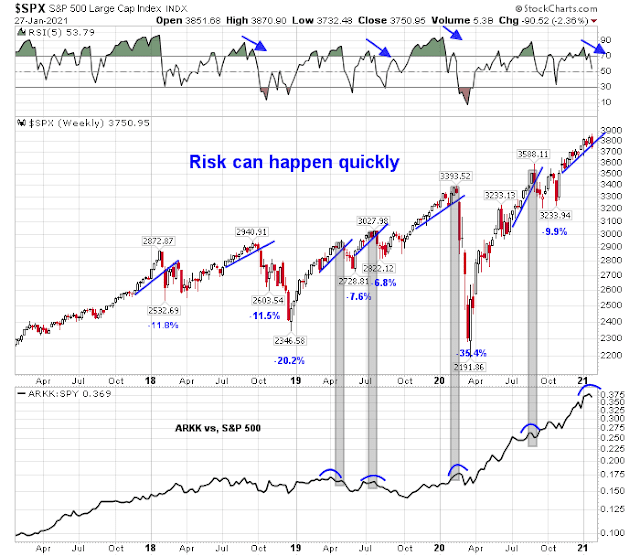

Mid-week market update: What are we make of this market? In the last four years, the weekly S&P 500 chart shows that we have seen six corrective episodes of differing magnitudes. Risk happens, and sometimes with little or no warning.

About half of those instances saw negative 5-week RSI divergences, which we are seeing today. Since the start of 2019, when the ARK Innovation ETF (ARKK) started to get hot, the ARKK to SPY ratio roll over every time during those corrections. That ratio is turning down again.

The stock market is becoming a market of stocks, instead of a stock market. Individual issues are moving separately instead of together. In the past, low realized individual stock correlations have been warnings of market corrections.

Will this time be any different? The S&P 500 hasn’t seen a downside break of the rising trend line on the weekly chart yet.

Reasons for caution

The bear case is easy to make. Signs of froth are appearing everywhere. The PBoC warned about asset bubbles and withdrew liquidity from the financial system. The overnight repo rate spiked as a consequence. The Chinese and HK markets tanked on the announcement Tuesday, but steadied on Wednesday.

Bloomberg also reported that the “Goldman Team Sees ‘Unsustainable Excess’ in Parts of U.S. Market”.

Corners of the U.S. equity universe are showing signs of froth, but that shouldn’t put the broader market at risk, according to Goldman Sachs Group Inc.

Very high-growth, high-multiple stocks “appear frothy” and the boom in special-purpose acquisition companies is one of a number of “signs of unsustainable excess” in the U.S. stock market, strategists including David Kostin wrote in a note Friday. The recent surge in trading volumes of stocks with negative earnings is also at a historical extreme, they said.

However, the aggregate stock market index trades at below-average historical valuations after taking into account Treasury yields, corporate credit and cash, the strategists added.

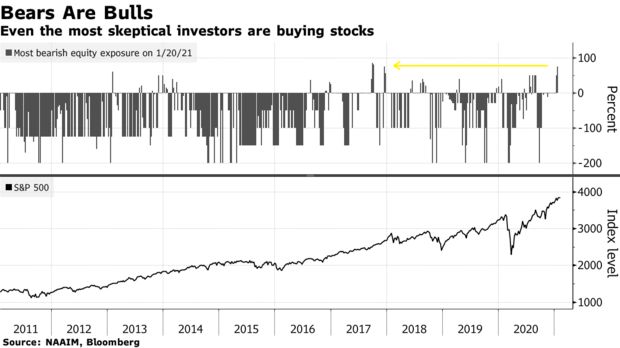

In a separate article, Bloomberg reported that the NAAIM survey of RIAs shows that the most bearish respondents are 75% long. To explain, NAAIM surveys RIAs from 200 firms overseeing more than $30 billion and asks their investment views. The survey reports an average equity exposure, an average top and bottom quintile exposures, and a maximum and minimum exposure. It is highly unusual to see the minimum at 75%. Most of the time, the minimum is negative, indicating a short exposure to equities. The last time minimum exposure was this high was the market melt-up in late 2017 and early 2018. Tom McClellan recently made the same observation about the NAAIM survey and came away with a similar bearish conclusion.

As well, money market cash levels are low. Historically this has led to subpar returns.

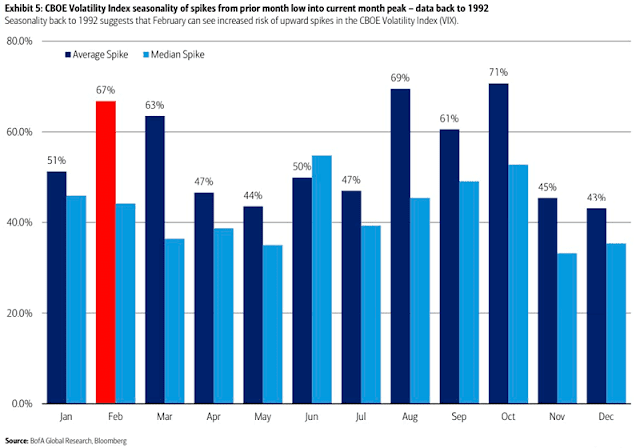

From a seasonal perspective, February has historically seen VIX spikes. Since volatility is inversely correlated with the market, this implies lower stock prices ahead.

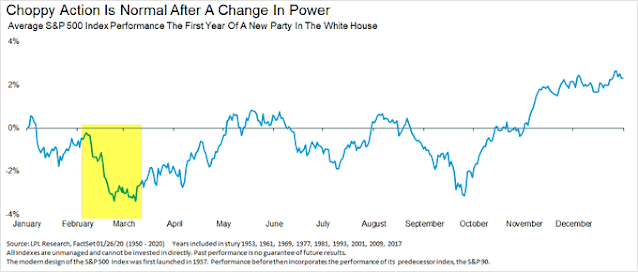

Ryan Detrick also observed, “When a new party is in power in the White House, that first year tends to be pretty choppy for the S&P 500.” Negative seasonality starts very soon and ends in March.

The market is due for a correction.

Here comes the flash mob bulls

There is no doubt that the market psychology is frothy and giddy. If you are unfamiliar with the Reddit flash mobs, take a look at the article, “11 Things to Know About the Wild GameStop Drama on Reddit WallStreetBets (WSB)”.

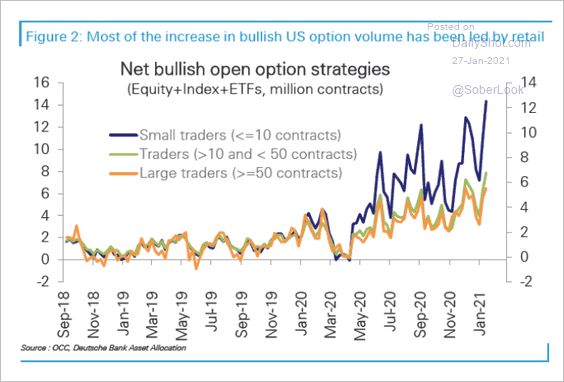

To recap, small retail traders have identified highly shorted issue and ganged up to push the stocks up. These traders have mostly used call options to maximize their leverage, and to force dealers to hedge their positions by driving up the underlying stock price. Small trader option volume has surged to fresh highs as a consequence.

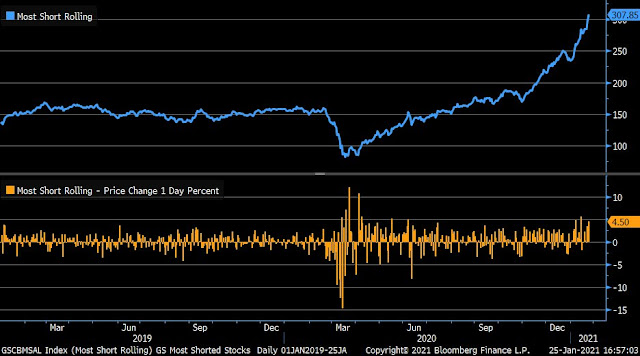

Indeed, most shorted stocks have gone wild on the upside.

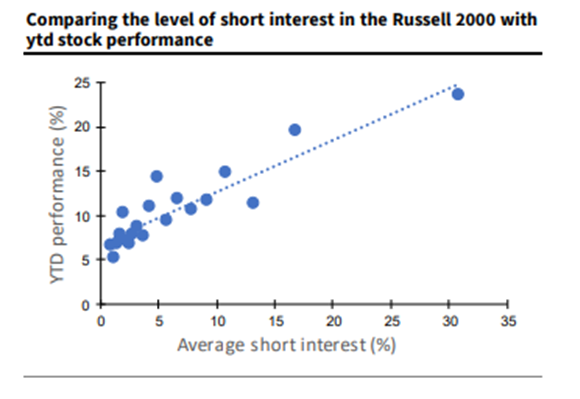

The short squeeze targets are small cap stocks, and there is a linear relationship between the YTD performance of Russell 2000 stocks and their short interest.

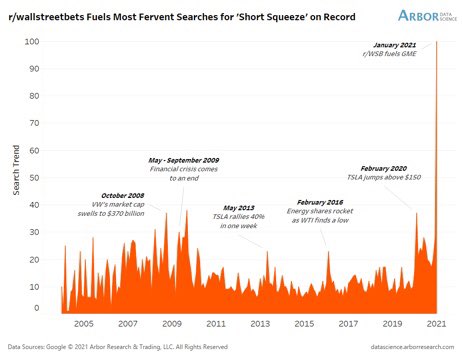

Google searches for “short squeeze” have skyrocketed.

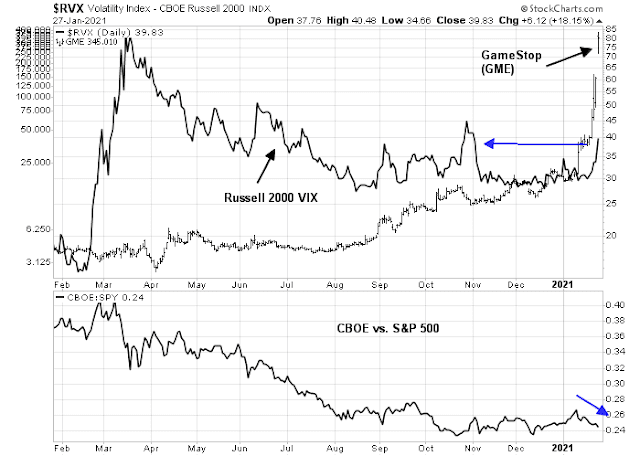

GameStop (GME) is the poster child of the short squeeze. Yet, even as GME rose like a rocket ship, the overall market reaction has relatively relaxed. The Russell 2000 VIX has risen but not spiked above its recent range, and the shares of CBOE has lagged the S&P 500.

How long can the WSB flash mobs prevail? Joe Wiesenthal of Bloomberg offered some perspective.

If you go back to the dotcom bubble, and you think about what stocks were really representative of it all, you probably think of Qualcomm or Cisco or Yahoo, or perhaps you remember TheGlobe.com. But some of the initial plays were a lot weirder. Back in the spring of 1998, traders went nuts for shares of K-Tel, the purveyor of corny compilation CDs that were sold via infomercials on TV. But when they started selling CDs online, the stock went bonkers, doubling many times over. Still, what seemed like irrational exuberance wasn’t anywhere close to the top of the market mania. It was barely even the beginning. K-Tel was like Hertz or the Scrabble bag.

It’s basically impossible to know in real time where you are in the cycle or how big things are going to get. Things can always get more nuts.

Before you think that the WSB pressure is restricted only on the upside, BNN Bloomberg reported that “Short-squeezed hedge funds are now getting hit on their bullish bets too”. Hedge funds have to trim their long positions in order to balance the losses on the short books. In the alternative, some traders are being forced to liquidate because rising volatility is causing VaR (Value at Risk) models to reduce book sizes.

Hedge funds are suffering as retail traders whipped up in chat rooms charge into heavily shorted names, fueling squeezes in stocks from Bed Bath & Beyond Inc. to AMC Entertainment Holdings Inc. Fund managers have spent recent weeks paring bearish bets, with hedge fund clients tracked by Goldman Sachs on Friday carrying out the biggest short covering in seven months.

But the long sides of their books are starting to feel the pinch too. On Monday morning, when stocks with the highest short interest soared as much as 11 per cent, the GVIP fund tumbled almost 2 per cent.

Such a squeeze not only hurts performance for hedge funds, it increases the potential size of a measure known as daily value at risk, both of which would prompt money managers to cut back their risk appetite, according to Kevin Muir of the MacroTourist blog.

“The real question is whether this selling starts a negative feedback loop,” Muir wrote Monday. “Even though it might seem like the stock market bulls should be cheering the squeezes, their success might end up being the trigger that brings about the general stock market correction many have been waiting for.”

Should the WSB squeeze continue, it opens up the possibility of one or more hedge fund blowups, such as a repeat of the August 2007 quant meltdown (see Khandani and Lo paper for more details).

In order to adapt to the new environment, I am changing my subscription pricing from being paid in USD, to being paid in shares of GME. This change will be immediate and apply to all renewals and new subscriptions*.

Risk levels are high

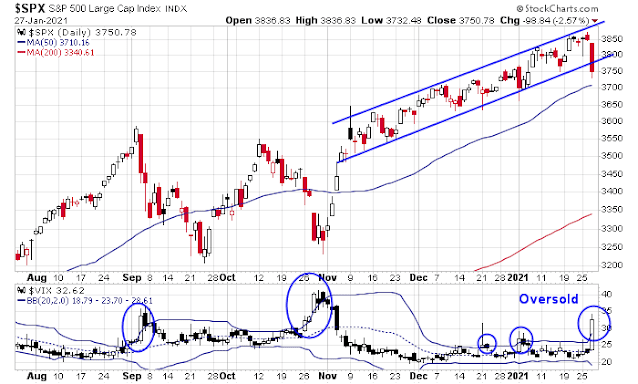

Tactically, today’s sell-off saw the S&P 500 violate a well-establish rising channel. In addition, the VIX Index surged above its upper Bollinger Band, which is the signal of an oversold market. The bulls need to hold the line here and rally. I am closely watching the behavior of the VIX. Will this a “once and done” spike, or an upper BB ride? Watch if there is any bearish follow-through.

My inner investor is bullishly positioned, but he has selectively sold covered calls against existing positions as a partial hedge. The long-term trend is still bullish, though short-term risk levels are high. My inner trader is holding his short position in the S&P 500.

* No, I am not serious. That’s a joke.

Disclosure: Long SPXU

Quote from a Reddit mob player,”We can stay retarded longer than they can stay liquid. “

These are newbies and talk like confident newbies. But they are not the main driving force. Their money would not be big enough to inflict such damages. There are other opportunistic hedge funds saw what’s happening and decided to pile into the game. I saw quite a few hedge funds and individuals making a lot of money from this. Sharks will eat other wounded and bleeding sharks.

The reason I said there are other hedges are involved is very simple. Dealers do not have to fully get into delta (gamma) hedging by using covered calls and driving up share price if what they saw was very frequent and small call option sizes. This has been going on the whole year. And you don’t see short squeezes of this magnitude. But what they found is that big money were coming in and they knew pros are in the game so they had to be fully hedged. I don’t know who’s going to last longer.

But this saga has proven my theory about TSLA share price increase. Some big money has had big loss due to their shorting. They were eaten by other sharks. Exactly what we are seeing right now.

Cam is right. Let’s see what happens next. Meanwhile Redditers can continue to thump chest claiming wins against the establishment. A group of useful idiots.

Plan A is to sell into a bounce on Thursday/Friday.

Plan B. Should we open further in the hole, I will consider adding a second (smaller) tranche to existing positions in the expectation (hope) that another decline brings in stronger hands looking for entries.

Plan C. Take the hit, and move on. I have a buffer in the form of an unexpected ~0.45% gain today. Given what is now a 30% exposure level, I’m prepared to see markets pull back an additional -1.5% before losses begin to eat into gains earned through Tuesday’s close. That’s a bet with a decent risk/reward profile.

SPX futures currently off another -0.87%. That’s a plus IMO – we need some type of retest with an undercut of the regular session’s lows, and I would prefer that it occur after hours with a recovery that then (hopefully) leads to a green open.

The ES has bounced from a low of 3703 – that’s a good start.

https://twitter.com/McClellanOsc/status/1354605609388109826

NYMO is well below lower BB. But the real upturn has to wait until NYSI RSI14 cycles back from under 30. It is now slightly under 30. It can go lower.

Understood. At this point, I’m more comfortable with following through on my plan to reopen positions ~SPX 3700 than I am with waiting for further downside that may fail to materialize. If we pull back further, I have the option to add.

I see GME and my first thought is Ross Perot.

Selloffs in Asia are buying opps IMHO.

Adding to an existing position in FXI. Reopening starters in BABA and ASHR premarket.

Reopening starters in QS/ FCEL/ NIO.

Wish I had reopened a position in JETS yesterday.

Adding a second tranche to EEM. Reopening a position in EWZ.

GME @ 480.

Kind of saw that coming. The thing with casino plays is once you’ve won at the tables, you need to walk away – it’s too easy to give it back. It helps that I played it yesterday and got it out of my system. I’m done with the stock.

Reopening RIOT. Reopening SNAP.

GME now @ 385.

Might as well be swimming across a riptide.

GME now @ 279 – unbelievable.

XLE/XLF up. I definitely think both sectors were vastly oversold as of yesterday.

Flyers on a couple of SPACs. INAQ/ GSAH.

Here comes the green open!

Trimming a number of positions, simply because I think they’ll pull back during the day.

XME/ KRE/ RIOT.

Closing FCEL.

Closing GDX. Closing XME entirely (+4%!).

Closing EWZ. Closing SNAP (+5%!).

Closing all positions here – at least everything I’m able to.

Will be closing RYSPX at the 730 am window.

Plan to close VTIAX/ VEMAX end of day.

+0.5% for the day right now. I just think the bounce is overdone.

GME/ AMC players giving it all back.

Reopening a position in PLTR.

Out. Ouch.

On the other hand, closed FCEL just in time.

Its weeks like this that I stay on the sidelines. Too much craziness and just more signs of a bigger pull back.

You’re probably right.

Plan A for Friday is to join you on the sidelines. Today’s action feels like a dead cat bounce, and the next move is likely to be down.

(a) Cam has made it clear that risk levels are high. That may not matter until it matters, but when it does the correction is likely to be steep and unfold quickly.

(b) In addition, yesterday’s candle was a shot across the bow. Followed by a dead cat bounce today.

Given a choice, there are undoubtedly better times to be long and strong. If I miss out on a little more upside – I’m OK with that.

So much of trading comes down to a combination of luck and psychology.

100% cash heading into Wednesday? That was at least 50% luck. Had I been holding into Wednesday, I would have closed all positions – and not participated at all in today’s bounce. (Worse, I have on more than one occasion in the past ended up chasing the open on days like this, and compounded my problem). Instead, I had the opportunity and the confidence to open positions on Wednesday in hopes of selling into today’s bounce.

Just two days ago I was trailing the SPX – now I’m ahead. In less than 24 hours the SPX may overtake me again. It’s all a continuing game and the best most of us can hope for is to be able to look back and think, ‘I did OK.’

That’s my perspective.

EEM headed for a gap-fill ~53.30.

Targeting a 49.22 gap fill for FXI.

Energy and banks holding up.

Scaling back into a few positions here.

XLE/ KRE/ XLF/ EEM/ FXI.

Broadening out to EFV/ VTV/ VEU/ VT.

Adding a flyer in BTBT.

These types of headlines help to jack up negative sentiment – they will also probably help to provide a floor under prices, at least for now.

https://www.marketwatch.com/story/get-ready-for-a-10-stock-drop-driven-by-the-3-rs-warns-bank-of-america-11611926024?mod=home-page

Reopening positions in VTIAX/ VTSAX/ VEMAX at the close (in descending order).

Back to ~35% invested.

Reopened a position in BABA in the after hours session. I had a note re 252.88 as a gap fill target but failed to set a limit order – looks like it hit midday. An after hours fill a little above 253 is good enough.

Both EEM and FXI hit my targets.

Friday selloffs tend to continue into the following Monday. So I’ll be looking to add to positions either premarket or early in the session.

It’s encouraging that SPX has managed to bounce off 3700 twice.