Preface: Explaining our market timing models

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)

- Trading model: Bullish (Last changed from “neutral” on 22-Sep-2023)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Poised for a rebound

There are numerous signs that the U.S. stock market is oversold, washed out and poised for a FOMO (Fear of Missing Out) rebound. The latest indicator is the CNN Fear & Greed Index, which is beginning to recover from levels seen at the market lows of October 2022 and March 2023.

The stock market has experienced a technical wipeout. Jay Kaeppel at SentimenTrader found that whenever the percentage of S&P 500 stocks fell below 15% (it reached as low as 8.6% last Tuesday), forward returns have been strong, with the exception of the 2008 experience.

Seasonal indicators are also pointing to a market rally. Combined with the deeply oversold nature of the market, the odds favour an imminent “rip your face off” rally to alleviate the oversold condition.

A leadership review

Should the market experience a relief rally, what vehicles could an investor use to position to maximize potential return under such a scenario?

Defensives sectors have also performed poorly on a relative basis, largely because utilities and REITs are interest-sensitive sectors that didn’t respond well to the surge in bond yields.

The relative returns of cyclically sensitive value sectors were mixed. Most were either flat with the index, though energy turned up but weakened when oil prices retreated.

The hidden surprise

The surprising flat relative returns of cyclically sensitive sectors highlighted a hidden investment theme. If these sectors, which should lag during bearish episodes, are flat with the market, does that mean they will perform well during a risk-on period?

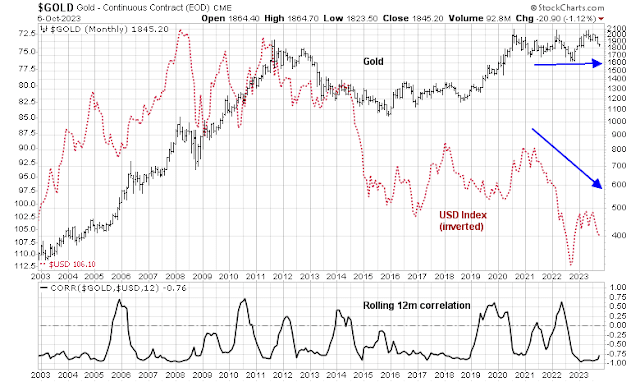

In particular, consider how gold has behaved since 2021. Gold has shown an inverse historical relationship to the USD. When the USD started to rally in early 2021, gold should have fallen. Instead, the price of bullion was mainly flat over this period.

Gold mining stocks offer a similar favourable risk-reward ratio. The gold mining to gold ratio is trading at a relative support zone, indicating excessive bearish sentiment. Similarly, the percentage of stocks bullish on point and figure charts is nearing 10%, which is another washed-out area. As well, gold miners to S&P 500 are testing a key relative support level.

From a long-term perspective, the gold to S&P 500 ratio appears to be making a bottom that should favour gold and inflation hedge vehicles over U.S. equities.

An analysis that zooms out from gold to the materials sector also shows a constructive picture. While the relative performance of materials stocks has been flat, relative breadth indicators (bottom two panels) are exhibiting underlying strength. This sector should outperform in a risk-on rebound.

No review of gold and materials without a word on the energy sector. Energy stocks retreated when oil prices weakened, but the recent events in Israel is likely to derail the Saudi-Israeli dialogue and increase the geopolitical premium on oil prices. Longer term, the transition to renewable energy creates significant disincentives for oil producers to invest in new production, which will put a floor on oil prices over the next few years. Oil has become the new tobacco.

Unanswered questions

You can tell a lot about market psychology by the way the market reacts to news. The S&P 500 took a reflex risk-off tone on the blowout jobs report, but turned around and rallied to a gain of 1.8% on the day. Earlier in the week, the market had been exhibiting a series of positive divergence on its 5-day RSI, which was a setup for the relief rally.

However, the eruption of war in the Middle East raises a number of unanswered questions for the trajectory of risk appetite:

- The early knee-jerk reaction on extremely thin CFD market has been a minor risk-off event. Will the risk-off tone continue?

- As wear breaks out, what will be the main beneficiary of safe haven flows, gold or USD assets?

- If flows move into the USD, will that alleviate the upward pressure on Treasury yields?

My Bottom Spotting Model flashed a buy signal about two weeks ago, and the signal was sparked by the extreme oversold nature of the stock market. The market’s risk-on reaction to the NFP beat Friday was a signal that the rebound had begun,

In conclusion, the stock market is oversold, washed out and poised for a FOMO relief rally. My review of sector relative performance leads me to believe that the leadership in a rebound will be led by the cyclically sensitive materials stocks. In particular, gold and gold stocks have defied their inverse correlation to USD strength and could be strong beneficiaries under a relief rally scenario.

My inner trader continues to be bullishly positioned in the S&P 500. The usual disclaimers apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXL

VIX doesn’t tell us the end of time is here, then market’s will be bearish for few days more, maybe a full week, and also the most bearish signal are the bullish failed ones.