I recently had a discussion with a reader about my Ultimate Market Timing Model (UMTM). The UMTM is an extremely low turnover model that flashes signals once every few years and is designed to limit the extremes of the downside tail-risk of owning equities. When extreme downside risk is minimized, investors can afford to take greater equity risk. Instead of, say, a conventional 60% stocks/40% bonds asset mix, an investor could be more aggressive and move to a 70/30 or even 80/20 asset mix and revert to a more defensive posture such as a 40/60 or 30/70 asset mix under risk-off conditions.

In that context, the reader asked why the UMTM flashed a buy signal in February and flipped back to sell in March, even as the S&P 500 rallied to a new recovery high.

As it turns out, the UMTM was whipsawed by a trend-following model, which is an unfortunate feature of trend-following strategies. To explain further, let’s unpack the details of the model, which is based on a blend of trend-following strategies and a macro overlay.

The pros and cons of trend following

Let’s begin with the trend-following component. The study shown in the accompanying chart shows what happens when an investor applies a 200-dma filter to the S&P 500 as a proof of concept of trend-following strategies. A number of simplifying assumptions were made to the study:

- Buy the S&P 500 when the index is above its 200 dma.

- Hold cash when it’s below the 200 dma.

- Trades are executed the day after a signal is triggered at the closing price.

- There are no transaction costs.

- There are no dividends.

- Holding cash earnings 0%.

The study was conducted based on daily price data from January 1, 1995 to June 30, 2023, and the cumulative wealth lines were normalized at 100 on the start date in January 1995. I can make the following observations, which is applicable to virtually all trend-following strategies.

- Trend following underperformed the buy-and-hold benchmark, but…

- Trend following was able to sidestep the worst of the secular bear market drawdowns.

As a proof of concept, my Trend Asset Allocation Model, which is separate from the UMTM, has been extremely successful. The model applies trend-following techniques to a variety of global equity indices and commodity prices to reach a composite signal. I have been running this model since 2014. When I apply the out-of-sample signals to a simple asset allocation of varying equity and bond weights by 20% around a 60/40 asset mix, the results are impressive. The Trend Asset Allocation Model achieved almost equity-like returns with balanced fund-like risk. Moreover, the model beat its 60/40 benchmark in seven out of nine years. Even when it lagged its benchmark, the underperformance was relatively minor.

The macro overlay

From an operational viewpoint, trend-following strategies have a disadvantage of experiencing whipsaws, when the model issues frequent buy and hold signals when the index encounters volatility around the moving average.

How can investors achieve the downside protection of trend-following models while avoiding the disadvantage of whipsaws? Enter the macro overlay.

A study of market history shows that recessions are bull market killers. If an investor could forecast recessions, he could sidestep recessionary equity bear markets. In addition, recessionary bear markets tend to bottom after the recession has begun.

In light of those two observations, we can construct an Ultimate Market Timing Model using the following rules:

- If recession risk is low, stay long equities.

- If recession risk is high, buy equities only when the Trend Asset Allocation Model is flashing a buy signal for equities.

Even with these rules, the UMTM isn’t perfect. This model would have been bullish into the Crash of 1987, and it experienced a signal whipsaw during the February and March of this year.

Where are we now?

What are the models saying now? Recession risk is high, and the Trend Asset Allocation Model is on a neutral signal, which translates into a risk-off or sell signal for the Ultimate Market Timing Model.

Recession signals are mixed. The latest FOMC minutes shows that the Fed’s staff economists expect “a mild recession starting later this year”, though they “saw the possibility of the economy continuing to grow slowly and avoiding a downturn as almost as likely as the mild-recession baseline.”

The manufacturing part of the U.S. economy is extremely weak.

Jeroen Blokland pointed out that a tanking ISM Manufacturing survey has historically been a recession signal.

On the other hand, the service part of the economy has been resilient. ISM Services and different components of the survey are above 50, which indicates expansion.

While Street expectations of a H2 2023 recessions are widespread, they have receded a bit. The key to the recession question is employment – and the labour market is showing mixed signals.

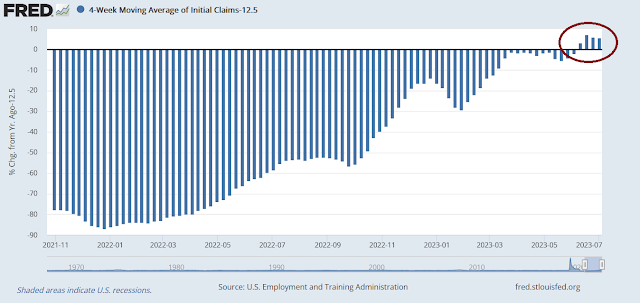

On one hand, the 4-week average of initial jobless claims has risen over 12.5% year-over-year for four consecutive weeks. If it persists, this would be a recessionary signal that the labour market is rolling over, which would weaken the demand for services and be the last Nail in the recession coffin.

In addition, the recent Supreme Court defeat of Biden’s student loan forgiveness initiative represents a fiscal contraction hitting household balance sheets, especially for the young. This will reduce consumer demand for goods and services.

On the other hand, the May JOLTS survey told a good-news bad-news story about the jobs market. The good news is job openings are falling (blue line), which is an indication that labour market tightness is softening, which reduces inflation pressure. But the quits/layoffs ratio (red line) rose for a second consecutive month. While this data series is noisy, it is a signal that employment is strong.

Looking ahead to the July FOMC meeting, a quarter-point rate hike is locked in in the absence of an extremely weak June jobs report, which it wasn’t. Headline payroll grew slower than expected at 209K, compared to market expectations of 225K, and the unemployment rate fell from 3.7% to 3.6%. However, average hourly earnings rose stronger than expected and the U6 unemployment rate, which includes under-employed and discouraged workers, rose from 6.7% to 6.9%.

Where does that leave us?

I can see two scenarios, neither of which is equity bullish. The first is a mild recession, which is consistent with the Fed’s staff forecast. In that case, equity investors will have to adjust to and discount a sudden series of downward EPS revisions. As we approach earnings reporting season, forward EPS revisions are still rising, but barely. This would be a jolt to the recent trend of rising forward EPS estimates, which is potentially a challenge in elevated valuations by historical standards. The mild recession scenario is likely to be equity negative while bond positive.

The other more ominous scenario is the false soft landing which turns into stagflationary growth. The economy avoids a recession, but inflation remains elevated, which forces the Fed to tighten further than market expectations. The recent trend in de-globalization is likely to depress productivity, barring an AI-driven productivity surge. This will be both equity and bond negative.

In plain English, these scenarios explain why the Ultimate Market Timing Model remains cautious on equities.

Macro and fundamentals are really slow to show themselves in prices while technical takes less time, only no chart pattern is infallible.

But when one has a macro idea, one has to remember that it could take years or decades to manifest.

Think USD or gold. There are good reasons to expect gold to go up and the $ to go down, and 20 years from now there is a good chance that gold will be up in terms of the USD, but this is not likely to help for the price in 6 months.

With the enormous debt burden and the history of what debt does to GDP growth, the unprecedented rise in relative rates that the Fed has dictated, the inversions of multiple yield curves all scream recession to me.

Recessions are supposed to be bull market killers, but one has to keep in mind the currency. In Zimbabwe and the Weimar Republic during their hyper inflations, the economies must have been bad, but the markets were bullish because the denominator was vanishing. I don’t think this will happen to the USD especially since all major currencies are fiat and subject to money printing, which leaves me with “bull market killer”

So are we in a bear market rally? They have a reputation for doing modified facelifts and this rally has been impressive. So take a look at some analogues, which of course don’t mean that such and such will happen, but there is a warning.

First more recently we have the etf IPO. Nobody will say it’s just a flesh wound, but there was a really impressive bear market rally, we know it was such because of price action in the past year. ARKK also shows an impressive bear market rally. So is the S&P in a bear market rally?

One thing they say about manias is that there is usually some kind of innovation behind it. Railroads, cars, whatever. We had the dotcom bubble and now we have AI. Both are tech. If one looks at charts of the QQQ and SPY for the Dotcom bust 2 things stand out to me. First is that the QQQ had a really strong bear market rally then really crashed and second is that the SPY had a more protracted less impressive bear market.

This should not be ignored. I don’t have any NVDA but if I did I would get out of most of it.

If you start of with the premise that know indicator is infallible or 100 % right, one has to have a Plan B. Even the Titanic had life boats. We are witnessing major Market Analysts of leading Banks continue to say they are right and the market is wrong. In the mean time the market is up over 30% in the Nasdaq. Traders and Money Managers are measured every quarter and every year. Market prognosticators have the luxury of making calls without any downside unlike managers and traders who lose their jobs.

Obviously no model is infallible. I pointed out that this model would have been fully invested going into the 1987 Crash.

Trend following models are slow to buy and sell by design. The Trend Asset Allocation Model is neutral

because elements are indicating high recession risk. That’s a feature, not a bug. If you find that the time horizon of the UMTM is wrong for you, don’t use it.