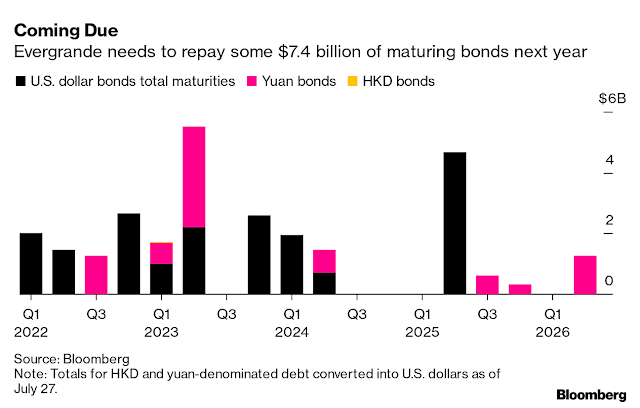

13 years ago yesterday, Lehman Brothers fell into bankruptcy. Today, the world is watching China Evergrande collapse in a debt spiral. The overly indebted property developer told China’s major banks that it won’t be able to pay loan interest due Sept. 20. The company has been swamped with protests from individuals who invested in its paper through wealth management products, its employees and suppliers who haven’t been paid, and numerous buyers who paid deposits for properties that haven’t been constructed.

Systemic risk

How did Evergrande get here? The tale is a familiar one. It overindulged on a debt-fueled expansion spree during the boom years. In addition to property development, which is a high leverage business, the company dabbled in non-core businesses like electric cars and bottled water. Reckoning arrived when regulators pressured overly indebted companies like Evergrande to pare its debt, which forced it to sell non-core businesses and cut prices on its properties to raise cash. Then the real estate boom slowed.

A

Reuters article explained the systemic risk posed by the Evergrande collapse.

China’s central bank highlighted in 2018 that companies including Evergrande might pose systemic risks to the nation’s financial system.

The leaked letter last year said Evergrande’s liabilities involve more than 128 banks and over 121 non-banking institutions. JPMorgan estimated last week China Minsheng Bank (600016.SS) has the highest exposure to Evergrande.

Late payments could trigger cross-defaults as many financial institutions have exposure to Evergrande via direct loans and indirect holdings through different financial instruments.

In the dollar bond market, Evergrande accounts for 4% of Chinese real estate high-yields, according to DBS. Any defaults will also trigger sell-offs in the high-yield credit market.

A collapse of Evergrande will have a large impact on the job market. It has 200,000 staff and hires 3.8 million people every year for project developments.

The

NY Times highlighted an additional systemic risk posed by Evergrande’s deleveraging.

Much of the cash that Evergrande has been able to drum up has come from presold apartments that aren’t yet completed. Evergrande has nearly 800 projects across China that are unfinished, and as many as 1.2 million people who are still waiting to move into their new homes, according to research from REDD Intelligence.

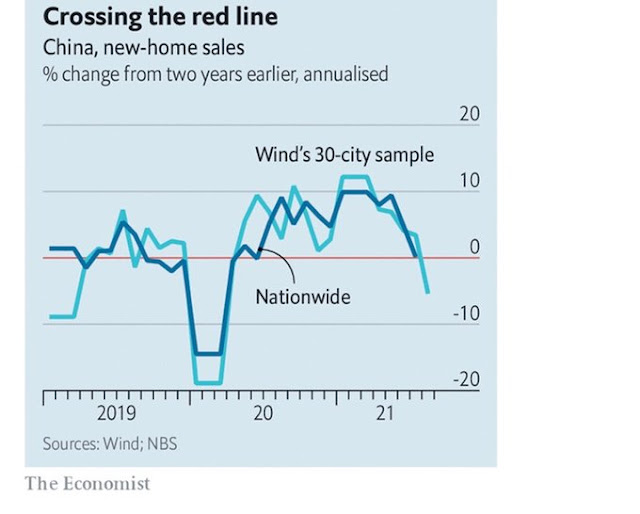

Evergrande has slashed prices on new apartments but even that has failed to entice new buyers. In August it made a quarter fewer sales than it did a year ago.

Some 70-80% of Chinese household savings have gone into real estate. If Evergrande were to go bankrupt and be unable to deliver on presold apartments, the household sector’s finances would take a major tumble. In addition, Evergrande’s forced liquidation will put downward pressure on property prices. In the past, the way to wealth for the ordinary Chinese is to scrimp together enough of a down payment to buy an apartment and watch prices rise as the real estate boom has become a one-way street. Protests over a falling real estate market have the potential to destabilize the economy and the Chinese Communist Party.

Market fallout

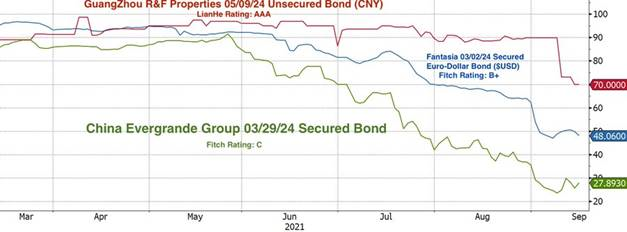

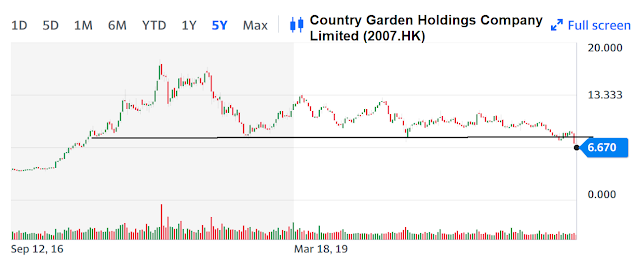

Evergrande’s bonds have collapsed before trading was halted and the bonds of other developers have also significantly weakened.

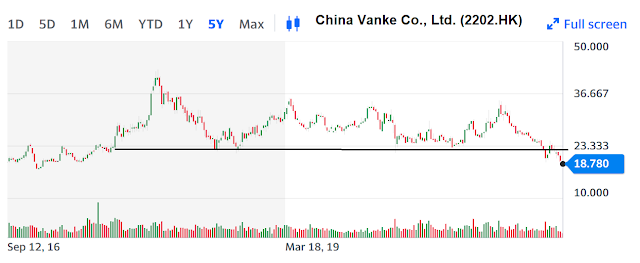

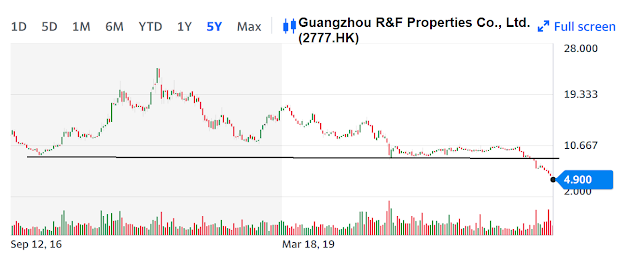

The shares of other property developers have fallen in sympathy and violated long-term technical support levels.

Contagion risk

Today, we have the dream scenario of the China bears. The combination of the Evergrande catastrophe and the Huarong Affair should shake the confidence in the Chinese financial system and see contagion risk ripple past its borders. Instead, real-time market signals indicate that contagion risk has been ring-fenced within the Chinese property development sector.

The Chinese yuan should be falling. Instead, it has been relatively strong.

By informing banks that the interest payments due on September 20 will not be paid, an Evergrande default is imminent. That should create stresses in the financial system, right? Instead, the relative performance of Chinese financials (red dotted line) is outpacing the relative performance of US financials (black line) and European financials (green line).

Another indirect way of measuring the strength of the Chinese economy is through commodity prices as China is a voracious consumer of commodities. Commodity prices reached a fresh all-time high yesterday and the cyclically sensitive base metals/gold ratio has been strengthening.

Industrial commodities have also been strong.

Equally surprising is the relative strength of Chinese material stocks relative to global materials.

In short, contagion risk has been contained. If the Evergrande catastrophe were to become China’s Lehman Moment, these risks would be evident in most of the indicators that I have cited.

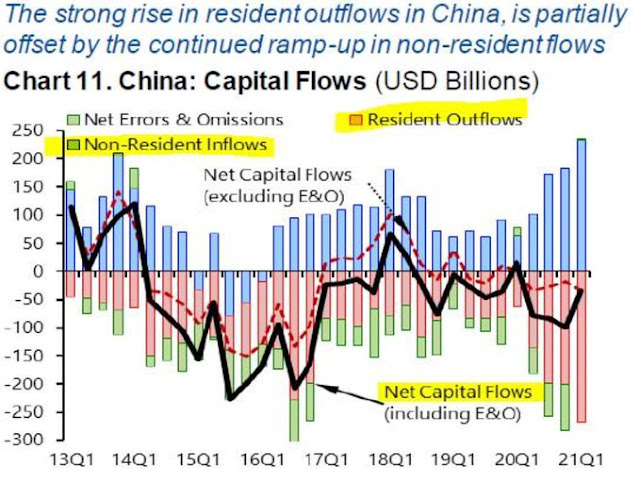

Does that mean that foreign investors in China should view this as a buying opportunity? Not so fast. Fund flow statistics show that as foreigners pile into China, the locals are selling and taking their money offshore.

Who is the “smart money” and who is the “dumb money”?

Foreign Devils beware!

It’s possible to buy an apartment or (rarely) even a detached house in China, but private land ownership is disallowed. So it’s not surprising that money has been flowing from China into the US/Canada/Australia for decades.

https://www.wsj.com/articles/pop-goes-the-chinese-property-bubble-china-evergrande-group-xi-jinping-11631827034?st=im6sjr1x66tb0ya&reflink=article_copyURL_share

The prices of the Bloomberg Industrial Metal Index may be driven by the desire to curb CO2 emissions (aluminium) and/or by expectations of increased battery demand. I’m curious about the Chinese Financials vs China ratio, how is that made up? If the multiples of the entire Chinese market have been brought down due to the tech sector crackdowns (and the expectation that the government will step in once a company grows too big too fast) – wouldn’t that automatically result in a low multiple sector like financials holding up better relative to the market?

In other news Morgan Stanley lowered their 2022 earnings estimate for SPY to $209 (consensus 220) due to higher corporate taxes. I’m not sure if the majority of the market will adopt this view, but shouldn’t investors in US indices still be worried about an increase in the corporate tax rate? Rates continue to stay low, but the move in gold may be an early indication that the market expects those to move higher while equities get “pinned” before opex.

What’s Im not getting is Evergrande has significant impact on a very important section in China (as Cam righfully called out 70-80% of the household savings are in real estate).

Should the foundation the belief that RE is a solid investment/savings vehicle be shaked. The ripple effect is far reaching.

Yet the stress is relatively contained within RE sector only in China and rest of the world is completed decoupled.

Why so calm? Are there cross currents underneath the surface that is about to rear its ugly head?

How would one position its portfolio under such situation? a) Take comfort that it is already discounted in market prices (looks like there isn’t much if any); b) prepare for some episode of contagion event (not Lehman like impact on global financial system).

Troubled China Evergrande Group should use market means to save itself and should not bet on a government bailout as it deems itself “too big to fail”, Hu Xijin, editor-in-chief of Chinese state-media Global Times, said on his WeChat social media account.

Hu said he did not think an Evergrande bankruptcy would trigger a systemic financial storm like Lehman Brothers, because it was a real estate business and the downpayment ratios in China were very high.

Who cares about peasants? They should work hard for the motherland and stop complaining.

Who is the “smart money” and who is the “dumb money”? Couldn’t agree more. When Elizabeth Warren is president and talking about implementing a program of common prosperity, I’ll be investing in China.

Opening a position in VTV.

Opening positions in EWZ and GDX.

PICK.

Scaling back into VT.

Adding to VTV.

Adding EEM/ FXI.

XLI.

Brutal selling this morning.

SPX breaches the 50-day. Does the selling accelerate, or will we see an undercut + recovery?

Here we go.

I think it’s 50/50 whether we gap up or gap down on Monday. I’ll either close positions on a gap up, or add to positions on a gap down. I’m pretty comfortable with my positioning.

Mr. Bond? You still with us?