Early report card

In reality, this isn’t quite an early report card and not a mid-term, but the results of a quiz. The big banks reported and the sector has performed well, indicating that the reports were generally well received. Underneath the hood, however, some details of the reports are a little disconcerting.

Based on all the stress we’re seeing in the system, we’re pretty confident we’re going to see that sharp rise in unemployment. .. It’s going to feel like a soft landing until you actually hit recession.

Here is a similar quote from Citigroup’s CFO:

We’ve got a base case, an upside, a downside. Our current reserves are based on the mix of those 3 macroeconomic scenarios. It reflects about a 5.1% unemployment rate on a weighted basis over the 8 quarters, and it’s roughly flat to what it was last quarter.

As a reminder, the current unemployment rate is 3.6%. An unemployment rate of over 5% is a sharp rise and recessionary. If banks are preparing for such an environment, they will tighten lending conditions, which leads to a credit squeeze. FactSet reported that banks are raising Q2 loan loss provisions.

The NY Fed reported that the rejection rate for auto loans is at a decade highh. Credit card rejection rates are rising, though they’re not at their peak yet.

As well, global mining giant Rio Tinto warned on its outlook: “China’s economic recovery has fallen short of initial market expectations, as the property market downturn continues to weigh on the economy and consumers remain cautious despite monetary policy easing…Manufacturing data in advanced economies showed a further slowdown and recessionary risks remain.”

What resilient consumer?

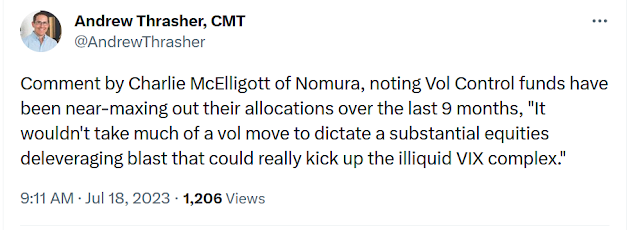

Vulnerable to a pullback

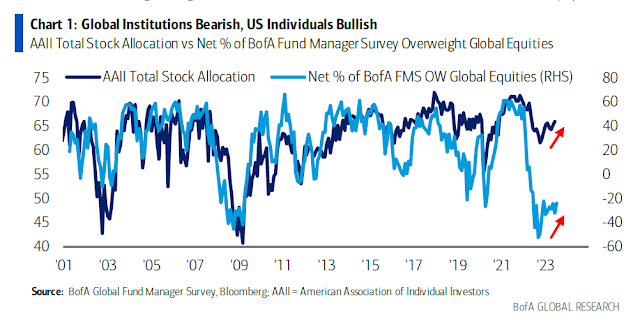

The latest BoA Global Fund Manager Survey highlighted a dispersion in sentiment. While retail investors are bullishly positioned, institutional managers are relatively cautious but recovering from extreme levels of bearishness. Technically, these readings look like a market that’s poised for a pullback within the context of a long-term uptrend. Individual investors are too bullish, which argues for a pause or correction. Institutional money moves glacially, but when it moves, the tide may seem never-ending.

The TSLA earnings beat but TSLA went down hard. Could be a sign.

Copper is not strong.

I wonder about what real estate is causing in China. Real estate is a big deal there and prices are going down.

If this is a bear market rally, where we base it on price and not PEs, we are running out of runway, so it would have to turn soon, otherwise we get an ATH which on a price basis equals bull market.