I had a number of questions and comments from my last post (see Wall Street: Where the Wild Things are) when I wrote that my trading account, while still bullish, had taken “partial profits earlier this week as part of his risk control discipline when readings became short-term overbought”. The comments ranged from “where can I find a record of where your decisions to take partial profits” (answer: you can’t) to “why did you not tell us when you made that trade?”/

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

What does this mean, beyond the usual legalese? Why is the content “not investment advice”?

What many investors don’t realize that the process of constructing a portfolio involves three major decisions:

- What do you buy and sell?

- How much do you buy and sell?

- How do you diversify your investments?

Much of the content on this site revolves around question 1. I know nothing about you. I don’t know what your return objectives are. I don’t know your tax situation, or even your tax jurisdiction. I don’t even know how much risk you can tolerate. With respect to the first question, I therefore don’t know if any investment or instrument discussed is appropriate for you. Since I know nothing about you, I would not even try to answer the last two questions.

That’s why nothing on this site is investment advice.

If I was your fund manager, we would have discussed your investment situation, and I would know enough about you to create an Investment Policy Statement (IPS). We don’t have that kind of relationship.

That’s why nothing on this site is investment advice.

If I were the manager of a fund that you bought into, there would be disclosure documents about the sorts of investment instruments that the fund can buy, and the risk levels that the fund is expected to undertake. We don’t have that kind of relationship either.

That’s why nothing on this site is investment advice.

Disclosure of conflict

At the same time, I write about my investment views on the site, and I will express bullish or bearish opinions on the market, sectors, or specific instruments. I believed that it was appropriate to disclose any possible conflicts that I may have because of my own investment positions.

That’s where the “trading alerts” come in.

Whenever I initiate a new trading position, subscribers get an email alert of those changes for conflict disclosure purposes. However, subscribers will not receive notification of changes in position sizing because any conflict has already been disclosed.

Here is the part that created the misunderstanding. I know nothing about you. I don’t know if my trading positions are appropriate for you. My tax situation is not your tax situation. My pain threshold is different from your pain threshold. In the absence of any such discussions, changes in my own position sizing is not necessarily relevant to your situation, and therefore it would be misleading for me to disclose those trades.

Not a chat room

There are a number of other websites that offer real-time chat room services. This is not one of them. There are a number of key differences between Humble Student of the Markets and a chat room.

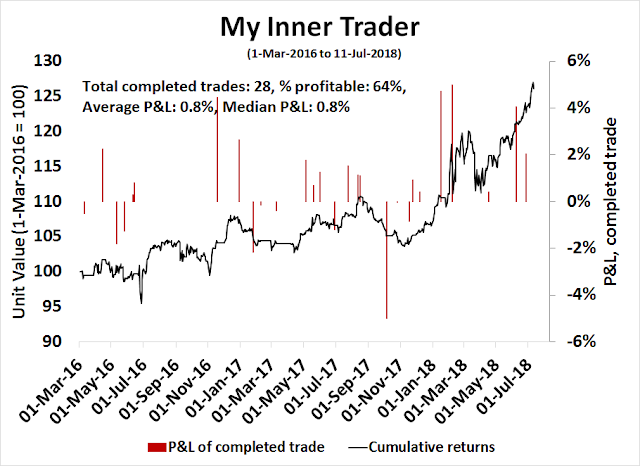

First, the holding time horizon of “my inner trader”, which represents my trading account, is longer than most chat room day trading or swing trading services. I publish and update the idealized track record returns of my inner trader on a weekly basis based on trades using signals from the subscriber trader alerts. The average holding period is 18.0 trading days.

I disclose the track record of “my inner trader”, which is contrary to the practice of many other trading services.

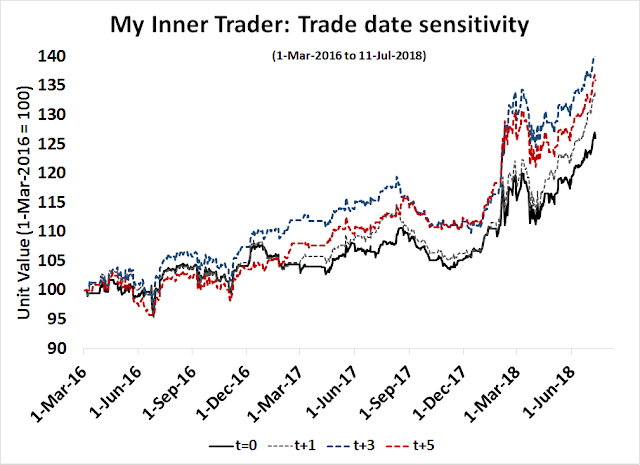

As the average holding period of these trades is relative long, there is little urgency to making the trades on the day of the signal. In fact, my analysis shows that the returns from waiting 1, 3, and 5 days after the signal are better than the base case where the trades are executed on the day of the signal.

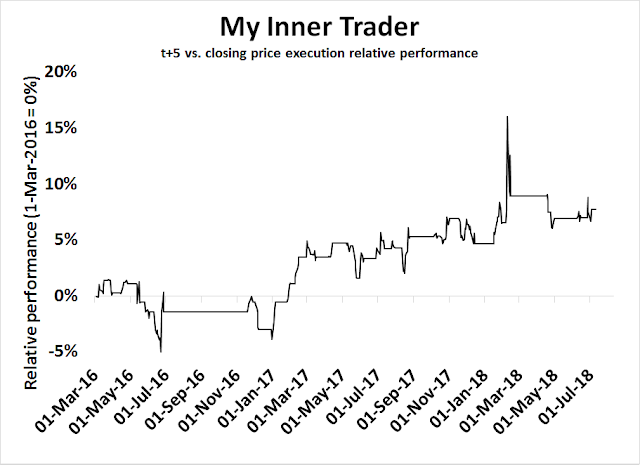

For another perspective, here are the relative returns of a hypothetical account that traded five days after the signal day. My conclusion from this analysis indicates that my trade timing isn’t perfect, and it is arguably early.

One last point about chat rooms. The going rate for a chat room subscription, where you get access to real-time signals, is about USD 200 per month, or over USD 2000 per year. That pricing structure is an order of magnitude higher from Humble Student of the Markets (see our pricing page).

In conclusion, readers who are looking for high frequency trading advice should look elsewhere (one useful site to take a look at is LaDuc Trading, where Samantha LaDuc takes the bold step of actually disclosing her trading record). At Humble Student of the Markets, my primary objective is to write about investments. A secondary objective is trading, but even then, the time horizon of my trades is longer than many day and swing trading services.

6 thoughts on “Don’t mistake this site for a chat room”

Comments are closed.

Hi Cam, I rely on your models to tell me if you’re bullish, neutral, or bearish..I then have my own parameters for what to buy/sell, how much, and when..I very much appreciate you sending email notifications when your models change..

“The latest signals of each model are as follows:

Ultimate market timing model: Buy equities

Trend Model signal: Bullish”

Trading model: Bullish”

Please keep up your good work!

Jim

Hi Cam, I appreciate your good work and insights into the market. I guess you are the E. F. Hutton for a lot of us, when you speak we listen.

Thank you for the kind words, but oh my, you’re dating yourself. (I remember those commercials too).

I admire Cam’s writing style of intellectual pursuit. My investment style follows Jesse Livermore’s “Be right and sit tight” in order to maximize profits. To do so requires lots of reading and planning. Cam helps tremendously.

Cam, your work provides excellent perspective, along with numerous other sources I regularly monitor. I appreciate your bull/bear case presentations enormously. I don’t always agree with you, but love the reasoned thinking. Thanks for providing us access to your thinking, and your trading insights. You cover a lot of territory, and frankly, that saves me some time. Sorry you had to make the “this is not investment advice” disclosure. We’re all grown ups here and should know better.

Hi Cam, please keep up the great work. I enjoy reading your insights and I find your analysis to be systematic and logical and covers a lot of different data points. An equalizer for the common folks. Thanks!!