Mid-week market update: Subscribers received an email alert last Friday that I had issued a tactical sell signal for the stock market. The VIX Index had fallen below its lower Bollinger Band, which is often a signal of a short-term top. Since then, the index has been trading sideways while the 5-day RSI slowly descended and flashed a minor negative divergence.

Here is the good news and the bad news.

The good news

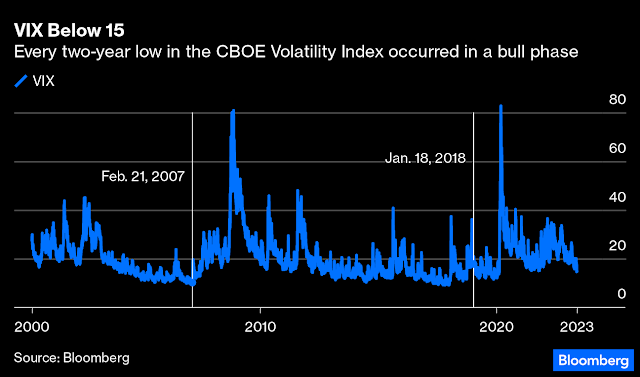

The good news is the VIX has fallen below 15, which is a bull market signal.

As well, BoA reported that private client equity flows are reaching capitulation selling levels, which is contrarian bullish.

The bad news

Here is the bad news. Tactical sell signals are piling up. The 5-day correlation of the S&P 500 and the VVIX, which is the volatility of the VIX, has spiked. Such conditions tend to be bearish for stocks in the short run, especially when the NYSE McClellan Oscillator is positive.

Nautilus Research also found that the first time the VIX Index falls to 14 after being above 20, which occurred yesterday, the S&P 500 faces headwinds on a one-week and one-month time horizon.

Where does that leave us? The odds favor a short-term pullback in the context of a longer term bull, but much will depend on how the $1 trillion Treasury issuance will resolve itself in the coming weeks and months. My inner trader remains short the market. The usual disclaimers apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXU

Cam,

The treasury issuance is for two reasons: fund the government and to refill the TGA at the Fed. The first is necessary and will go on. Does the treasury need to fill the TGA? If so, They may do it very slowly stretched over the next year and a half both to minimise the impact on rates as well as to take advantage of lower rates down the road. In that case, there should not be any perceptible affect.

What do you think?

There seem significant reasons to believe that we are coming close to end of the bear market here. Sure, short term pull back seems backed in the cake, but several indicators seem to suggest inflation is slowly receding.

Wild card here is EPS and they have held well, so far.

https://international.schwab.com/story/mid-year-outlook-fixed-income

Usually, bigger declines happen after the Fed starts to ease. This is on the basis that the economy goes in a tail spin, and the Fed is forced to relax. This time, earnings are holding up, so far, economic conditions are tight, unemployment is not too shabby, all in all, so far, stay as she goes. Not sure, what happens to economy and EPS by year end. Goldilocks??

What happened to a bear market bottoms when the mood is awful? Did I miss that?

Well, if this is just a correction and not a bear, maybe. But how come the recovery is so slow?

I can’t get my head around the debt. Debt is huge for all parties and cost of servicing debt has gone way up. A lot of real estate is sequestered out of the market because owners don’t want to trade to a new house and a mortgage that is 7% instead of 2 3/4

Well maybe there are so many known negatives that we get a bull market, but my gut says bull trap aka bear market rally.