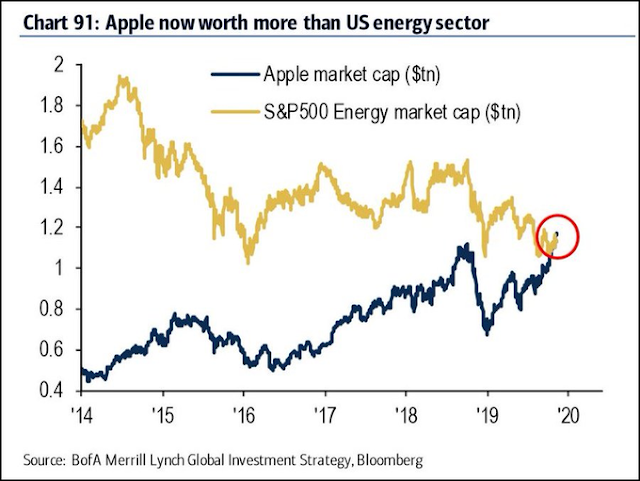

Callum Thomas recently highlighted an observation from BAML that the market cap of Apple (AAPL) is now larger than the entire energy sector.

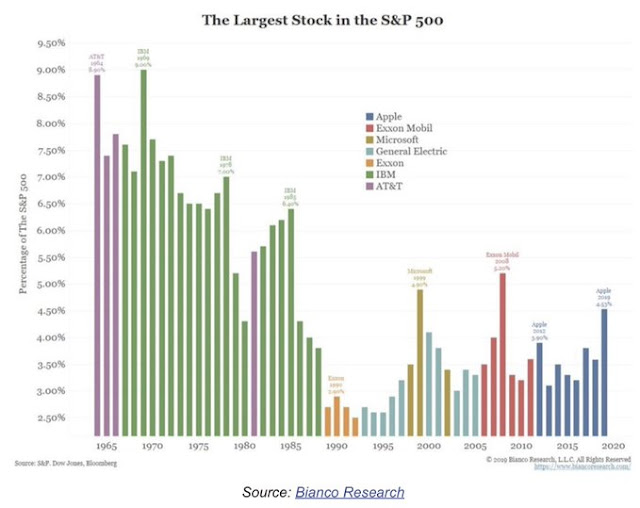

AAPL is now the largest stock in the index, but its weight at 4.5% is not especially extreme in the context of the historical experience. The fact that AAPL’s market cap has eclipsed the aggregate weight of the energy sector is telling.

Is this an inflection point for the energy sector? Do energy stocks represent a value opportunity that should be bought, or a value trap to be avoided?

I would like to propose a long-term bullish factor that has been ignored by the market. This factor has the potential to be the catalyst that digs these stocks out of their pariah status.

The Sun is about to undergo a period of low sunspot activity, which has shown to have a cooling effect on the Earth’s climate. The climate data that emerges over the next decade should show that the effects of human-induced warming to be partially or fully offset by the effects of the solar cycle. Public concerns about climate change, and policy surrounding a global climate emergency, are likely to abate, but that process will take time.

I conclude that while the sector is acquiring a value characteristic, sentiment is not yet a wash-out and price momentum is still a headwind for these stocks. To be sure, there is a long-term bullish catalyst waiting in the wings, but the effects of this catalyst may not be evident for several years. For now, the bull call on energy is only a trade set-up. I am inclined to wait for signs of a technical turn before turning significantly bullish on the sector.

The new tobacco?

In this era of hyper-sensitivity about climate change, energy stocks are being shunned in a way that they are becoming the new tobacco stocks. The topic has grabbed the attention of top policy makers and major investors. Canada’s Financial Post reported that BoE Governor Mark Carney warned financial services companies need to take action to cut CO2 emissions:

Financial services have been too slow to cut investment in fossil fuels, a delay that could lead to a sharp increase in global temperatures, Bank of England Governor Mark Carney said in an interview broadcast on Monday.

His remarks painted a big cross-hair on the energy sector.

Carney cited pension fund analysis that showed the policies of companies pointed to global warming of 3.7 to 3.8 degrees Celsius, compared with the 1.5-degree target outlined in the Paris Agreement on climate change.

“The concern is whether we will spend another decade doing worthy things but not enough… and we will blow through the 1.5C mark very quickly,” Carney said in a radio program guest edited by teenage environmental campaigner Greta Thunberg.

“As a consequence, the climate will stabilize at the much higher level.”

The Economist reported that Jeremy Grantham of GMO echoed Carney’s assessment.

Late last year Jeremy Grantham, an investor routinely described as “legendary”, spoke about esg (environmental, social and governance) investing at a conference in London. His presentation was slick; his accent floated somewhere in the mid-Atlantic (Mr Grantham is English but has lived in America for ages). “I love s and g,” he began. “But e is about survival.”

As a consequence, Grantham is uber-bearish on oil stocks, to the extent that he believes investors need to make the oil industry a pariah.

Is there also a moral case for disinvestment? An argument against is that oil firms are best placed to speed the transition to solar and wind power. They have experience of managing big projects in difficult terrain. And many would say that dumping oil stocks is a pointless salve to the eco-warrior’s conscience. Bill Gates, a software mogul and philanthropist, has argued that people should not waste idealism and energy on a policy that will not cause any reduction in the use of fossil fuels. What matters are incentives set by governments: tax breaks to fund research in green energy; tax rises to discourage carbon use. But this misses the point, says Mr Grantham: “You have to make the oil industry a pariah for bad behaviour.” Only then will politicians feel the need to act.

BlackRock CEO Larry Fink released a letter to CEOs to assert, “Climate change has become a defining factor in companies’ long-term prospects.” It is time for fiduciaries like Blackrock to act.

Over the 40 years of my career in finance, I have witnessed a number of financial crises and challenges – the inflation spikes of the 1970s and early 1980s, the Asian currency crisis in 1997, the dot-com bubble, and the global financial crisis. Even when these episodes lasted for many years, they were all, in the broad scheme of things, short-term in nature. Climate change is different. Even if only a fraction of the projected impacts is realized, this is a much more structural, long-term crisis. Companies, investors, and governments must prepare for a significant reallocation of capital.

While Fink did not come out and say it, his term, “a significant reallocation of capital” is code for divestment to force up the cost of capital of companies that contribute to climate change and global warming. As BlackRock’s assets under management total about $7 trillion, this statement will bound to have a chilling effect on the energy sector.

Cheap enough?

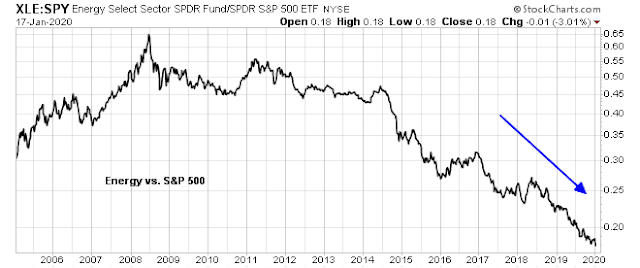

Are energy stocks sufficiently washed out? Investors have been shunning energy stocks for over a decade. The sector has undergone over 10 years of poor relative returns.

Is their valuation cheap enough? FactSet reports that the energy sector trades at a forward P/E ratio of 17.5, which is well below its 5-year average of 29.1 and 10-year average of 20.4. Before anyone writes me to complain that oil and gas stocks trade on cash flow multiples, I would point out that, on a cap weighted basis, the US energy sector is dominated by integrated companies with substantial downstream refining and marketing assets. In such instances, the use of a P/E multiple to value integrated stocks is entirely appropriate.

Moreover, the most liquid energy sector ETF,XLE has a dividend yield of 3.7%, compared to 1.7% for the market, as represented by SPY.

A long-term bullish factor

There is no doubt that energy stocks are cheap, but cheap stocks can become cheaper in the absence of a bullish catalyst, especially if investors perceive them to be in an industry in decline. However, I would like to propose a long-term bullish factor that has been ignored by the market. This factor has the potential to be the catalyst that digs these stocks out of their pariah status.

Cosmic rays.

An important article at Electroverse explains how cosmic rays (CR) and the solar cycle affect the Earth’s climate.

During solar minimums –the low point of the 11-or-so-year solar cycle– the sun’s magnetic field weakens and the outward pressure of the solar wind decreases. This allows more cosmic rays to penetrate the inner solar system as well as our planet’s atmosphere:

The solar cycle has a regular ebb and flood pattern of 11 years. The Sun is about to undergo a period of low sunspot activity. The level of cosmic ray radiation is inversely correlated with the level of sunspot activity, which affect the Earth’s climate.

More crucially however, CRs hitting Earth’s atmosphere have been found to seed clouds (Svensmark et al), and cloud cover plays perhaps the most crucial role in our planet’s short-term climate change.

“Clouds are the Earth’s sunshade,” writes Dr. Roy Spencer, “and if cloud cover changes for any reason, you have global warming — or global cooling.”

The upshot of this current solar minimum (24) –the sun’s deepest of the past 100+ years (NASA)– is a cooling of the planet, with the coming solar cycle (25) forecast by NASA to be “the weakest of the past 200 years“:

In fact, the forecast calls for a prolonged period of low sunspot (high cosmic ray) cycle that is reminiscent of the Maunder Minimum. Studies by NASA have attributed low sunspot activity to be the cause of prolonged cooling periods like the Maunder Minimum, otherwise known as the Little Ice Age of the 17th Century. For some perspective, here is a painting by Hendrick Avercamp entitled “A Scene on the Ice” documenting life in Holland during that period (see link for source).

Subsequent to the Little Ice Age, the Earth experienced another one of the Sun’s extended periods of low sunspot activity called the Dalton Minimum. This particular minimum lasted from about 1795 to the 1820s. The year 1816 was in the middle of the Dalton Minimum period. It is still known to historians as the “year without a summer”, the “poverty year”, or “eighteen hundred and froze to death”. Poor conditions were said to have been caused by a combination of a historic low in solar activity and the Mount Tambora eruption of 1815, which spewed extensive amounts of volcanic ash around the world.

It was a time of ecological disaster. 1816 saw snow in June in the U.S. and Europe. Crops failed and starvation followed, many Europeans spent their summers huddled around the fire. It was during this bleak summer that Mary Shelley was inspired to write Frankenstein and John William Polidori, The Vampyre.

The Electroverse article continued:

Solar cycle 25 is predicted to be a mere stop-off in the suns descent into its next full-blown GRAND solar minimum cycle. (GSM).

NASA has linked GSM episodes to prolonged periods of global cooling, like the Maunder Minimum. or Little Ice Age.

Viewed in this context, Anthropogenic (human caused) Global Warming, or AGW, is a blessing in disguise that offsets the effects of the cooling effects of the solar cycle. The magnitude of the cooling observed during that era dwarves the worst case scenario of climate activists. These offsetting factors would represent good news for the human race for the rest of this century.

Investment implications

What does this mean for investors?

NASA’s models for the current solar cycle, which lasts 11 years, calls for the Earth to undergo a cooling period from rising cosmic ray radiation. The models calling for a Grand Solar Minimum cycle are more speculative.

Nevertheless, the climate data that emerges over the next decade should show that the effects of AGW to be partially or fully offset by the effects of solar cycle 25. Public concerns about climate change, and policy surrounding a global climate emergency, is likely to abate, but that process will take time.

While this development is bullish for energy stocks (and agricultural commodities) in the long run, it does nothing for the energy sector over the next one or two years. The effects of the solar cycle represents only a trade setup, and not a full-blown buy signal. While political pressures are rising for solutions to climate change and global warming, the market reaction to these pressures is only beginning. As an example, CNBC reported that Microsoft aims to become carbon neutral by 2030, and eliminate its historical carbon footprint by 2050. Amazon has pledge to be “net carbon neutral” by 2040. These calls to action are reminiscent of the atmosphere during the dot-com era of the late 1990’s, when even mining companies would not dare to present to investors without a “broadband strategy”.

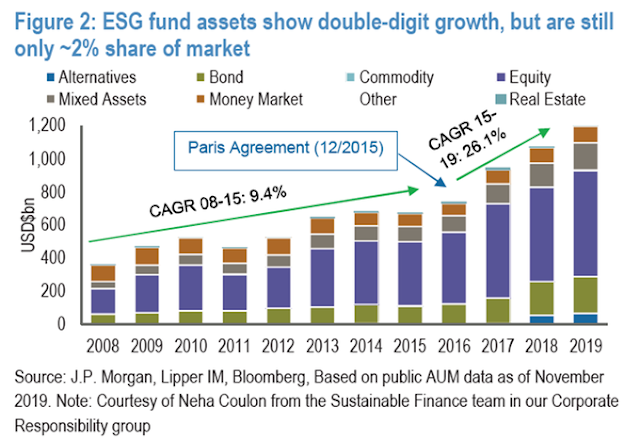

ESG investing is still a nascent theme. At only 2% of the market, it has much more room to expand, especially in light of Larry Fink’s call to action.

Looking over the next 12-24 months, the BAML Global Fund Manager Survey shows that while managers are underweight the sector, they have not been in such a prolonged underweight position that these stocks are hated. We have not seen the classic signs of investor capitulation and wash-out yet.

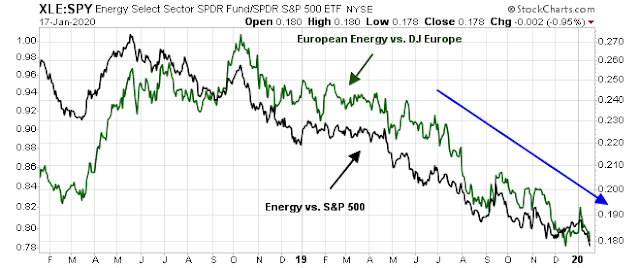

From a trader’s perspective, both US and European energy stocks remain in relative downtrends, punctuated by a brief spike owing to Iranian tensions. Until the relative downtrend shows some signs that it is ending, an underweight position remains tactically warranted.

I began this article with the rhetorical question of whether energy stocks represent a value opportunity, or a value trap. While the sector is acquiring a value characteristic, sentiment is not yet washed-out, and price momentum is still a headwind for these stocks. To be sure, there is a long-term bullish catalyst waiting in the wings, but the effects of this catalyst may not be evident for several years. For now, the bull call on energy is only a trade setup. I am inclined to wait for signs of a technical turn before turning significantly bullish on the sector.

Cam: Great write-up. Not what I signed-up for but made the entire subscription worth it. Let us know when you flip the switch.

Thank you. I try to give you some out-of-the-box thinking once in a while.

Cam, your commentary on climate cycles is in alignment with my own research. There are major natural climate cycles which simply are not being discussed, and their patterns would indicate we have entered a global cooling cycle – which implies an increasing demand for energy and challenges in maintaining crop yields. So politically incorrect to discuss, kudos to you for doing so despite the risk of being tarred and feathered for daring to challenge the consensus.

PS, the sunspot cycle/cosmic ray count you discuss is also linked to increased volcanic activity. Increase volcanic activity may be another contributing factor to the temperature cycle. I can send over some papers if it is of interest to you.

Hi Cam,

Thank you for including the likelyhood of an extended Solar quiet period and the resulting cosmic ray increase resulting in cloud formation in your newsletter. The Global Warming scam is one of my pet peeves.

Another worrisome fact that will affect our climate are the earth’s wobbles and rotational cycles. These vary our path through the sky every 20,000 to 1000,000 years. These are thought to be the cause of earth ice ages. Unfortunately we are on the cold swing of at least one of these cycles.

Another thing I should mention is that C02 has a very minor effect on our climate. It is almost negligible at present trace gas level. Without writing a long book here about why we can ignore C02 in climate change here is a quote from a respected MIT Environmental Scientist,

The influence of mankind on climate is trivially true and numerically insignificant.

~ Richard Lindzen

God, I am ready to explode!

Our problem is disregard for the environment, not CO2!

CO2 is recycled by the environment, NASA has photos from 50 years ago showing that the borderline ecosystems are greener now.

Maunder minimums happen, and we don’t really know if we are causing global warming or not. 20,000 years ago New York city was under a mile of ice that melted…wasn’t us. There have been posts about an incoming Maunder Minimum due around 2030 or so for many years, so we will probably get one. Nice charts Cam!

Is environmental degradation, mass extinction of species important? Duh, yes.

But CO2 levels have been falling for eons and will continue to fall, and one day the planet dies. In the short run the CO2 we have pumped in the air has changed the ph of seawater and this is bad for many species…nature is resilient…if given enough time organisms would adapt…our society of course might collapse. Anyways, long ago the atmosphere was around 10% CO2, before the limestone, you know, cliffs of dover, limestone all over the place, I don’t know how many cubic miles of limestone exist, but it is calcium carbonate from micro-organisms…mini mollusks. So all the clams, snails, oysters etc make shells out of calcium and CO2, calcium carbonate and the carbon dioxide gets sequestered in stone, and they won’t stop….so at some point in the distant future there will not be enough CO2 for plant life as we know it. At present, yes decreasing CO2 is a good idea, but if we continue doing all the other environmentally bad things, it is moot.

Now to get to what makes me want to explode. So they want us to stop funding the energy companies, but they don’t want nuclear, but lets ignore the carbon footprint of making lithium batteries or the charging of them. So what happens to the price of fuel? Oh we don’t drive as much because we can’t afford it, the politicians will still get to travel and those who are wealthy enough. Maybe since the agricultural industry uses so much fuel we should stop growing food. Gates is right. Make incentives for entrepreneurs (not government toadies) to discover greener industries and processes, but wanting to stifle oil development is stupid, let the market do it when people are using less. The irony is that unless we perfect nuclear fission (I don’t know enough about thorium reactors) we will one day have a true shortage of oil and these same people will say we have a critical shortage…go figure

Are there any examples of the governments interfering in the market place that turned out well?

Don’t drive a gas guzzler, try and minimize your carbon footprint and your environmental footprint, but what the politicians are saying is BS.

Energy is in a bear market and unless this time is different will one day enter a bull market, but maybe not for years. One thing the politicians can’t do is push the price of oil globally to a negative number, so the bear in oil has to end some day.

Ok, done with my rant

Cam, try doing a google search on “Electroverse”

Please note that I have said nothing about AGW, or human caused global warming. I am only pointing out that the solar cycle is another factor we need to consider in climate change.

The two issues are not mutually exclusive.

If you are willing to accept NASA’s data as a source of global warming activity, then you should also accept their research in solar activity as well.

LOL. It’s tough delving into even the fringes of that topic without some of us old farts feeling like we need to express our 2 cents.

Humble student of cosmic rays…

https://climate.nasa.gov/blog/2893/nope-earth-isnt-cooling/

Please check the above article from NASA. Yes, there may be a cooling trend in the near term, however, longer term, the earth is getting increasingly hotter. See animated graph # 1.

Interesting piece of intellectual pursuit today from Cam. Enjoy inputs from all fellow subscribers here. In the grand scheme of things it doesn’t matter in any way. The Sun will eventually become a red giant and in the process destroy the three plants closest to it. Unfortunately the earth is among the closest three. Then the sun becomes a white dwarf and sheds its outer layer. And the original earth becomes star dust. Remember that we are formed by the star dust? Like we saw in movies in which the preachers always say “Dust to dust, earth to earth” during funeral burials?

I was excited about this post, then I checked the linked article, and was then underwhelmed. It is difficult to see an investment case which would be based on the opinions of renegades. NASA does not seem to be predicting that Global Warming will be mitigated by less sunspots etc to any crucial degree.

By the way, the New Ice Age thing is old, and comes up every few years or so.

Regardless of anyone’s opinion on the course of global warming, the investment case remains the same. The energy sector is going to be shunned for the foreseeable future.

As this solar cycle is just beginning, we will start to see the data in the next 5 years. If there is indeed a cooling effect, there will be great debate about the data, in the manner of how temperatures flattened out for close to a decade before resuming their rise.

Bottom line: This is not an actionable investment story. Stay bearish on the sector until the data/opinion changes, but that could be another decade.

Don’t get political in your investing. We will find out whether I am right or wrong in about 10 years.

In that case, what are you getting so excited about?

Excited: not as an investor, but as a concerned citizen. I thought it was wonderful that the clock might stop ticking for a few decades. Technological solutions to GW are on the horizon, but need time.

Thanks Cam.

Enjoyed reading the write-up and all the comments.