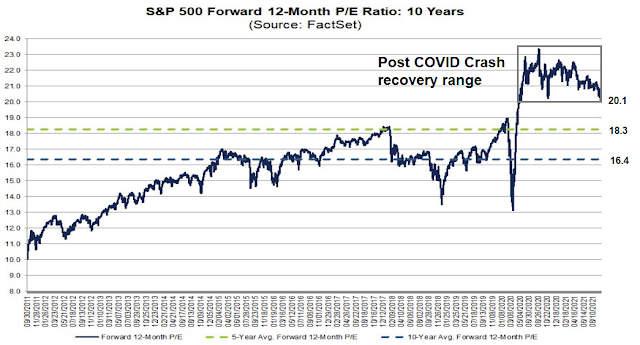

The recent pullback in the S&P 500 has deflated the forward P/E to 20.1 as of close last Thursday, which is in the bottom of the post-COVID Crash recovery range. The P/E derating is not surprising as bond yields have risen to put downward pressure on P/E ratios.

What’s next? The upcoming Q3 earnings season will be a test for both bulls and bears. The key question for investors is whether the E in the forward P/E ratio rises fast enough to support stock prices and offset rising rates?

A mixed picture

Wall Street earnings estimate revisions present a mixed picture. S&P 500 EPS estimates had declined for two weeks in a row, though a more updated report from

FactSet shows upward revisions in the following week. By contrast, estimates for both the mid-cap S&P 400 and small-cap S&P 600 show strong positive momentum.

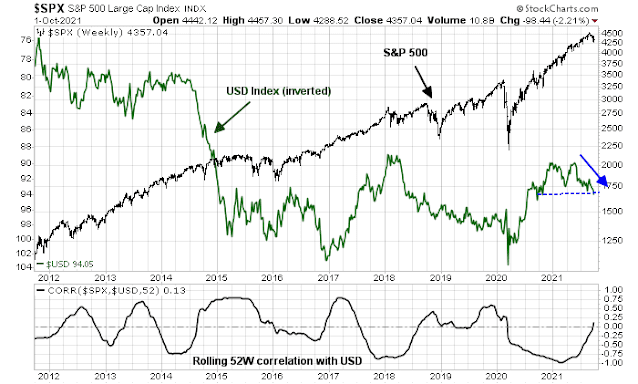

The weakness in S&P 500 revisions may be attributable to USD strength. Large-cap companies tend to have more foreign operations and their sales and earnings are more sensitive to currency fluctuations.

That said, the S&P 500 has exhibited an uneven correlation with the USD Index in the last 10 years. The USD is a safe haven currency and can experience fund flows during both risk-on and risk-off periods, but relative growth and interest rates are also important factors in determining currency levels.

A detailed estimate revision analysis

The Street is entering the Q3 earnings season on a fairly upbeat note.

FactSet reported that Q3 2021 is the fifth consecutive quarter that analysts have shown positive estimate revisions.

In more normal times, company analysts tend to be overly optimistic. They initially post high estimates and gradually revise them down as the reporting period approaches, according to FactSet:

In a typical quarter, analysts usually reduce earnings estimates during the quarter. During the past five years (20 quarters), the average decline in the bottom-up EPS estimate during a quarter has been 2.9%. During the past ten years, (40 quarters), the average decline in the bottom-up EPS estimate during a quarter has been 3.7%. During the past fifteen years, (60 quarters), the average decline in the bottom-up EPS estimate during a quarter has been 4.9%.

To be sure, the rate of revisions has decelerated. The monthly analysis of quarterly estimate revisions shows a gradual downward trajectory for Q3 earnings. The key question for investors is whether expectations are too rosy.

The bottom-up view

On the other hand, the bottom-up view from companies is still upbeat. The rate of positive to negative guidance is still positive, which is contrary to the historical record of the preponderance of negative guidance.

However, the macro summary from The Transcript, which monitors and summarizes earnings calls, sounded a cautionary note about supply chain bottlenecks..

Inflation and supply chain challenges continue to be the most prominent economic theme. It doesn’t appear that supply chain challenges are getting any better.

The previous week’s earnings calls had similar warnings, though it was more upbeat about the waning effects of the pandemic.

Economic weakness driven by the Delta variant appears to have been short-lived. While growth may have slowed some from the euphoric pace earlier this year, the economy continues to benefit from high consumer demand. Supply chain disruptions are not getting better though and inflation is likely to last into next year. The FOMC met last week and decided to keep monetary policy unchanged. However, Jerome Powell was relatively direct in saying that tapering is likely to start at the next meeting.

Where does that leave us? I am cautiously bullish as we enter the Q3 earnings season. Expectations are high but history shows that companies have guided sales and earnings estimates to slightly beat them. The bulls will say that the guidance rate remains positive and the macro environment supportive. The bears will say that the rate of positive estimate revisions has been falling, which is a sign of deceleration.

The reporting calendar is very light this week and the Q3 earnings season is to begin in earnest next week. The coming month will be a crucial period to determining the direction of stock prices.

For now, this really seems to be just a valuation reset. Support at SPX 4300 held today, that is constructive at least. Not sure if the semis are a useful indicator here, Micron had disappointing guidance and higher multiple stocks like NVDA or AMD are getting caught up in tech valuation reset. Cheaper cyclicals like autos are doing better while semis are getting punished for being expensive. Transports still weak, but possibly bottoming on a relative basis. The economy may do well as spending for services picks up due to delta receding, but this may not be so positive for the market which would do better in scenario where people spend their money on goods instead of services. Besides that there is margin pressure on higher input prices for many sectors.

Some observation:

1. Four sessions of $TRIN show the likelihood of tech capitulation/liquidation with Monday’s doji.

2. Seasonality enters favorable period.

3. Entering into 3Q reporting season, as of 10/1, tech has biggest revenue revision (+0.6%) since 2Q reporting season ends to yoy 18.7%. The other two positive revisions are health care (+0.4%) to 11.1% and RE (+0.3) to 13.1%.

Tech might gives us some surprises during the reporting season.

Scaling back into VT ~102.4x.

Feels as if the pain trade is higher.

FXI. BABA.

NIO.

Obviously, I would have done better buying VT early this morning. But the risk level was much higher then. Taking another swing at VT today as it cleared 102.40 (yesterday’s high) seemed to be more prudent. We now have a potential double-bottom against which to trade, and the fact that it cleared yesterday’s high tells me that anyone caught in Monday’s bull trap (which took VT down as far as 100.90 – a level last seen in mid-July) has probably exited at breakeven, and we may now be cleared for further upside. Obviously, there are no guarantees in the market…

Possible bottom soon? Starting to see articles in my newsfeed about a crash or bear market in equities.

Dipped my toe in longs. GL all.

I’m on the same page.

I’m even starting to look at FXI/ ASHR/ EEM/ BABA/ KWEB and thinking we may be looking at a generational buying opp without being able to see it.

I’m not as positive on large-cap US equities, but I tend to use VT (the total world stock market) as a default trade when that happens – I don’t need to guess which sectors will out- or underperform and international and/or US small- and mid-caps (many of which are already in bear markets) can often keep things going when US large-caps struggle.

A somewhat simplistic strategy but it works for me.

I’ll be looking to add on weakness or trim on strength over the next couple of days. Will also be looking to expand positions sizes in China and emerging markets.

In their midday market report Goldman attributed today’s market rally to the well received ISM services report, strengthening the thesis that as delta is fading the economy is able to pick up on growth. This is true and I continue to believe it is good for the economy but not good for markets. People spending their money on services (instead of products which is what happened during the pandemic) is bad for the market, it will expose that consumer discretionary companies have been earning above trend and are now facing a double whammy of an input price shock and consumers shifting their spending behaviours, in addition to demand destructing inflation. On the other hand the economy should be doing well enough to support monetary tightening. A market negative environment, with some Chinese uncertainty as a side note.

The GDPNow model estimate for 3Q 2021 is JUST 1.3% now.

https://www.atlantafed.org/cqer/research/gdpnow

The economy doesn’t seem ready for monetary tightening yet.

Yes, but will the growth slowdown be enough to delay tapering? Because tapering is tightening and inflation is certainly ready for central banks to take action. Also, longer term inflation expectations are finally starting to move up again.

The consensus ‘trade of the year’ back in January and February was emerging markets. Among other things, analysts were touting China’s resilience during the 2020 global pandemic as a reason to expect outperformance in 2021. How did that work out?

Now the consensus opinion is that China is ‘uninvestable.’ How do we think that’s going to work out?

How often do investment firms and investors stop to consider why they’re paying for opinions that more often than not steer them in the wrong direction?

https://www.marketwatch.com/story/this-simple-investment-can-earn-you-more-than-6-with-no-risk

There’s a catch:

‘How many I bonds can you purchase? There’s an annual limit of $10,000 per individual. That means a married couple with two children could buy up to $40,000 in total.’

Even so, it’s a solid deal. I plan to start laddering in this year.

Pretty ugly. Lots of misdirection the past two weeks. Although I hate to be wrong three times in two weeks (albeit interspersed with one good trade) that’s what the market has handed me and arguing with the market is pointless. I’ll be exiting positions within the first thirty minutes.

VT/ BABA/ FXI/ NIO closed.

My take right now is that the market is headed down – but doing its best to trap bulls along the way.

This is either a bull market giving us many buying opportunities or a bear market giving us many shorting opportunities. I’m leaning to the bearish side, but the bulls keep on kicking and screaming.

What’s the real contrarian trade here? Going/staying long in the face of negative sentiment – or going short as traders fade the negative headlines?

Maybe it is buy Facebook, short energy. I don’t know, I simply want to stay out of US markets. Quite frankly, this looks like a clown show where bigger forces are trying to lure in and shake out retail investors. Or hedge funds are trying to play games with each other. Too many pockets of insanity inside these markets. And the index level movements look kind of scripted to stop people out of positions.

It must be tough for TV analysts to try and make sense of market movements when the essence of the market is to mislead and confuse.

In reality, they’re doing the best they can to frame chaotic behavior in rational terms.

Anyone know this guy?

https://www.marketwatch.com/story/why-the-stock-market-is-signaling-melt-up-through-the-end-of-2021-11633507257?mod=home-page

Congratulations to everyone who stayed the course today.

Trying to day trade the past week has taken its toll on me. Staying in cash would have been much easier.

Are the markets now cleared for takeoff? I don’t know. Had I held my positions this morning, I would be taking them off here.