One of the main elements of my Trend Asset Allocation Model is commodity prices as a real-time indicator of global growth. As well, John Authers recently wrote, “The commodity market is a real-time attempt to assimilate geopolitical developments, growth fears, and shocks to supply and demand, so it’s an important place to look for the next few weeks.” So far, commodities have been elevated even as the global economy showed signs of slowing. The divergence is attributable to supply shocks.

We all know the recent story of supply shocks. The COVID-19 pandemic disrupted global supply chains and caused both a supply shock. As the virus first emerged in China, Beijing responded by shutting down the economy and its industrial capacity came to a virtual halt. Just as the world began to recover from the COVID Crash, the Russia-Ukraine war sparked another supply shock, this time in energy and agricultural products.

Despite the supply pressures, commodity prices have finally started to fall. In particular, the cyclically sensitive industrial metals have rolled over.

Here is what it all means.

Supply chain disruptions

The supply chain effects of COVID Crash are well known, so I won’t repeat the story. What’s new is the less publicized story of how the Russia-Ukraine war is sparking another supply shock.

This map of the Russian military control of Ukraine tells the story of how Russia is strangling the Ukrainian economy. Before the war began, Ukraine exported most of its goods through its Black Sea and Sea of Azov ports, such as Izmail, Odesa, Kherson, and Mariupol. Now that most of those ports are under Russian control and the Russian navy is blockading access to Odesa, Ukraine’s export capacity is greatly diminished. While Ukraine can still ship products by rail, rail capacity is a fraction of its port capacity. Moreover, the cost of rail freight is about three times higher than maritime shipping and Ukrainian rail gauges are different than European rail gauges, which creates logistical problems at the border.

In addition to being an important source of agricultural exports to the world, Ukraine produces about half of the world’s neon, which is an important input for semiconductor manufacturing. The neon plants are located in Mariupol, which has been flattened by the war, and Odesa, which has stopped production. Even if hostilities ends tomorrow and the Odesa plant resumed production, it needs a means of export. That’s why Ukraine’s maritime access matters.

Turning to energy, the Russia-Ukraine war has disrupted energy supplies, mainly to Europe. The EU is on the verge of banning Russian oil imports by year-end. In addition, Russian gas exports to Europe through Ukraine are being shut off. That’s because Ukraine’s gas grid operator said it can’t receive gas at Sokhranivka because of a lack of control, but Gazprom refused to move shipments to Sudzha, though there are other routes for Russian gas to reach Europe.

The energy shock won’t just affect Europe, its effects are global. Recently, there have been dire warnings from various quarters about tight refined product markets, such as

diesel,

jet fuel, and

US East Coast diesel. This all adds up to higher prices and a slowing economy.

As well, there is the supply chain disruption from China’s zero-COVID lockdown policy. The low rate of vaccination, especially among the elderly, opens China to the risk of another wave of COVID related deaths unless Beijing significantly alters course on its pandemic policies.

The central bank response

Here is the worrisome central bank response. Minneapolis Fed President Neel Kashkari recently stated in a

speech that the Fed is willing destroy demand and drive the economy into recession if supply chain difficulties don’t ease.

If supply constraints unwind quickly, we might only need to take policy back to neutral or go modestly above it to bring inflation back down. If they don’t unwind quickly or if the economy really is in a higher-pressure equilibrium, then we will likely have to push long-term real rates to a contractionary stance to bring supply and demand into balance. The incoming data over the next several months should provide some clarity on these questions.

Kashkari’s views are consistent with an influential

1997 paper by Bernanke, Gertler, and Watson, “Systematic Monetary Policy and the Effects of Oil Price Shocks”, which concluded that energy price shocks on their own don’t lead to recessions, but slowdowns are attributable to the central bank’s tight monetary policy in response to higher inflation.

Interpreting commodity weakness

Here is how commodity prices stand today. Broad-based commodity indices, which have heavy energy weights, are in faltering uptrends. Equal-weighted commodities are displaying a sideways pattern and violated their 50 dma. The copper/gold and base metals/gold ratios have fallen dramatically in the past two months, indicating cyclical weakness.

Putting it all together, what we have is a Federal Reserve that’s tightening into widespread evidence of a slowing economy. Not only have global equity prices fallen, but cyclically sensitive commodity markets, which had been held up by supply shortages, are cracking.

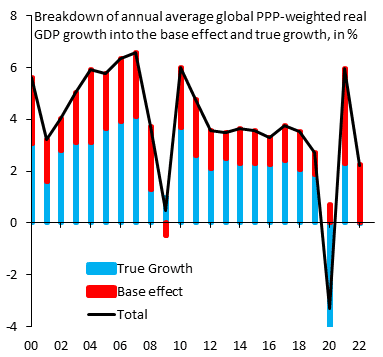

Robin Brooks at IIF stated that the world is on the verge of a recession. Setting aside base effects, 2022 global growth is effectively zero.

Silver linings

Even though the outlook appears dire, there are two silver linings in the dark clouds of recession that are on the horizon. First, peace may be at hand in the Russia-Ukraine conflict. Russian ally and Belarus’ President Alexander Lukashenko admitted in an

AP interview that the Russian offensive had stalled and he was calling for negotiations.

The 67-year-old president struck a calm and more measured tone in the nearly 90-minute interview than in previous media appearances in which he hectored the West over sanctions and lashed out at journalists.

“We categorically do not accept any war. We have done and are doing everything now so that there isn’t a war. Thanks to yours truly, me that is, negotiations between Ukraine and Russia have begun,” he said.

Moreover, Russian President Putin did not escalate the war as expected on Russia’s Victory Day on May 9. Russian advances in the Donbas, which was the new reduced objective of the war, have been minimal and a Ukrainian counteroffensive had pushed Russian troops back to the border near Kharkiv. Russia lacks the means to escalate by mobilization, as it has neither the training facilities nor trainers to train new troops. Moreover, it lacks means to equip the troops with such things as tanks and fighting vehicles because of the effects of sanctions on its weapons production capacity.

This sets up incentives for Putin to call for a ceasefire and negotiations, which has the potential to spark a risk-on rally. Stay tuned.

As well, the Treasury market is finally behaving as expected and long yields are falling in anticipation of a weakening economic outlook. In the past, peaks in the 30-year yield have led to turns in the Fed’s tightening policy by 1-6 months. Despite the Fed’s hawkish rhetoric, a pivot from a restrictive monetary policy could be closer than you think.

In conclusion, weakness in commodity and equity prices is signaling a global slowdown and possible recession. Conventional wisdom would call for cautiousness in portfolio positioning. However, investors should be prepared for good news, either in the form of a cessation in Russia-Ukraine hostilities, or a turn in the Fed’s tightening policy.

I get raising rates if demand is outstripping supply, but when the problem is supply, it’s normal for prices to go up and this curtails demand and can also lead to a recession. Why make the debt burden worse when prices are already decreasing demand.

Didn’t Greece go through a rough patch with high unemployment and austerity was advocated, and the unemployment among youth went to insane levels?

I wonder if what is really behind this is a recession would make more oil available for Europe.

I’m glad it’s not my call.

The Fed has stated repeatedly that it is concerned about inflation expectations, you can also find research links in the footnotes of previous Powell speeches.

Both economy and inflation are likely slowing and may decelerate even more in coming weeks and months. The Fed may take a pause and see the results of its tightening (actually, the tightening the bond market has already done on its behalf) before continuing with the tightening campaign.

Some are arguing that there might be a small window for stocks to rally before the Fed resumes with its campaign if the inflation remains persistent.

Hard to see inflation falling unless the war ends and/or the Zero-Covid policy is terminated.

The Fed can’t do anything about supply to fight inflation. Its only lever is to destroy demand with a tight monetary policy.

Greece wasn’t in control of its monetary policy. That’s the problem with a currency union. Otherwise it could have devalued its currency.

Cam, Any comment on MTUM rebalancing? Or, is it too small to matter (only $10bn in assets)?

Quick MTUM Rebal Thread

https://twitter.com/PythonTrader/status/1525097008910020608

Tech 32.3% (current) –> 9.4%

Fin 23.8% –> 6.8%

Health Care 12.39% –> 28.52%

Energy 6.8% –> 17.6%

Staples 3.7% –>19.1%

Utilities 0% –> 5.9%

Sorry, no strong opinions on MTUM

I have a strong opinion. I have avoided it because the last rebalance was November. That meant they were in exactly the wrong sectors, the ones that had peaked.

This rebalance will be perfectly timed. Now we have a group that will outperform in a bear market as they have YTD.

Thank you both.

Cam,

“…either in the form of a cessation in Russia-Ukraine hostilities, or a turn in the Fed’s tightening policy.”

Will the stock market take its cue from the bond market (declining yields) or will it wait for a turn by the Fed?

Probably wait for the turn from the Fed. There is some anticipation involved. For example, Mester said in so many words that half-point rate hikes are baked in for the next two meetings, but they’ll make a decision in September on what to do next.

If CPI/PCE inflation pressures start to ease before then, the market will anticipate the turn.

As for the Russia-Ukraine war, if Russia calls for a ceasefire, you’ll get a reflex rally. The Ukrainians are mad enough that after all the pain they won’t settle for anything less than full capitulation by the Russians. The conflict will go on and the rally will fade.

I spoke with Russian Minister of Defense Sergey Shoygu today for the first time since February 18th. I urged an immediate ceasefire in Ukraine and I emphasized the importance of maintaining lines of communication.

https://twitter.com/SecDef/status/1525148219545640961

High inflation is not good for the economy, society and longer term health and growth. It needs to be brought under control. I don’t think there is much disagreement on it.

What is an acceptable level of inflation and how quickly should Fed get it under control? I think Powell, Dudley, Kashkari et al will stay on rate hiking course even if the economy goes into a recession. Russia, China and global slowdown will help Fed achieve it’s goals but not deter it from hiking rates unless inflation and inflation expectations return to ‘normal ‘.

Long term bonds should provide some ballast to the portfolios.

I don’t expect Fed to change course. Peace in Ukraine will be a humanitarian and economic relief.

It would be very helpful if Cam did a blog post on this.

Much depends on the shape of the peace deal. There are too many moving parts to even try to forecast the economic and market implications.

The unanimous passage of the Ukraine aid package tells me that the US is committed to prolonging and even escalating the war. These funds will make some people in the US and Ukraine (who have control over the respective governments) fabulously rich.

The last round of negations in Istanbul broke down after Zelensky, under US pressure, withdrew his consent on already negotiated times.

At this point, Russia will agree on a peace treaty only on their terms. Economically, the west has very little leverage left over them. Politically, Putin has overwhelming support at home (to a great degree thanks to the west’s reaction to the conflict and propaganda, which are perceived as anti-Russian, not anti-Putin) and sufficient support from abroad (China, India, South America).

Militarily Russia is doing perfectly fine. Their strategy is consistent with the way they have always conducted wars – degrade the enemy’s capabilities, create cauldrons, cause a total collapse. Their tactics are also not surprising – use their numerically inferior troops (in this conflict) to pin and immobilize the opposing forces while they are being degraded, tactical withdrawals to preserve their manpower, surround cities but leave green corridors for evacuation, avoid destruction of civilian targets whenever possible. Similar to how they operated in Syria. So far Russia has used only a fraction of their military capabilities and active duty personnel. Most of the ground fighting in Donbas has been carried out by local militia. Once the Ukrainian troops in the Donbas are dealt with (maybe in the next 1-2 weeks), I expect more rapid development towards west/ south-west (Odessa).

In my opinion the conflict will continue until the public puts sufficient pressure on the US and EU governments to negotiate for peace. I have no idea when this might happen in the US. Things may develop faster within the EU because: (1) the dependency on Russian gas and oil will have more severe economic consequences; (2) they will foot most of the bill to maintain and reconstruct what is left of Ukraine; and (3) the large number of Ukrainian refugees.

(1) and (2) are obvious. Let me comment on (3). I’m from Eastern Europe and my parents hosted Ukrainian refugees. When they first started arriving, they were greeted with open arms, treated like VIP guests and given everything they might need for free – housing (including in 4,5 star hotels), food, medical care, child care… even though some of them were clearly well off. However, as the local population begins to struggle with higher prices, gas shortages, maybe even electricity black outs, I expect that there will be resentment towards the refugees and protests towards the government’s politics.

Anyway, for what it’s worth, these are some of my opinions based on reports and analysis that I have read/watched, including from independent and Russian sources. I could go on and on, but I think that if one is genuinely interested to understand the reality of the situation, they should do their own research. In every foreign conflict that the US is involved, the media attempts to personify and vilify the opponent, and present its leader(s) as erratic, incompetent, delusional, paranoid, crazy. It is not different in this case. I know many Russians (and Ukrainians; my earliest childhood memories are from Kiev), I have worked with them and have studied science from Russian textbooks. I can tell you that they are competent, rigorous and meticulous in their work. I’d be very surprised if the situation is different with regard to their military operations. Finally – the degree of censorship, misinformation and intolerance of decent that I’m seeing now is comparable to what we had under communism in Eastern Europe. I hope we are able to reveres things before it’s too late…

well said…

Truth is generally hard to swallow.

Thanks for sharing this. Most people in the US won’t have access to this viewpoint.

We’ve known for some time that US stocks are overvalued relative to historical valuation measures and also relative to ex-US stock markets.

Most of us would acknowledge that mean reversion will take place at some point – but if you’re like me haven’t given much thought as to how/when it will unfold.

I think the mean reversion process has already begun, and may have much, much further to go.

So we’re probably looking at a snapback rally at best.

I’m somewhat more sanguine re the outlook for bonds.