House Speaker Nancy Pelosi has set a Tuesday deadline for an agreement for a coronavirus stimulus package before the election. Recent data begs the question of whether more stimulus is even needed.

Last Friday’s retail sales print was astonishingly strong and beat market expectations. While retail sales statistics are notoriously noisy, September retail sales rose sequentially in all major categories.

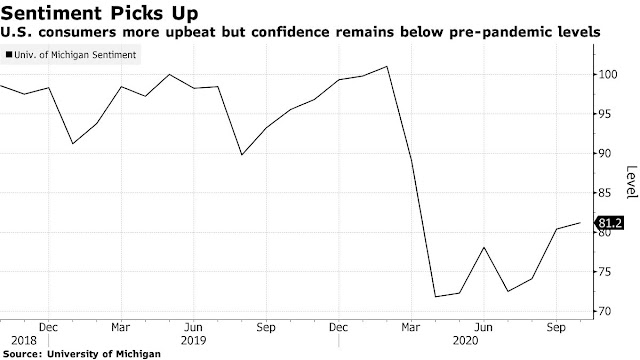

In addition, consumer confidence improved in early October despite the expiry of the $600 per week stimulus payments.

Stimulus spent, or saved?

A New York Fed study is supportive of the fiscal hawks’ case that more stimulus is not needed. The New York Fed studied how households used the payments, and most of the funds were saved either directly, or indirectly by paying off debt. As of the end of June, “29 percent—was used for consumption, with 36 percent saved and 35 percent used to pay down debt”. A demographic breakdown showed that even the most disadvantaged group in the “non-white” category directly saved 27.2% and indirectly saved 46.4% of payments through debt repayment.

If a substantial amount of the stimulus was saved, does that mean the CARES Act was too generous. pr unnecessary?

Fiscal cliff delayed

I know this is going to be an unpopular opinion, but the fiscal stimulus may have been less important for retail sales than widely assumed. What we see inside the retail numbers – the shift in spending away from the services component – has happened in the economy overall. Spending on goods has remained strong largely because households were unable to spend on their typical basket of services and that extra money had to go somewhere.

In conclusion, the fiscal cliff is very real, though its effects are slightly delayed. I wrote in my last post that the market is expecting a cyclical recovery (see How the US is becoming an emerging market). A collapse in household finances is an ever-present threat to the recovery investment theme, and it’s a risk that investors should keep in mind.

“A collapse in household finances is an ever-present threat to the recovery investment theme, and it’s a risk that investors should keep in mind”.

The US Fed has discovered the nefarious virtues of MMT promoted by the like of Professor Stephanie Kelton. If necessary, the US will start buying retail products, goods a services directly from the sellers, in addition to lining peoples pockets with money.

Despite the cynicism in the above statement, to the chagrin of investors who follow rules, the US Fed (and other central banks) have laid threadbare all known investment tenets.

The market has a way of negatively impacting us regardless of what we do. The +30 move in SPX futures placed a damper on my morning.

Selling into yesterday’s down draft is the equivalent of punting on fourth down. When I was younger, I might have opted to pass on 4th and long – but I’ve burned badly on that play.

It is only when you are desperate enough to close your shorts that the market sells off hard!

Right – that sounds like the market I know.

Thought about reopening a position in the long bond – if it sells off again on Wednesday, I’ll take a shot at a ST bounce.

Opened or reopened small positions in NIO and SNAP after hours. SNAP was purchased in two allotments between 34 and 35.

Hulbert’s sentiment index now ~23 percentage points below its recent high. Closing in on a tradeable bounce.

Opening in the hole on Wednesday would work for me. I just don’t think it happens – we’re more likely to see the reverse.

Reopening positions in AAPL/ XLE/ QQQ.

Opening a position in OSUR.

I’ve been trading around SNAP.

Adding XLF.

Unloading most of the SNAP position here.

Damn – I always misjudge how far these things can run.

Hit a limit order to reopen at 36.70. I’ll try to hold this one.

Reopening SPY.

Reopening NET.

Adding AMZN. Doubling up on QQQ.

A bet we break to the upside.

Adding to QQQ.

IMO, it’s a fake out to the downside and we close near the highs.

Tricky market.

I’m adding a small position in DIA at the close.