As at the time of writing, the White House and the Republican-led House haven’t come to a debt ceiling deal yet, though both sides are getting closer to a deal. But you only die once, and focusing on the fear of a catastrophe isn’t very useful. Hedging only works if there is someone you can collect from on your hedge, and obsessing over a U.S. default only gets you so far. Instead, I will focus on getting back to the technical structure of the market by assuming that all parties agree to step back from the brink.

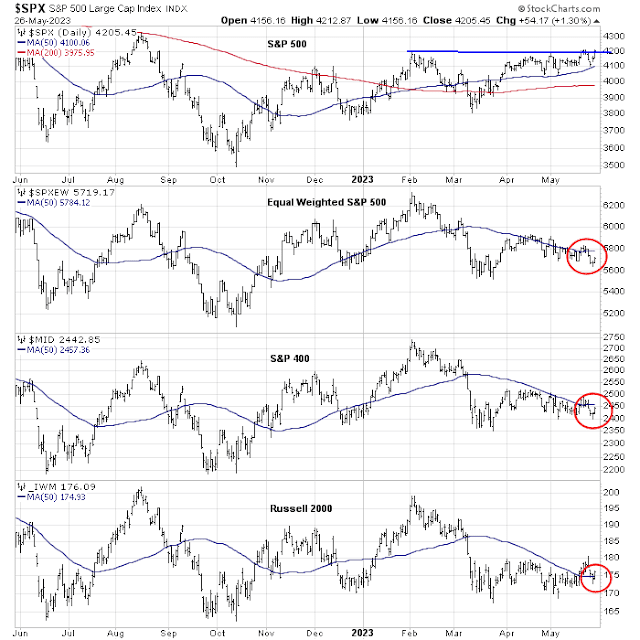

From a longer-term perspective, the narrow leadership of the S&P 500 is disturbing. Remember Bob Farrell’s Rule #7: “Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names”. As the S&P 500 tests its 50 dma, the equal-weighted S&P 500, the mid-cap S&P 400 and the small-cap Russell 2000 have already violated their 50 dma.

How much does bad breadth matter?

The bull case

With apologies to Bob Farrell, narrow leadership may not really matter all that much. Dean Christians of Sundial Capital documented past instances of narrow leadership, and the stock market didn’t fall apart in those cases.

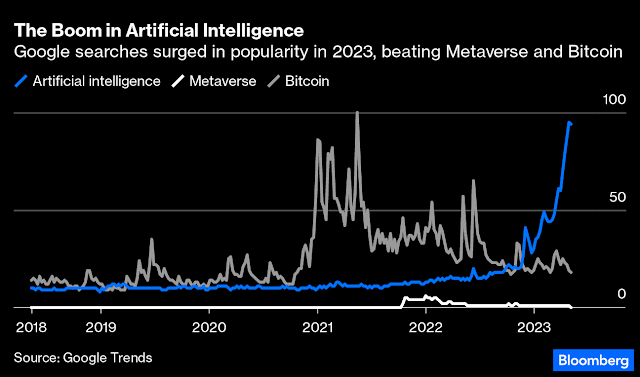

Still, there are good fundamental reasons for the boom in large-cap tech, namely Artificial Intelligence (AI). AI has the potential to disrupt the way we work, and it could be just as disruptive as the internet was in the 1990s.

During the internet bubble, the shares prices of companies like Cisco and Oracle soared because they supplied the backbone of the internet. Today, NVDIA could be the Cisco and Oracle of the AI era. This Bloomberg podcast with Bernstein semiconductor analyst Stacy Rasgon explains NVDIA’s competitive position, which I summarize below.

NVDIA specializes in the production of Graphics Processing Units (GPUs). GPUs are powerful parallel processors capable of making large-scale calculations of mathematical matrices for linear algebra applications. To explain linear algebra, recall the problem of solving simultaneous equations back in high school. A typical example might be the following set, where you are asked to solve for x and y:

3x + y = 16

x – y = 0

Without going into a lot of detail, the solution is x=4 and y=4. This example involves two variables and two equations. To find a solution for a set of simultaneous equations of n variables, you need n equations (in most cases). GPUs happen to be very good at doing those kinds of matrix calculations. Initially, GPUs were used mainly for graphics applications in computer gaming. Instead of two variables and two equations, imagine thousands of data points, each representing a pixel, that need to be refreshed quickly. That was how NVIDIA made its mark.

Researchers went on to discover that GPUs are also useful for AI applications in computing repeated very large matrix calculations. That was the second stage of NVIDIA’s growth path. In addition to supplying high-performance GPUs, NVIDIA also created a suite of software applications to make it easier for users to make matrix calculations. That became NVIDIA’s competitive advantage, giving it a technological lead over its competitors.

If you understand and buy into the disruptive nature of AI, you understand the parallels of NVIDIA with the Ciscos and Oracles of the internet craze of the 1990s. To reinforce our point, NVIDIA’s blowout earnings report cements its status as the new AI darling.

The bear case

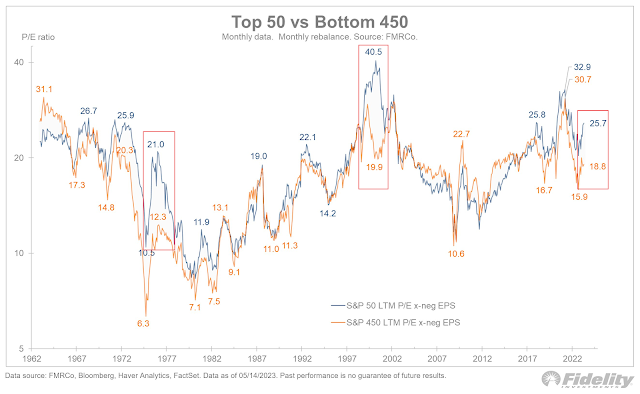

Here is the bear case. Every market cycle has its manias. The tricky question is how far each bubble inflates before it pops. Jurrien Timmer at Fidelity documented how the gap between the trailing P/E ratio of the top 50 stocks and the bottom 450 of the S&P 500 is only exceeded by the Nifty Fifty era and the NASDAQ Bubble. This doesn’t mean that valuations can’t become more extended, only that they are becoming very stretched.

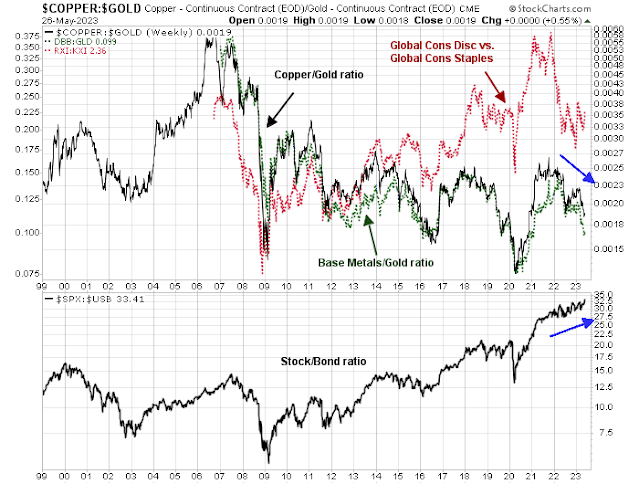

An analysis of the rest of the market reveals some troubling signs of a cyclical downturn. The relative performance of cyclical industries are all in relative downtrends, with the exception of homebuilding. From a bottom-up perspective, the market is telling a story of an imminent economic downturn or recession, which is an environment that’s not friendly to equity returns.

A similar chart of global risk appetite comes to a similar conclusion of negative divergences. Cyclical commodity indicators such as the copper/gold and base metals/gold ratios are falling, while the relative performance of global consumer discretionary to consumer staples are flat to down. By contrast, the stock/bond ratio is rising.

Moreover, Ed Clissold of NDR pointed out that the investment environment has changed from TINA (There Is No Alternative to stocks) to TARA (There Are Reasonable Alternatives) as the yields on fixed income instruments are becoming more compelling.

In conclusion, the White House and the Republican-led House haven’t come to a debt ceiling deal as at the time of writing. Assuming that both sides come to some sort of accommodation, a review of the market’s technical structure reveals serious negative divergences characterized by bubbly narrow leadership and weakening cyclical indicators. While this doesn’t mean that the stock market is about to crash, it does indicate that investors should be prepared for reduced long-term return expectations from U.S. equities.

if x – y =0, then x=y and both are 4.

What has not changed in the last 5000 years is human nature, which is why we still have greed and fear, and also irrational markets.

The internet is great but has it really created jobs? It is great for a service based economy, which requires spending. Spending does not bring wealth. Self liquidating debt does, but that is investing, whether it be a rental property or a stock that pays a reasonable dividend (2% is not reasonable).

That people only see a bubble after it bursts is false. What is true is that nobody knows when it will pop.

When you compare the S&P to equal weighted S&P or Russel is like the old Dow non confirmation of Industrials and transports (my gosh, the world was different but not different then).

Does anyone really believe there will not be some kind of debt ceiling arrangement? How come you can still find beans and chili in the stores? Do you believe the market has not already accounted for this ? For sure there will be a reaction, whether it be a blow out or “meh” and decline (where it will be sell the news because the market already priced it in), this we don’t know.

Technically we have what could be this long rising wedge, which should be bearish. It’s all choppy and overlapping. But we could go higher in spite of this.

The fundamentals suck. We have debt, inflation, high PEs (compared to the 70s).

The government is stuck. Unless things change we have huge and likely growing deficits until things fall apart. I’m too old to do the Mad Max thing if I even wanted to, so selfishly I hope the wheels stay on until I am gone.

In any case deficits are the flavor of the era and this will lead to inflation eventually which makes debt harder to carry because interest rates go up. The only way out of this is if gov’t debt is treated differently from private debt. Isn’t that what the BOJ has been doing? Then the cost of gov’t debt can be zero, only the central bank would buy the debt. For the rest of us we would have inflation, debt issues etc. In this scenario having an asset that produces or generates cash makes sense or is real like a house, or precious metals, but are we there yet? I don’t think so because to change we need something really really bad to happen.

My take is that when the debt ceiling thing is done, the emperor will be seen to have no clothes, the reality of debt, fiscal deficits, zombie companies , underemployment will become manifest and the market goes down. For how long, no idea but then the spending will resume with a vengeance.

People criticize Bernanke, but I remember at the time he said “helicopter money” people looked like he was nuts. What were the stimulus checks? People being paid more to stay off work than they got paid for work?

The spending won’t stop until the dollar no longer has meaning, but when that day arrives I have no idea, but not this week anyways.

I forgot, AI will likely destroy many jobs, helpful though it might be. Some will make money but many will be unemployable. What matters is if it improves the standard of living. 1000 years ago if you had no work to do likely you were about to starve to death. Nowadays many are not working but the standard of living is much higher. So what matters is if your life is better?

the solution is x=4 and y=5

? No, 4 and 4

This is why when I ask Chat GPT to make a picture of a bunny in a convertible I might get a Playboy model in a Benz, or an easter bunny in Barbie’s pink convertible. I don’t think there is a math singularity where the laws of math do not apply, but maybe AI is introducing “math check ” on Cam’s computer, I know that spell check is a bane on my messaging. But AI does trial and error, so if 4 and 5 don’t work , what about 4 and 6?. If you have a legion of blind squirrels looking for nuts, you get a lot of tired hungry squirrels, but AI will work for some things.

Glad I’m human, will an AI ever be able to feel glad it is an AI?

Cam wanted to see if we’re paying attention.

Yess

🙂 🙂

Looking beyond the valley of debt ceiling saga, there are still two major issues: Inflation and Fed’s reaction function; narrow market leadership.

What kind of companies are in the leadership? Apple, Alphabert, Microsoft, Amazon, NVidia and maybe Meta. Each of these companies created new products and services that transformed how we live and business is done. They are transformational companies that are globally dominant and adaptive.

The climate that has allowed them to be in the leadership is their balance sheet, capital allocation and intense focus on research and development.

Yes, the valuation will probably correct at some point as it did in 2022. But they are compounders over the long term.

If you wait for all these issues to be resolved, the market will already be at 6,000.

I agree. Perhaps my post isn’t clear. Narrow leadership by businesses I quoted does not change my view as I am a long term investor in all these businesses through ups and downs. They have been innovative as well.

I think Fed will cause a recession and a reset of valuations particularly of the cyclicals. I have raised cash by trimming some positions and I patiently wait for a better entry point.

Yes, x=4 and y=4

It was a typo and I apologize for the error.