A question of breadth

A detailed analysis shows the reversal of the MACD buy signal can be attributed to poor breadth. The accompanying year-to-date performance of several market indices tells the story. While the S&P 500 advanced impressively for this year, the strength was mainly attributable to the megacap growth stocks in the index. By contrast, the equal-weighted S&P 500 and the broadly based NYSE Composite have gone nowhere for the year (as marked by the horizontal lines). Is it any wonder why the monthly MACD of the NYSE Composite reversed to negative in September?

The strength of the S&P 500 has meant that its monthly MACD is still positive. A study by Ryan Detrick of S&P 500 MACD crossovers showed strong returns over a one-year time horizon.

Trend Asset Allocation Model still bullish

In addition, my Trend Asset Allocation Model is still showing a marginal bullish reading. As a reminder, the Trend Model is a composite model that applies trend-following principles to a variety of global equities and commodities. A model portfolio that uses the out-of-sample Trend Model signals to overweight or underweight the S&P 500 against a 60/40 benchmark has exhibited almost equity-like returns with balanced fund-like risk.

The most bullish component of the Trend Model is commodity prices, which are in an uptrend. The cyclically sensitive indicators are mixed. The copper/gold ratio has been trading sideways, but the more broadly based base metals/gold ratio has been slowly rising since June.

Turning to global equity markets, the S&P 500 has been weakening, but the index is holding above its 200 dma. Call that a neutral condition.

Across the Atlantic, European markets are mixed. The Euro STOXX 50 has violated both its 50 and 200 dma, but the FTSE 100 is weathering the correction and holding above its moving averages.

In Asia, it’s remarkable how well equity markets are holding up in light of widespread evidence of weakness in the Chinese economy. China and Hong Kong are weak, but the Japanese market is strong, while other Asian markets are mostly flat. Call it a neutral reading.

Putting it all together, the Trend Model interprets the combination of commodity strength and mixed equity market readings as a weak buy signal.

Addressing the bear case

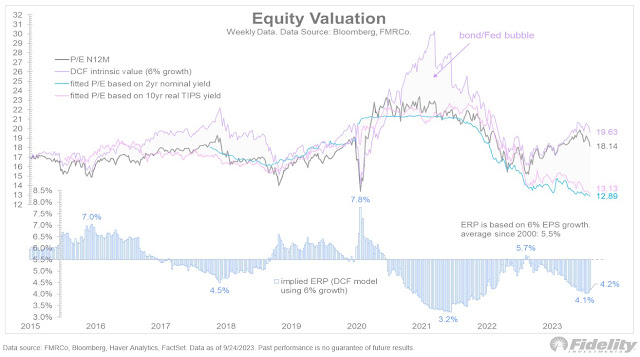

Nevertheless, the latest bout of equity market weakness has fundamental roots. The surge in global bond yields has pressured equity valuation. As yields have risen, the equity risk premium has compressed.

Before you become overly bearish, consider that corporate insiders have started to buy this dip. Insider buys are exceeding sales. Similar past instances have signaled good buying opportunities.

As well, consider that large speculators are in a crowded short in Treasuries.

At the same time, a divergence is showing up between the Citigroup U.S. Economic Surprise Index and the 10-year yield. Historically, the two have been relatively correlated. The recent trend of decelerating positive surprises in U.S. economic data should put downward pressure on yields. I have no idea what data release may be the catalyst, but it could spark a bond and stock market rally of significant proportions.

An additional bearish factor that’s unsettling market psychology is the U.S. government shutdown. While the sample size is small, government shutdowns have tended not to last very long, and Jurrien Timmer at Fidelity found that even prolonged shutdowns have had little impact on stock prices in the past.

Ironically, a prolonged shutdown may have a calming effect on the Treasury market. The shutdown will delay the release of key economic statistics such as inflation and employment. The lack of data will induce paralysis at the Fed and increase the likelihood that it will stay on hold at the November FOMC meeting and possibly the December meeting as well.

Finally, the stock market is experiencing a severe technical wipeout, as measured by the percentage of S&P 500 stocks above their 50 dma that fell below 15%. Such episodes have always resolved in a short-term relief rally of varying magnitudes. In addition, its percentage of stocks above their 20 dma is exhibiting a positive divergence, which is another bullish sign.

So, when interest rates are low, equities, led by tech rally.

When interest rates rise, equities led by tech rally too.

When inflation is low or high, equities led by tech rally.

No matter what the consumer confidence says, or what the macro back drop is, equities led by tech, rally!

What am I missing?

They talk out of both sides of the mouth. Are rates going up because the economy is strong and demand for money is high to put in business, bank rates go up for this reason, and less money into treasuries…so rates go up. Or is it inflation which can have multiple causes which like today gets the Fed to tighten.

If you look at long term charts, something happened in the 90s. I think it is the cumulative federal deficit. When the gov’t has a deficit, we have a surplus. Trade imbalance doesn’t count like in the old days when the gold stayed in other countries, now it gets recycled as treasuries. So where does all our surplus go? Year after year, mattresses?

It is accepted that the stimulus spending was inflationary and gave the market a boost. Why, because it was “stimulus” and not the usual porkbarrel stuff?

So we have this demographic bulge which will require huge amounts of spending on medicare, and social security. Are we at “peak federal deficit”? I think we are just starting and with some breaks along the way the market will keep going higher.

When the dollar breaks and the trade balance goes positive is when the true crisis happens, until then they can kick the can. When that will happen I have no idea it could be 10, 20 even 50 years, but one day people elsewhere will stop making things to send to us for magic paper. The old “if something can’t go on forever” saying.

One of the catalysts for that will be when they have a choice. Right now there is no good choice, but I think real goods like commodities have global worth. We all need copper, silver, oil, corn etc. That’s where I think we go, but remember how commodity prices are cyclical and recessions affect them.

The emerging leadership in resource extraction sectors and industries. See gold miners, for instance.

The trend model makeup is new info for me, I was under the impression it was:

Risk-on: 80% SPY (S&P 500), 20% IEF (7-10 Treasuries)

Neutral: 60% SPY, 40% IEF

Risk-off: 40% SPY, 60% IEF

Fiscal 2023 deficit is close to 1.6 trillion dollars. Fiscal 2024 spending is likely to remain the same, or more, not withstanding the shutdown. If economy slows, as expected, revenues may decline causing deficits to likely grow. Fed is on a QT program. I see Treasury borrowings to stay elevated. I think longer term interest rates should be higher due to tremendous supply in the coming years.

What’s the likely impact? Higher costs for consumers, businesses, government and other countries. When inflation does come down, Fed funds rate should decline, but longer term rates may not come down much.

I think of it as a period of slower growth!