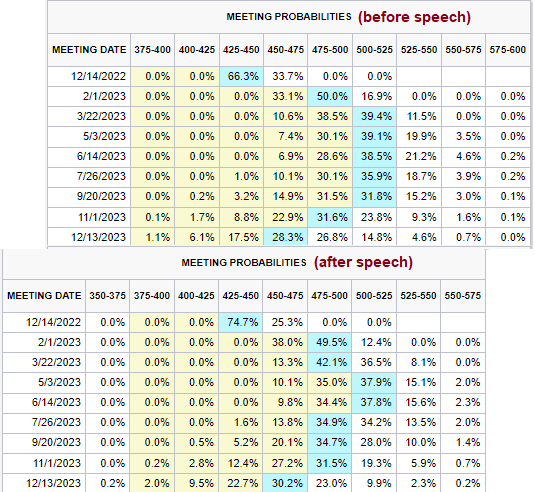

Mid-week market update: In the long awaited Powell speech, the Fed Chair signaled, “It makes sense to moderate the pace of our rate increases…[and] the time for moderating the pace of rate increases may come as soon as the December meeting”. The market reacted with a risk-on tone and began to discount a series of rate cuts in Q3 2023.

Every Fed speaker this week has said that the Fed isn’t going to cut rates. Powell concluded his speech with:

It is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.

The change from 75 bps to 50 bps has long been anticipated. Is the risk-on reaction appropriate in this instance? Should investors buy “the 50 bps in December”, or sell the “stay the course until the job is done” nattative?

Analyzing Powell’s speech

Powell covered the topics of inflation and the labor market. On inflation, he found the October inflation data to be encouraging, but “it will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains much too high.” Powell observed that goods inflation is falling. The housing services component is accelerating, though he acknowledged that it is a lagging indicator. Core services less housing has been flat, which is a function of the labor market.

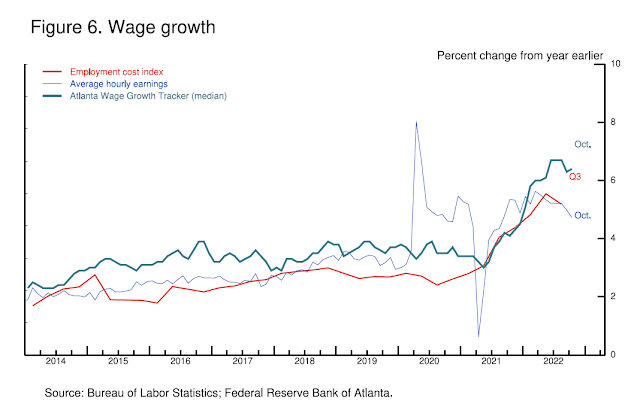

However, the labor market is still too tight, and “a significant and persistent labor supply shortfall opened up during the pandemic—a shortfall that appears unlikely to fully close anytime soon”. He added, “A moderation of labor demand growth will be required to restore balance to the labor market.”

Wage growth has also begun to decline, “but the declines are very modest so far relative to earlier increases and still leave wage growth well above levels consistent with 2 percent inflation over time. To be clear, strong wage growth is a good thing. But for wage growth to be sustainable, it needs to be consistent with 2 percent inflation.”

While he confirmed market expectations that the Fed will raise rates by 50 bps at the December meeting, he cautioned that “Given our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level.”

In other words, don’t expect rate cuts anytime soon. In fact, there was no discussion of easing in his speech.

Other warnings

There are other warning signs. In addition to Powell’s speech, Vice Chair Lael Brainard made a speech to the BIS that highlighted the risk central bankers could face more inflationary volatility from climate change, demographics, and deglobalization.

In addition, to the extent that the lower elasticity of supply we have seen recently could become more common due to challenges such as demographics, deglobalization, and climate change, it could herald a shift to an environment characterized by more volatile inflation compared with the preceding few decades.

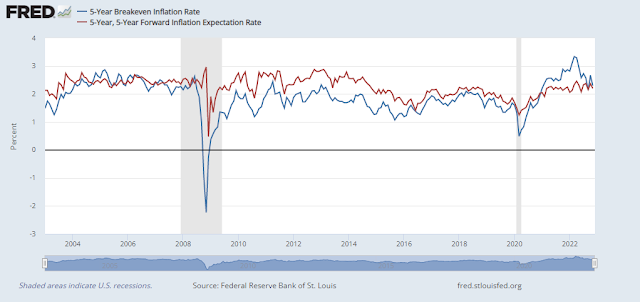

While bond market based measures of inflation expectations have been relatively stable, other metrics present a more disturbing picture.

The Central Bank Research Association is maintaining an experimental inflation expectations indicator, or indirect consumer expectations (ICIE), based on research from the Cleveland Fed.

Surveys often measure consumers’ inflation expectations by asking directly about prices in general or overall inflation, concepts that may not be well-defined for some individuals. In this Commentary, we propose a new, indirect way of measuring consumer inflation expectations: Given consumers’ expectations about developments in prices of goods and services during the next 12 months, we ask them how their incomes would have to change to make them equally well-off relative to their current situation such that they could buy the same amount of goods and services as they can today.

The good news is ICIE is in retreat. The bad news is the absolute reading of 7.56% is very high compared to conventional surveys.

In conclusion, the knee-jerk risk-on reaction of the market to the Powell speech seems unwarranted. The Fed will stay the course until the job is done.

Market technicals

From a technical perspective, the S&P 500 is testing key resistance at the 200 dma and the descending trend line while the NYSE McClellan Oscillator flashes a series of negative divergences.

As well, equity risk appetite indicators peaked in mid-November. Equally disturbing is the violation of relative support by the highly speculative ARK Investment ETF.

Despite the recent show of market strength, defensive sectors are all in relative uptrends.

I am inclined to stay cautious. My inner trader is holding to his short position and he has a stop placed just above the descending trend line.

Disclosure: Long SPXU

Unfortunately for those who are short going into strength rallies which happened again today with SPX >+3.0% (second time in 14 trading days since 11/10/22), they are going against 65 years of SPX history and 108 years of INDU and inflation history.

These strength rallies don’t happen in a vacuum and if they happened with CPI>5% peaks, they all rallied in the past for >100 trading days with gains > 20%.

01/27/1975, 75.37 +27% 117 trading days

04/22/1980, 103.43 +36% 147 trading days

11/10/2022, 3956.37 ??

if drop CPI down to 5% criteria, then add

10/6/1982, 125.97 +37% 179 trading days zero drawdown

Does who think this is another bear market rally hasn’t really studied market history very well and are not really systematic traders who are driving this market. This rally in November from the Oct 13, 2022 bottom happens with price strength on top of price strength. Ask yourself, who would pay for higher and higher price if the market is in a bear market?

https://toot.community/@ttmarket/109434842933644360

There is short covering, and they can fade the buying or selling, it works both ways.

Remember how 20 out of 27 huge up days in the past were in bear markets.

We’ll see.

I think we will go lower, eventually, when , I dunno. How far down is anyone’s guess.

There is a macro view that earnings growth must bottomed before stock price bottomed – which is a fallacy when it came up against peaked inflation rate, as in 1/27/1975. What else have the macro analysts missed? Kudos to a few that could pick this up, mainly Jurrien Timmer, one of the best macro person, from Fidelity. Timmer does not see an all clear end to the bear market and neither should the systematic traders who follow the peaked inflationary trade – but these traders would know when the market turns far earlier than any macro bros.

https://twitter.com/TimmerFidelity/status/1598334217594740737

The study I showed was specific to peak CPI rolling over with strength on strength rallies but one could look at generalized market strengths absence of CPI relief and the results are also quite positive, here looking at back to back 5% monthly gains which we saw for Nov 2022 (but not earlier in 2022):

https://twitter.com/RyanDetrick/status/1598361111752953856

I would like to make two observations:

1. The German DAX Index historically leads the US Index. It had cleared its 200 Day Moving Average about 12 days ago. It was a great “Tell” that the S&P 500 was going to do the same.

2. Short dated options (Daily &Weekly) have distorted the normal support and resistance trend lines. In fact, I would not be surprised if traders “gun” for these areas. Therefore, I think it is a good idea to consider support and resistance areas as a band of 1 to 3%.

The next major resistance on the S&P Futures is 4175 about 2% higher.

Nobody is listening. Isn’t one of the huge up days more typical of a bear market?

Anyways, I think the Fed is talking to congress as in “No more free money!”

Why is it that all the QE from the GFC on didn’t cause high inflation? It did , but in assets. All that QE money and MBS didn’t go to buying hamburgers or Barbie dolls, it went into financial assets.

Now they can blame supply bottlenecks all they want, but IMO it is the free money. The pandemic exposed how fragile our society is. Can you imagine if there had been the lockdowns but no support? How many could have not had a job or business functioning for months on end? So they tossed a couple trillion into the general circulation. This causes inflation, bottleneck or no bottleneck.

So my take is the Fed is saying “If you do this again, we will do this again” to congress.

We are in a deflationary demographic, along with technology just getting better. The inflation should subside, so long as there are no more helicopter money episodes.

Will congress learn? This I don’t know. Remember they get elected, but not the Fed, so the Fed can spoil their party

The ‘helicopter’ money may come sooner than most expect via government funding bill by December 16.

Who wants to spoil the holiday party?

On November 16, I posted how China had set up perfectly to start a new bull market by hitting ALL my Tactical Factor Strategy indicators. Since then, the Central Bank has reduced bank reserve requirements to ease monetary policy further. We are only two weeks into it. The Covid situation in China is a smokescreen for inaction. Remember the bottom of the US market was March/April 2020 when the country was shut down as Covid raged and the Fed and government was aggressively easing. The easing was key. Now the Chinese government is easing monetary policy and aggressively supporting real estate.

I repeat the Nov 16 post below;

November 16, 2022 at 2:01 pm

Totally agree with the analysis but there is CHINA.

It has set up perfectly for my Tactical Factor strategy.

1) Market must be down (was down over 30%)

2) Market must have TWIST (Big TWIST in China 300 AND Hong Kong indexes)

3) High Yield debt must keep on rallying strongly (take a look at KYHB)

4) there must be a narrative around government or Central Bank stimulus. (Multipoint plans for Covid reopening and Real Estate supports)

Check, check, check, check.

Oh yes, one more item – “I don’t want to do it.”

But of course, I do it because I ask myself, “If you do all this research and you don’t act, why the hell are you doing it?”

Also on my “Leading Edge Momentum Rankings” China and regional countries (Taiwan, Singapore, Japan, Australia) are leaders with all Chinese related subindexes (CHIQ, KWEB)

News out of the G19 on China wanting to smooth relations is another positive.

Note also the metal commodity prices are strong.

Great call, indeed, Ken. Thank you for sharing your expertise and insights.

Looks like Friday SPX gap down (as much as -1.65% futures premarket open) has been filled by 15:15 and VIX is lower Friday than Thursday and may close around 19.0. Those who were banking on VIX reversion to much higher numbers and were shorting SPX at VIX <20 or Bollinger lower band extremes may need to rethink whether there is a regime change, at least temporarily that may keep VIX at a low level.

Often VIX trend following can be more accurate than VIX mean reversion. This is true for intraday as well as daily charts.

https://toot.community/@ttmarket/109444882043710365