The year 2021 is nearly complete and it’s time to issue a report card for my three investment models. Going in order of short to long time horizons, these are:

- The Trading Model;

- Trend Asset Allocation Model; and

- The Ultimate Market Timing Model.

All showed strong results.

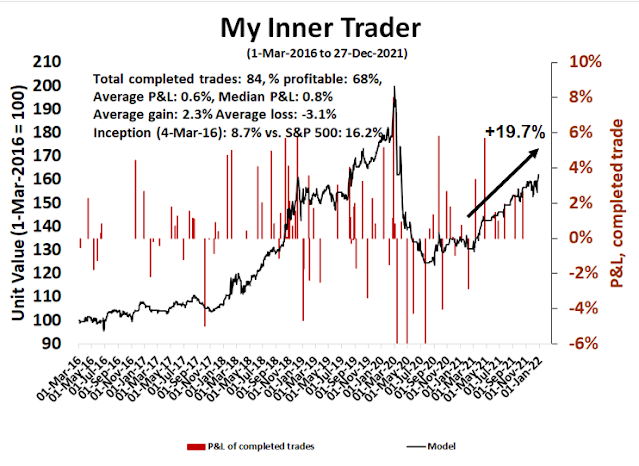

The Trading Model

The weakest result came from the trading model, which was strongly positive but lagged the S&P 500. This was still a solid result as it is arguably an absolute return strategy that should be benchmarked to cash rather than the stock market.

After a dismal 2020 in which the model incorrectly shorted the market as stocks rallied, the trading model clawed its way back in 2021. Based on the methodology outlined in My Inner Trader, the trading model returned 19.7% in 2021, assuming no trading costs and dividends. While this was impressive, it nevertheless lagged the S&P 500 capital-only return of 27.6% to December 27, 2021.

After a difficult 2020, I made an adjustment to the trading model. After realizing most of the past losses were from short positions, I made a decision to forego shorting in 2021 as long as the intermediate trend is up. I expect that 2022 will be more challenging, as the intermediate trend will turn choppy, which will call for some short positions, which will offer both opportunity and risk.

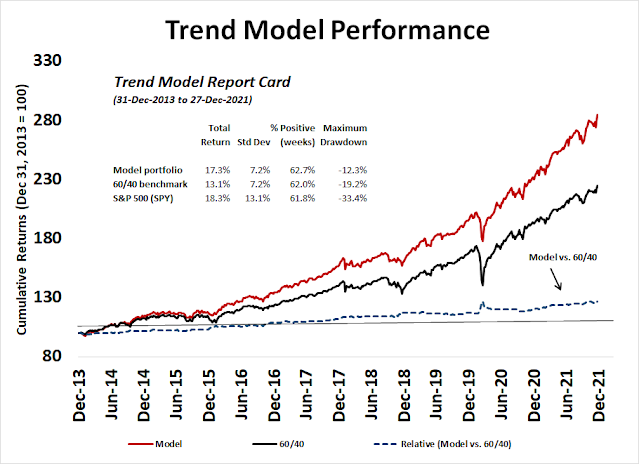

Trend Asset Allocation Model

The Trend Asset Allocation Model also had a strong year. Using the switching methodology outlined here, the model portfolio showed a total return of 23.7% compared to a 60% SPY/40% IEF benchmark of 16.5%.

As a reminder, model portfolio returns were backtested based on specified asset allocation rules, but the signals were produced out-of-sample. Past individual year returns during the out-of-sample period also showed a consistent pattern of outperformance.

- 2020: Model 20.6% vs. 60/40 14.2%

- 2019: Model 22.3% vs. 60/40 22.6%

- 2018: Model 1.9% vs. 60/40 -2.7%

- 2017: Model 17.4% vs. 60/40 13.8%

- 2016: Model 13.9% vs. 60/40 7.9%

- 2015: Model 2.5% vs. 60/40 1.4%

- 2014: Model 14.2% vs. 60/40 12.2%

The Trend Asset Allocation Model was designed for individual investors and portfolio managers whose objective is to achieve equity-like returns with balanced fund-like risk on a long-term basis. For advisors and portfolio managers who adhere to Investor Policy Statements for individual clients, the Trend Model is a useful tool to achieve superior returns while maintaining the risk profile demanded by each firm’s Compliance department. The idea is to begin with a 60/40 benchmark and either over or underweight equities by 20% depending on model readings.

This model achieved its objective again in 2021.

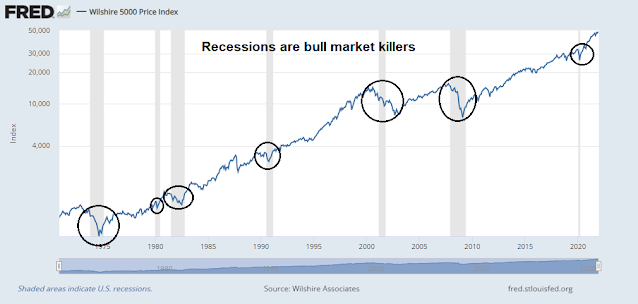

The Ultimate Market Timing Nodel

While the Trend Asset Allocation Model usually flashes several signals a year, the Ultimate Market Timing Model only flashes a signal once every few years.

This model combines the risk control elements of trend following models with an economic overlay. Trend following models using moving averages can spot falling markets, but they have the disadvantage of flashing false-positive signals that whipsaw portfolios in and out of positions. By recognizing that recessions are bull market killers, the Ultimate Market Timing Model will only de-risk when the economic model (see my Recesion Watch indicators) warn of a recession and Trend Asset Allocation Model issue a sell signal. It re-enters the market after a recession signal only when the Trend Model returns from bearish to neutral.

This model exited the market in the wake of the COVID shock of 2020 and re-entered the market in Q3 2020. It remained 100% long in 2021 and reaped a 27.6% return to the S&P 500.

This model is designed for investors who don’t want to trade but are willing to bear normal equity risk of 10-20% drawdowns. An investor using this model can then enjoy the benefits of higher long-term equity returns while avoiding the negative returns from major bear markets.

In conclusion, I began Humble Student of the Markets to help readers achieve better returns. Unlike most other services, I have not shied away from reporting my results. After a difficult 2020, the models all exhibited strong returns in 2021 and I continue to refine my investment process as needed.

The process is working and I hope to report similarly positive results a year from now.

Impressive on many metrics. Excellent transparency.

Congratulations!! Thank you !

Excellent systematic approaches. Thanks.

Congratulations! Excellent Returns.

I’m starting to build positions in TIP (TIPS) and IEF.

I’m learning to fish and your insights allowed me to take on more risk, so far up 29.07%, Thanks