The high momentum stocks are up 15% and the low momentum down a few percent. The gap between the two is huge and has happened so fast. This is very unusual.

So the calm upward movement of indexes is actually boiling inside. What is going on? My guess is that generative A.I. is giving people the tools to easily build sophisticated evaluation and trading tools that back test and are then used confidently. A couple of those tools have been marketed to me recently. As millions more traders parse the market with similar tools looking at similar huge databases, they become self-reinforcing successes. The stocks they pick will be similar and pushed higher. They will shun similar stocks. The next stock market bubble (long time away) will shockingly be in quality stocks outside of the Silver Seven pushed far too high by A.I. practitioners, amateur and professional.

In my opinion, this is why momentum ETFs are killing it. I have studied momentum and keep researching it. Historically, momentum outperforms the market by about 10% per year, 80% of the time. It only sucks from the bear market low for a few quarters as the crap stocks celebrate not going bankrupt in the recession. This pattern of outperformance has been interrupted in the last three years as Value and Growth swung hugely back and forth in leadership after the Covid crash and unusual economic aftermath. The momentum ETFs rebalance every six months and kept zigging and zagging into the wrong stocks. Now, I believe, we are back to normal with momentum calmly sorting the right winners to persist in winning. Momentum wins when performance persists. The outlook, in my opinion, now favors persistency within the bull market Cam has outlined.

The brilliant, Yuval Noah Harari said recently, “Nobody knows where the world will be in 20 years.” I totally agree. Wherever we will be in future, momentum will mathematically own the winning companies and avoid the losers. I believe the difference between winners and losers will be very stark and surprising. Why surprising? Because after a sea change in so many areas of the economy coupled with a transformational technology revolution, long-term experience not only doesn’t help one invest wisely, it’s detrimental, especially so, if one has been successful in the old pre-sea-change world. Many experts will confidently invest wrongly. I get Rosenberg’s expensive daily letter and he has missed the entire bull market with deep proofs every day as to why markets and the economy will plunge. They didn’t and I bet he doesn’t really know why.

Momentum investing just admits to the impossibility to sort out the new complexity and relies on the cream rising to the top. One needs to put one’s ego aside and just make money.

Welcome to the golden age of momentum.

I just had a thought. Back in 1973, there was the Nifty 50 that were in a bubble at the peak of that market cycle. These were stocks like Polaroid, Kodak, Zerox and others that were sure bets.

Now envision with A,I. investing tools, a Nifty 1000 group of sure bets at a future peak all at bubble valuation and investor confidence. Juicy getting there but scary at the top.

Thanks, Ken.

You have been researching momentum investing in different asset classes, I was wondering if you can share the performance over a long period of time compared to a broad index. Let’s go back to the beginning of 21st century if possible. We have seen three major financial events in that period along with a 7 5% annualized return of SPY from 1/1/2001 till now.

Back-testing of any investment strategy or indicator before the sea change in 2020 will mislead. We are in a sea change period of investment market history from 2020 onward in so many areas, low inflation to high inflation, low interest rates to high, peaceful geopolitical cooperation to adversarial, political strife in America, globalization of commerce reversing, and generative A.I. transformative technology.

If you accept these new impossibly complex forces are at work, you would use a strategy that can successfully navigate the era. Or, one could roll T-Bills at high rates and just invest with small ‘fun money’ . But if you believe , like I do, this will be a very great time to invest in those companies operating throughout the economy that harness the new A.I. technology successfully, you want to commit a large amount of your capital to equities. My research says that momentum will enhance returns by gravitating to winners and reduce risk by avoiding disrupted losers, all mathematically.

Ken, thanks!

Not backtesting but actual performance over a long period of time of an investment strategy, risk adjusted basis.

You made some very valid points here. Since tools are now available to everyone the differentiating factor will be one’s temperament. In other words patience and discipline. I guess now Jeremy Grantham will remain in dog house indefinitely.

What being said about publicly available database does not apply to specific domains. Domain knowledge together with AI tools is where the real value is created. But I think most of traders will just use TA to find biomarkers to locate those stocks. Basically it will be trend following by the herds, or just herding. And it is so easy to spot I think someday very soon primary school kids will be into trading. Who needs school or working hard? Truly maximum randomness, and for governments it is so out of control.

I’ll cite a use case for AI tools, just recently. Some of our fellow readers might think it is a joke, but it is not. Sildenafil (you know, those jokingly blue pills) has been proven in labs to treat Alzheimer’s and Dementia, and to our surprise very effectively. It does not only stop the degeneration of neurons and the connecting synapses but actually regrows them to restore and improve the functioning. This idea has been found after more than 1600 research articles and the databases are combed thru and extracted. And this process will accelerate thru the loops with each loop gaining more relevancy and coherence. Picture this process being applied to every facet and every phase of our current industries.

100mg of Sildenafil costs a few cents to manufacture in India. Pfizer cannot gouge consumers anymore. Now imagine this. It is used to treat certain pulmonary heart disease, and now it can treat Alzheimer’s, and there are some preliminary reports supporting general brain function improvement. It is almost a wonder drug. Does that mean our gov will require senior citizens to start taking it daily to lower Medicare expense? The drug is so cheap. With AI tools and domain knowledge we will live indefinitely.

One potential side effect is that senior citizens will start to engage in reckless physical activities or start to flirt in bars. The future is so unimaginably fun, and to enjoy it you need to make a lot of money because there will be a lot of rich people.

So, I fail to see how anyone makes money in the use case above and similar discoveries using AI. FDA would still be involved.

I know there is a gold rush and I am part of it, I am still awaiting a use case that actually has an ROI. Granted creativity would be enhanced, lives would be different Etc.

Ken has declared that this time is different. Let’s give it some more time to unfold.

Just an old timers perspective.

very interesting thoughts, thank you!

Care to share which A.I. tools you have been offered / which ones you think are worth their weight in salt?

Sorry I didn’t pursue them. I almost only use ETFs not stocks.