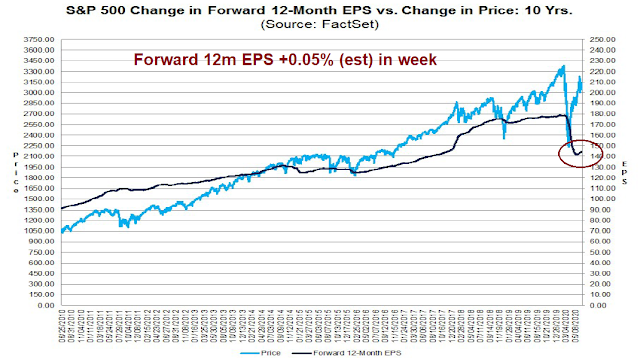

As Q2 earnings season is about to begin, it would be useful to assess the level of expectations going into reporting season, and the risks ahead. According to FactSet, forward 12-month EPS estimates have been bottoming and begun to turn up after a massive downdraft.

On the surface, this appears to be a constructive backdrop going into earnings season. While I would normally agree, the current environment is anything but “normal”, and there are plenty of risks ahead.

Flying blind

Indeed, a summary of this week’s view from The Transcript, which monitors and summarizes earnings calls, reveals a feeling of cautious optimism based mainly from a top-down perspective.

- Economies around the world are reopening even as cases increase (IMF)

- People seem willing to accept higher infection rates (BlackRock)

- Even travel may rebound faster than people expect (TravelZoo)

- But there are still 20m unemployed and many won’t go back to work (Palo Alto Networks)

- A vaccine would be a game-changer (Bain Capital, IMF)

However, The Transcript from the previous week was far more cautious, though the perspective was more bottom-up.

- Demand continues to bounce back (GM, McDonald’s, Federal Reserve, Union Pacific)

- But uncertainty about the future is still very high (Federal Reserve, IMF)

- A huge number of people are still unemployed (The Kroger)

- Travel restrictions will probably remain in place for a while (Anthony Fauci, US National Institute of Allergy and Infectious Diseases)

- And there are signs that a second wave may be building (McDonald’s, Food and Drug Administration Former Ex-Commissioner Dr. Scott Gottlieb)

In other words, nobody knows anything, and the level of uncertainty is very high. FactSet reported that the level of corporate guidance going into earnings season has plummeted. Even though forward 12-month EPS estimates are rising, the confidence level of the estimates is low. Wall Street is flying blind.

The risks ahead

The main risks surrounding Q2 earning season are the difficulties and extra costs of reopening, the expected level of reopening, and rising liquidity risks due to low capacity utilization.

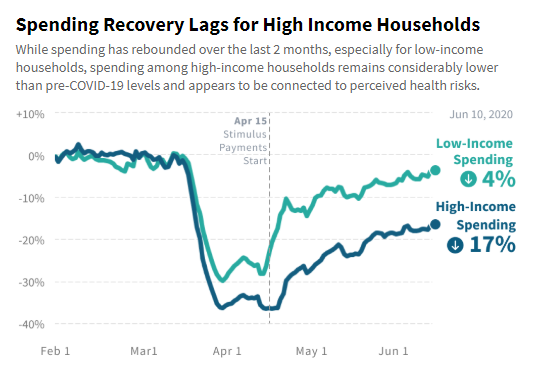

Tracktherecovery.org reported that the spending recovery has continued, but low-income household spending has recovered faster than high-income households. That’s not surprising, because low-income workers have a higher propensity to spend their stimulus payments. This begs the question of whether there will be another round of fiscal stimulus when the CARES Act payments ends at the end of July. The Senate is not expected to take up the question until mid-July. Both the Democrats and Republicans have their own political agenda in crafting stimulus plans. With the election only four months away, the risk is both sides of the aisle cannot come to an agreement and the economy goes over a cliff.

A real-time snapshot shows that small business revenue recovery has flattened out. Anyone expecting a V-shaped recovery is likely to be disappointed.

The US COVID-19 case counts are climbing again. While other developed economies have bent their curves, the unfortunate fact is US conditions are on par with EM countries like Brazil, India, and Iran.

The S&P 500 is at a technical crossroad as it tests its 200-day moving average and backtests its broken trend line. The VIX term structure is not signaling extreme fear. I interpret these conditions as that the market is cautious, but no panic. It may not fully discounting the risks and possible bad news from Q2 earnings season.

The WSJ observed that the market has already assigned a risk premium to companies that withdrew guidance, but will that be enough?

Many companies that have pulled their guidance represent the industries most affected by the coronavirus pandemic and most damaged in the stock market. On average, shares for the companies that have withdrawn or withheld guidance are down 18.2% year to date. By comparison, the S&P 500 is down 6.9%.

Investors need to be prepared for the risks of a change in the market narrative in the weeks ahead.

Cam, you had earlier suggested an SP500 level in the 1800 to 2000 level (+/-). I think I saw another estimate in the 2600 to 2800 area (but that may have been someone else).

Do you have an updated guesstimate as to where index might land now? Or do you want to see some earnings posted before taking a stab at it?

I expect that the S&P 500 will bottom out at below 2000 after the dust settles. I have a guesstimate target of 1300-1800 but it’s wide range.

At this point the market is wildly overvalued but it was that way 1997-2000. Anything can happen.

Cam, You mentioned recently that you thought your target might take as long as 9 months before reaching the bottom. Are you still looking at that long of a time frame.

And, I suspect the FDA is going to try to push a vaccine for approval before the election. Rumors are going to start flying sometime in September. Do you have a guesstimate as to how the market would react in that event? Will that invalidate your bottom target?

” I suspect the FDA is going to try to push a vaccine for approval before the election.”

Wally, this seems very optimistic. What is this based upon?

I read an article and statements from Trump that he is pushing for it before the election.

Operation Warp Speed is targeting January 2021. So November 2020 is a Hail Mary. Anything’s possible – but IMO a vaccine prior to the election is improbable.

I wonder if people would actually trust a vaccine that was developed at “warp speed”.

https://www.bloomberg.com/news/articles/2020-06-19/wall-street-expects-a-covid-19-vaccine-before-the-u-s-election

Thanks, RX. I knew you had my back!

Wouldn’t that be just a teensy bit immoral to rush a vaccine in just to try to win an election?

Would not one care if the vaccine(s) backfired and did not work, or worse, had negative side effects?

Nah. Just me over thinking this.

Joyce, I think it is just a rush to get a vaccine approved so we can end this Covid pandemic. Maybe there is some thought to the election but I believe the primary rush is to save American and world lives.

There are 205 vaccine development in the pipeline. There is a mad rush to the finish line with the winner takes all.

Wow. Thanks.

I recall a Tony Dwyer remark from last March or April – in the absence of any historical precedent or reliable earnings forecast, he decided to rely on sentiment as a indicator while basically flying blind.

Fwiw – the Hulbert newsletter sentiment index pulled back six percentage points despite today’s rally. I don’t think many market participants are bullish right now.

Would the sentiment be used as a contrarian indicator then?

That’s correct.

But now the earnings questions are about to be answered – for better or for worse, I think.

Again, we also get NFP on Thursday with a forecast of +3,037,000 – which may well happen but now we have the shutdowns kicking in the sun belt (and elsewhere) which will presumably cause employment losses.

Not to mention the acceleration of cases around the world, which won’t increase the worlds economic value, even if no lock downs (Brazil, India, sub Saharan Africa, etc.)

And the world economy can hardly be said to be firing on all cylinders, either.

A rather scathing interview on the Chinese economy and the businesses – even Alibaba and Tencent. May have implications for the global market. Any opinion?

https://themarket.ch/interview/china-is-stuck-in-a-vicious-cycle-ld.2199

ASY is a terrific strategic thinker and her firm is good at uncovering frauds. But she’s by her own admission a terrible trader. See her comment about selling out of Beijing property in 2011.

Thanks, Cam. I had never heard of ASY before.

Fwiw, my younger brother works for an international law firm and is a structured finance specialist based in HK. He’s traveled to China extensively for over thirty years. He’s had nothing but negative things to say about China for over thirty years – broken systems, corruption, fraud, pollution – and invests only in US stocks. My take is that you’ll find corruption and fraud in any market, and diversifying among a large basket of stocks will hopefully keep you from getting hurt when companies like Enron or Luckin go down.

Great article. Scary even if 50% true.

Neand developments which makes Covid look less scary than commonly believed

Immunity higher than indicated by antibody testing

https://news.ki.se/immunity-to-covid-19-is-probably-higher-than-tests-have-shown

Infection fatality rate 0.6% and 0.1% for those under 70

https://www.folkhalsomyndigheten.se/publicerat-material/publikationsarkiv/t/the-infection-fatality-rate-of-covid-19-in-stockholm-technical-report/

I had to look up the difference between the two types of immunity –

https://biodifferences.com/difference-between-humoral-and-cell-mediated-immunity.html

Encouraging news!

Although I have zero knowledge about this, it seems that the cell-mediated immunity could leave the victim still infected and a carrier of the virus. Sort of like a Typhoid Mary.

Possible vaccine from China. Approved for military use only. Bold experiment

https://www.reuters.com/article/us-health-coronavirus-china-vaccine-idUSKBN2400DZ

“….showed some efficacy…..”

I guess it might give you immunity or it might not. Personally, I would be afraid of a vaccine from China.

if offered a vaccine from China, or one developed in haste to assist Bunker Boy with his re-election, I think I’d literally prefer to play Russian Roulette.

Biden isn’t up for re-election!

Ha ha. I don’t think that’s what Martin meant.

Cam, how far do you think this two day (so far) rally has to go? It looks to me that it is up against initial resistance to me.

Sentiment Trader says stocks are bullish 6-12 months from now. 100% probably if I am not mistaken. So can Sentiment Trader be wrong?

I like to buy some SPXU today but apprehensive because of Sentiment Trader.

Not hearing from Cam, I added a little SPXS today but I’m just doing it to hedge part of a small long position I have.

Joyce, here is an article from Zacks about 3 dividend stocks for the 2nd half of the year.

https://finance.yahoo.com/news/3-dividend-stocks-buy-second-183506852.html?.tsrc=rss

Thanks Wally. I still can’t “believe” in this market :(. It makes going long a very difficult decision. Trouble is, I am too emotionally attached to my money and can’t bear the thought of the market going seriously tilt. So I can’t tell the difference between a down day or two and the start of the next bear leg down – if there is going to be one.

Being in keeps me awake at night, being out ditto. Sigh.

“I am too emotionally attached to my money”

LOL Aren’t we all!!

See, there’s the thing – in a “normal” market, I can invest quite well and take the rough with the smooth. But this is all far from normal. It doesn’t even feel like a “normal” bear / bull market (read 2000 to 2004 and 2007 to 2009). Stay in cash I suppose.

There are only two ways to deal with the dilemma – wait for market conditions to change, or change your mindset towards the market. I don’t think market conditions really ever ‘change-‘ it’s inherently a difficult environment; the nature of the beast.

Emotional attachment to money is a mind game. One thing I notice when traveling is enhanced awareness of the real world. The fact that you’re a participant in Cam’s website tells me you’re better off than 99% of the world’s population. Think about that. Most of them will never have enough discretionary income to invest in the market. If you lose your entire portfolio, I’ll bet you’d still be better off than 99% of the world’s population. Try giving some of it away to someone who really needs it, ‘throw it away’ on a trip of a lifetime with family/friends, or buy yourself a front row seat the next time the Stones are in town. You’ll begin to emotionally detach from the money, and in return you’ll have memories far more valuable.

RX, I don’t think she wants to emotionally detach from her money. Money is like a security blanket – It doesn’t seem important until you don’t have it.

Right. But she admits to being ‘too’ emotionally attached, to the point where either being in the market OR being out of the market keeps her awake at night. So a little less attachment would be helpful.

Good point.

Hulbert sentiment index +24 percentage points relative to Monday. FOMO kicking in, perhaps.

For what it’s worth:

“Currently, the Put/Call Ratio for the $NDX top 5 weighted names (40% of the index) is telling us that the market is extremely greedy – everybody is on the same side of the trade.”

https://twitter.com/MacroCharts/status/1277919815173373953

Thanks for posting that link, Sanjay.

It’s important to note which market the comment refers to->the Nasdaq 100.

Below the original tweet is the following reply:

SP

@sparkf19

·

Replying to

@MacroCharts

and

@JC_OHara_

although a bit improved now, CFTC data on E-mini S&P 500 showed the opposite (record short positioning)… FYI

Interesting new development… not sure if it will

boost the market short term. https://abcnews.go.com/Politics/day-small-businesses-apply-ppp-134b-remains-emergency/story?id=71529975&cid=social_twitter_abcn

Helpful video… Tchir has been bullish since Mar, possibly changing now https://tdameritradenetwork.com/video/rB4AoXL0GEiBcwZGvbIIBA?utm_source=social-interviews&utm_medium=TWTR&utm_campaign=TWL%20Tchir%20063020%3Fcid%3DSMTwitter%3ATWLTchir%3A2020-06-30

SPY seems poised to take out yesterday’s high at the open – if that holds, the bulls have the reins back and should try to run it back to the June highs. Seasonality turns positive in July.