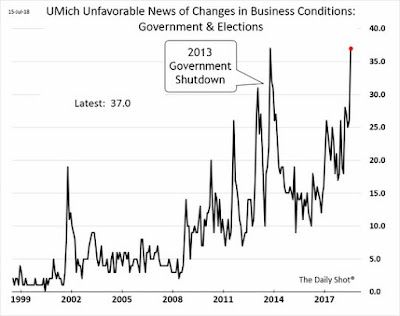

Understandably, there has been a lot of market angst over a looming trade war. Indeed, the University of Michigan Business Confidence Index shows a rising level of anxiety.

How worried should you be?

Measuring the Trump effect

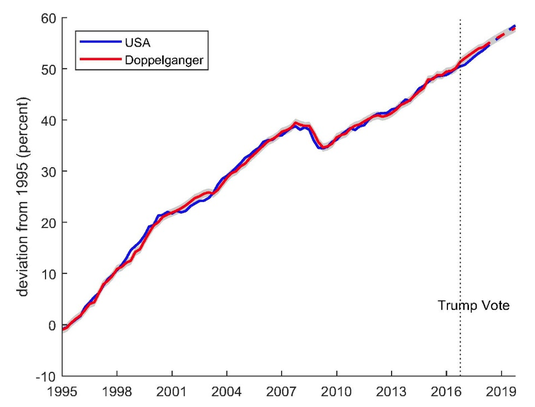

I approach the question in a number of ways. First, let’s measure the Trump effect on the economy. An article over at VOX used a technique called “synthetic control method” that is frequently used to estimate the effects one-time shocks, such as German re-unification or Brexit. They found that Trump had little or no net effect on economic growth or employment:

Our approach is to let the data speak for itself. We let an algorithm determine which combination of other economies matches the evolution of real GDP in the US beforethe 2016 election with the highest possible accuracy. For this purpose we rely on a large data set of 30 other OECD economies and observations from 1995Q1 up to 2016Q3. Assuming we find a good match, we can then compare the evolution of the US economy since the election of Trump to its doppelganger that did not get the ‘treatment’ of electing Trump.

This so-called synthetic control method goes back to Abadie and Gardeazabal (2003) and has been successfully applied to study the effects of similar one-off events such as German reunification, or the introduction of tobacco laws in the US (Abadie et al. 2010, 2015). We also use it in a recent study that identifies the economic costs of the Brexit vote (Born et al. 2018b).

It is important to stress that the economies picked by the algorithm and the weight they are assigned is entirely data-driven and open to replication by other researchers. The better the algorithm constructs a close economic doppelganger for the US economy as a weighted combination of other OECD economies, the more accurate our results will be. For the US, the matching algorithm attributes high weights to Canada and the UK, but also to Denmark and Norway (for details, see Born et al. 2018a).

Trade war anxiety

One of Trump’s signature policies has been to hold trade partners’ feet to the fire in order to obtain what he perceives as a better trading relationship. As the market has a disposition to free trade, these trade initiatives have been viewed as equity bearish.

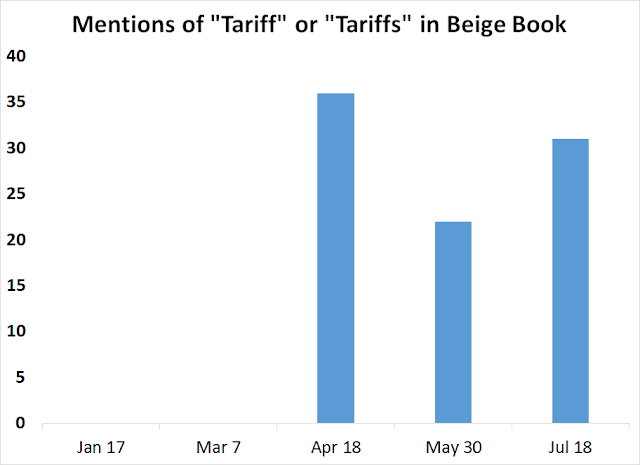

The chart below shows the incidence of the word “tariff” or “tariffs” in the Fed’s Beige Books in 2018. While the level of anxiety has risen since the April Beige Book, a simple frequency count indicates that concerns have stabilized and began to taper off.

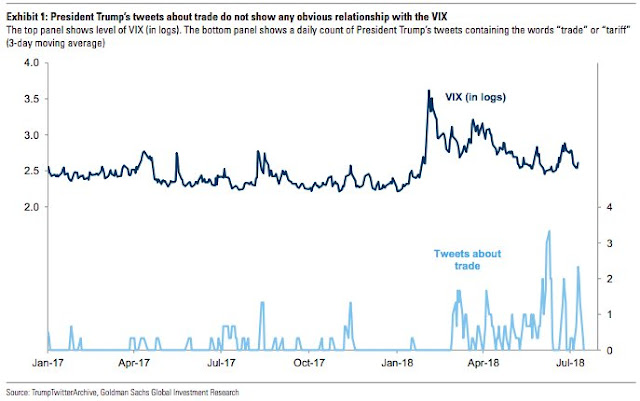

Goldman Sachs also found the frequency of Trump’s tweets on trade bear little relationship to the VIX Index.

These last two charts constitute a Rorschbach test on the market’s reaction to trade policy. Is the market telling us that Trump’s bark is worse than his bite when it comes to trade policy, or is it under-reacting?

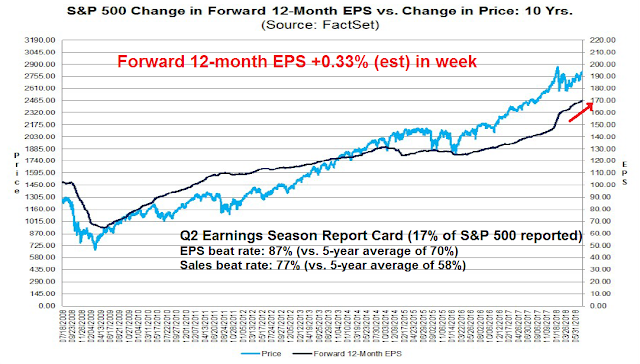

If you are in the former camp that the message from Mr. Market is correct, then you should be shrugging off the trade jitters and jump on the fundamental momentum bandwagon. As earnings season progresses, stock prices are likely to undergo a FOMO (Fear of Missing Out) rally.

On the other hand, if you take Kevin Muir’s position and Trump will increasingly press his trade policy views as we approach the mid-term elections, then you should either sell everything or possibly short the market.

It’s your call.

Midterm elections are on 6th November. The trade spat with China must be dialed down or resolved well in time before 6th November. Let us see if China blinks or not. It is an issue of strategy when it comes to stock markets. If earnings come out as strong as they have so far, and the US$ sells off (see today, Yen strengthened against the $), FOMO may be round the corner.

Cam–for once you seem to have no opinion. If you agree with Muir that Trump will dial back nothing–he is full ballistic mode now–then you surely have a view as to when this will become part of the market. Bob Millman

The objective of this site is to teach you how to fish. I’ve laid out the pros and cons of each case. What do you think?