Mid-week market update: In my last post, I suggested that the stock market is headed for a corrective period, though a short-term bounce was possible this week because of its oversold condition (see Correction ahead: Momentum is dying). The market has staged a remarkable recovery this week by surging to test a key resistance level and readings are now overbought.

The key question then becomes, “Is the correction thesis dead?”

A review of momentum

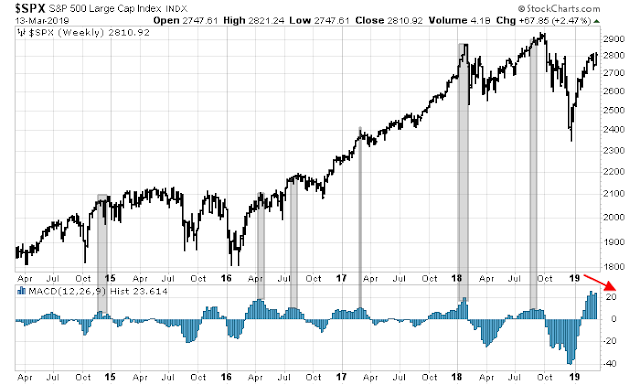

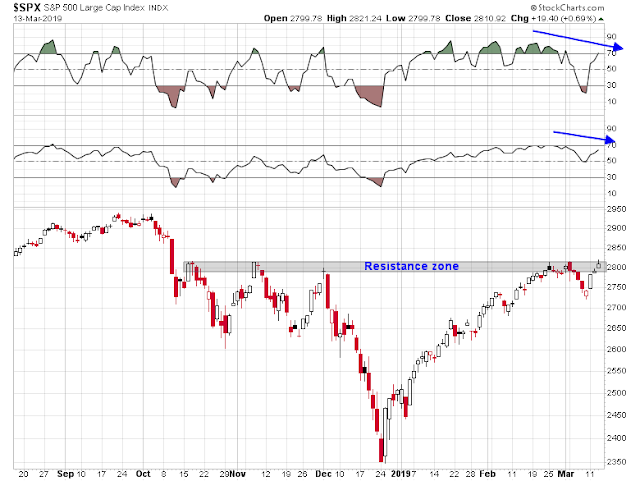

The correction call was based on the observation that price momentum was rolling over. In particular, I focused on the narrowing MACD histogram as a sign of weakening momentum. Let us review how MACD has behaved since the relief rally this week. Here is the weekly S&P 500. Past episodes of weakening momentum has seen either the market correct, or consolidate sideways.

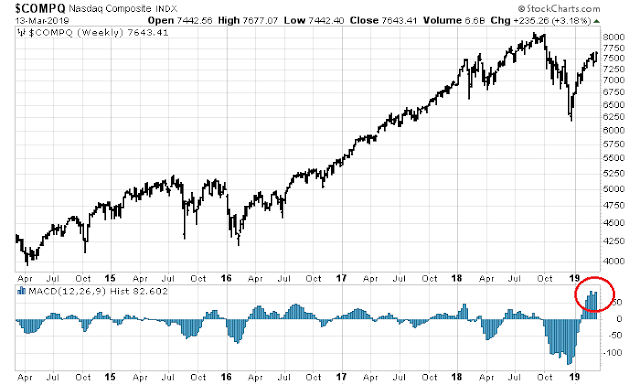

Here is the NASDAQ Composite, which is the one bright spot in the market.

The small cap Russell 2000 continues to see waning momentum.

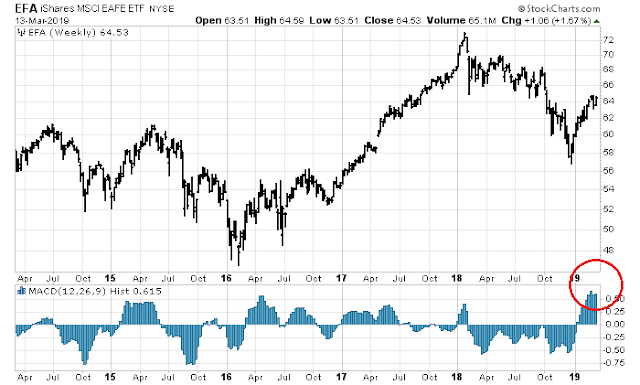

Outside the US, developed market equities, as measured by EAFE, is also exhibiting a similar pattern of weakening momentum despite the price recovery this week.

Emerging market stocks led global markets with a MACD roll over.

Bottom line: With the except of the NASDAQ, weekly momentum remains weak across the board.

Other momentum factors

What about the price momentum factor. There are two ways of measuring price momentum using ETFs. The MTUM is a pure price momentum ETF, while FFTY mimics the IBD 50 based on a combination of price and fundamental momentum. The relative performance of both ETFs had been highly correlated until last fall, but there are few signs of a strong momentum rebound.

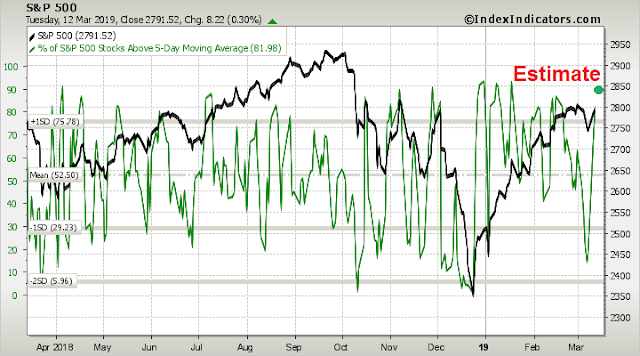

In addition, the market rebound has moved short-term breadth from an oversold to an overbought condition.

Moreover, the daily S&P 500 chart shows negative RSI divergences on the 5 and 14 day RSI.

At a minimum, I would not want to be buying a market that is testing resistance while overbought and exhibiting negative breadth divergences. Overbought markets can become more overbought, but it pays to be cautious when breadth readings have become so extreme so quickly.

Disclosure: Long SPXU