Mid-week market update: Wall Street has many adages. One concern is the Santa Claus rally: “If Santa should fail to call, bears may come to Broad and Wall”. The Santa Claus rally window began the day after Christmas and ended today, two days into the new year. The S&P 500 has been range-bound since mid-December. Are the bears coming to the NYSE, which is located at Broad and Wall?

Let’s start with the good news. Even as the S&P 500 consolidated sideways, breadth and momentum indicators have been rising and exhibiting positive divergences.

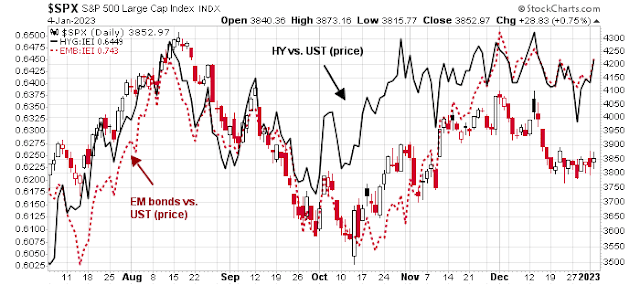

Credit market risk appetite is also showing positive divergences.

The usually reliable S&P 500 Intermediate-Term Breadth Momentum Oscillator (ITBM) is on the verge of flashing a buy signal, which should be good for a rally of at least a week. As a reminder, a buy signal is indicated when the 14-day RSI of ITBM recycles from oversold to neutral.

The primary trend is still down

Here is the bad news. The primary trend is still down. Even if a market rebound works out, and the short-term seasonal trend is positive for the next two weeks, don’t expect much more than a brief advance.

The weekly chart is still on a sell signal when the stochastic recycled from overbought to neutral in early December. The S&P 500 will remain on an intermediate sell signal even if the index stages a counter-trend rally up to the trend line at about 4000. Support can be found at the 200 wma at about 3670.

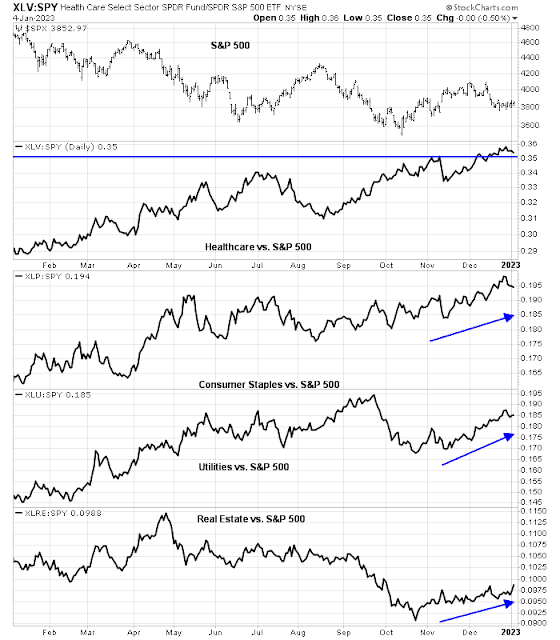

Moreover, the relative performance of defensive sectors is still strong, indicating that the bears are in control of the tape.

Enjoy what is likely to be a brief party, but don’t overstay your welcome.