Mid-week market update: You know things are bad when 1987 parallels come out of the woodwork. The key difference is the Fed and the USD. In 1987, the Fed implemented a

series of inter-meeting rate hikes to support the USD. The USD needs no support today.

During these times of market stress, it’s worthwhile keeping in mind the title of Walter Deemer’s book on technical analysis.

How oversold?

This oversold stock market is experiencing a re-test of its recent lows, trend line support, and its 200 dma at about 4200. How oversold? Not only has the VIX spiked above its 20 dma Bollinger Band, it rose above its 20 week Bollinger Band, which has signaled short-term bottoms in the past.

The percentage of S&P 500 stocks above their 50 dma fell below 10% yesterday, which is another sign of a short-term bottom. Furthermore, it’s exhibiting a series of positive divergences on the percentage of stocks above their 20 dma.

The Zweig Breadth Thrust Indicator became oversold last week, bounced, and turned oversold again. Such oversold conditions are not sustainable and they have usually resolved in a relief rally.

At the same time, there are numerous historical studies that indicate a near-term bullish reversal. Andrew Thrasher observed that 43% of stocks are showing bullish divergences, an extremely bullish condition.

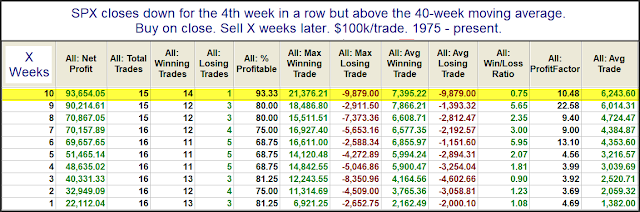

Rob Hanna found that when the “SPX close[s] down for 4 weeks in a row, but still remain[s] above its 40-week moving average”, the expected rebound is strong and long lasting.

The latest risk-off episode was sparked by weakness in the Treasury market. Peaks in long-bond yields have historically either led or coincident with peaks in the Fed Funds rate. The latest surge in yields is partially attributable to the “higher for longer” monetary policy narrative. For what it’s worth, the 30-year Treasury yield is testing a key long-term resistance level, which could prove to be a ceiling. Watch for my more detailed this weekend on the bond market.

My inner trader continues to be bullishly positioned in the S&P 500, with a stop-loss placed slightly below the 200 dma. The usual disclaimers apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Hi Cam,

Have you done a study to see if the indicators you refer to in this and previous letters are the start of an intermediate rally (lasting weeks and months)? Similar to 4/25/2023 or these indicators just remove the over sold condition i.e 9/07/2023 and the decline resumes.

On a fundamental basis I think we need to see the bonds stabilize, the dollar & oil stop going up. Maybe, today was a small baby step in the right direction. Unfortunately, the Russell did not rally.

The indicators point to a short-term rally because everything is so oversold. I am watching ITBM, which is a momentum indicator, to see if we get a sustainable rebound.