I just want to publish a quick note. Panic is in the air.

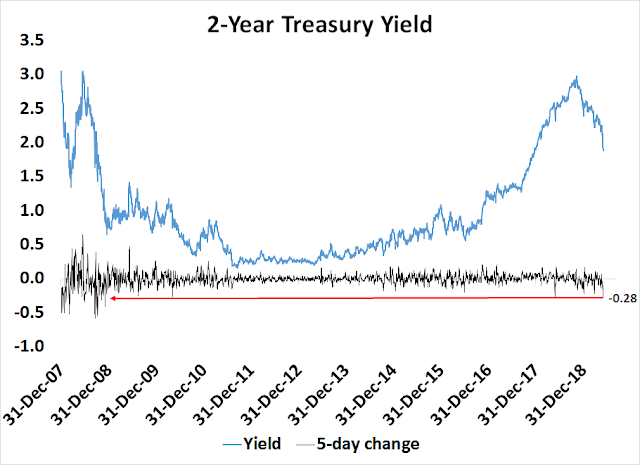

Investors are piling into the safe haven of USTs. The 5-day plunge in 2-year Treasury yield has not been exceeded since the stock market bottom of 2008.

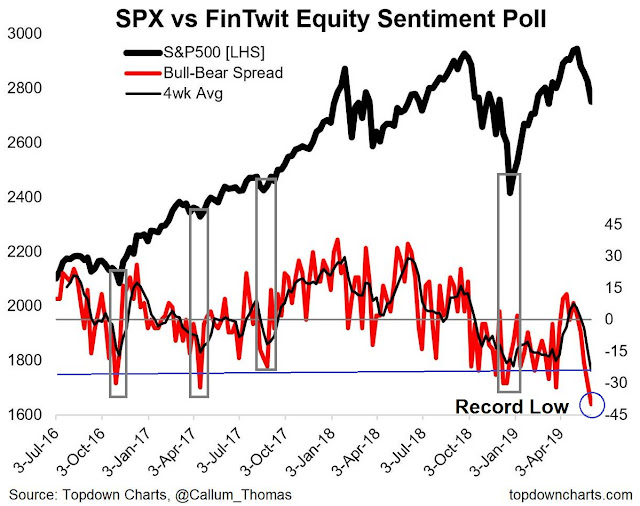

Callum Thomas` weekly (unscientific) Twitter poll is in record net bear territory. Not only that, the 4-week moving average is also at a record low. Past short-term stock market bottoms have coincided with either the weekly low, or the 4-week average low. Take your pick.

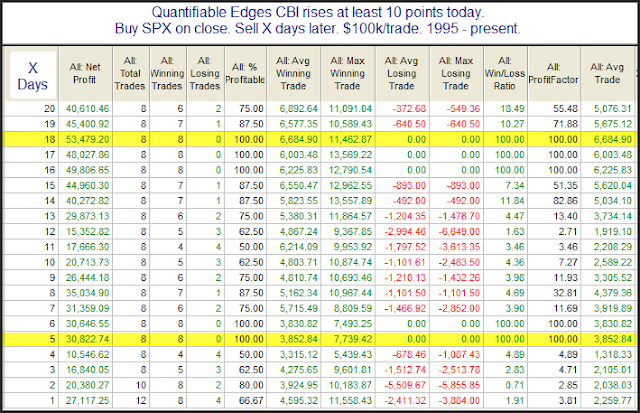

Lastly, Rob Hanna at Quantifiable Edges observed that his Capitulative Bottom Index (CBI) spiked 10 points on Friday. Absolute readings of 10 or more have been buy signals, so a 10 point CBI spike is nothing short of astounding.

The Quantifiable Edges CBI has spiked over the last few days. After closing at a basically neutral “4” on Wednesday, it rose to 6 on Thursday, and then posted an extra-large jump higher to 16 on Friday. In the CBI Research Paper I showed that a CBI total of 10 or more has generally been a bullish sign. But Friday saw the CBI rise by 10 points on just that day. That is a very strong 1-day change.

He added a caveat that today may not necessarily be the bottom:

It appears the bounces have typically been strong, but they have not always been immediate. 2002, 2008, and 2015 all show some additional scary selling before the big reversal arrived. The CBI is suggesting a strong chance of a sizable bounce at some point this week. It may or may not begin on Monday.

Do you want to be contrarian?

Disclosure: Long SPXL, TQQQ