Mid-week market update: It is said that there is nothing more bullish a stock or an index can do other than to make new highs. Both the DJIA and the SPX made fresh all-time highs today. While that may appear to be bullish, there are plenty of warning signs beneath the surface that this advance may not be entirely sustainable.

One of the missing ingredients in this rally is momentum. The SPX is exhibiting a negative 5-day RSI divergence, indicating flagging momentum even as the index made new highs. In addition, the VIX Index fell below its lower Bollinger Band, indicating an extremely overbought condition.

Other divergences

Another warning sign can be seen in the risk appetite in the credit markets. Even as stock prices made new highs, the relative price performance of high yield (junk) bonds did not confirm the advance.

Sentiment flashes warnings

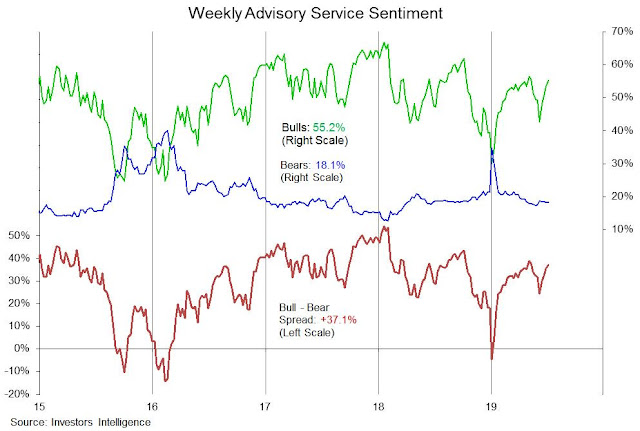

Sentiment models are becoming excessively bullish. The latest II sentiment readings show that % bulls have recovered. This is not an outright sell signal, but some caution is warranted.

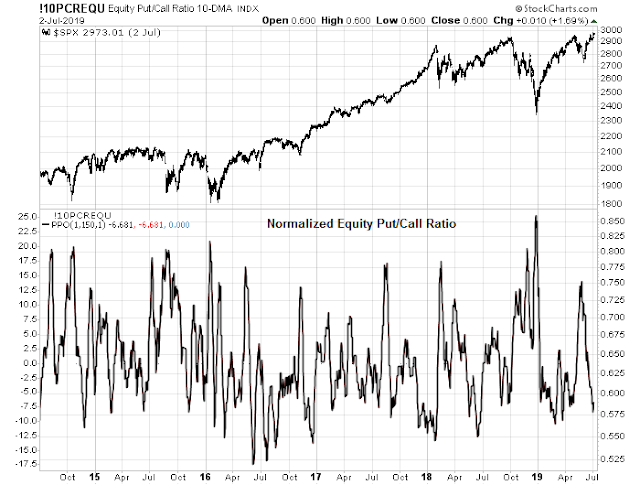

Our normalized equity put/call ratio is also at or in the complacency zone, which is contrarian bearish.

Where’s the breadth thrust?

The analysis of the top five sectors of the market reveals lackluster leadership. Since these sectors make up nearly 70% of index weight, the market cannot advance in a sustainable fashion without signs of strong leadership from a majority of these sectors.

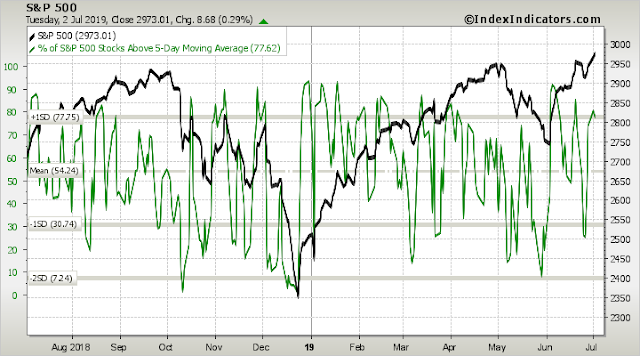

In the meantime, short-term breadth is already at overbought levels as of Tuesday night’s close, and readings will be even more extended based on Wednesday’s rally.

The combination of all these factors argue for a short-term stall. My inner trader entered into a small short position on Monday, and he may add to that position should the market strengthen further.

Disclosure: Long SPXU