A bounce ahead

There are other signs that stock prices are poised to bounce. Subscribers received an email alert this morning that my inner trader had initiated a long position in the S&P 500. The NYSE McClellan Oscillator (NYMO) had reached a sufficiently oversold condition that the odds favour a tactical long position.

In addition, the Zweig Breadth Thrust Indicator became oversold as of last night’s close. In the past, such oversold conditions usually resolved in relief rallies.

Here’s another constructive sign of possible bearish exhaustion. The market was rattled by a Fitch warning that it was going to downgrade the credit ratings of several U.S. banks including JPM. While I understand that financials aren’t all banks, the relative performance of U.S. financials bounced back today. Moreover, the relative performance of European and Chinese financials appear healthy, which is an indication of a lack of contagion risk.

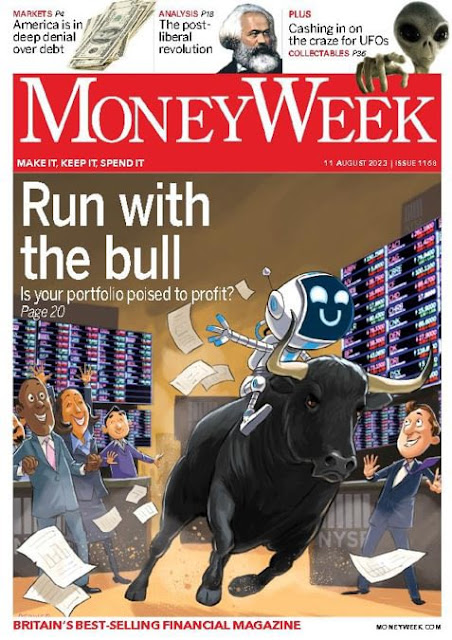

A contrarian magazine cover indicator

While my inner trader is positioning for a relief rally, he has few elusions about the durability of any possible rebound. the most recent Money Week cover provides a sobering contrarian magazine cover indicator that the market may need to fall further before the correction is over.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXL

The market closed at its lows today. If we do not get a rally in the next few days it will not be a good sign. Over sold can get more over sold. I think the stock market is captive to the ten year yield which keeps shooting up. We need a sellers exhaustion in bonds before we get a decent bottom.

Yup! The rising yields and the poor economic data out of China are scaring the wits out of investors.

Need some good news, preferably on both fronts, not necessarily at the same time.

WMT reports BMO tomorrow. China data was less exports, but does that mean WMT spent less on inventory replacement and so earnings will beat? Or less buying because sales suck?

We’ll see in the morning.