This is one in an occasional series of articles highlighting the hidden investing factor exposures, starting with small cap stocks. Small caps have been on an absolute tear lately, both on an absolute basis and relative to large caps.

Does that mean you should jump on the small cap momentum train?

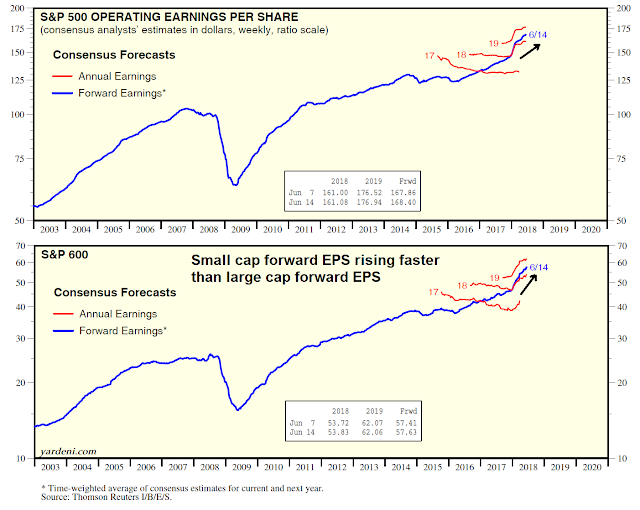

Momentum is evident even from a fundamental viewpoint. Analysis from Yardeni Research reveals that small cap earnings estimates have been rising faster than large caps, even after the tax cut earnings surge. If you squint, you will see that the slope of small cap EPS revisions is steeper than large cap revisions.

Hidden USD factor exposure

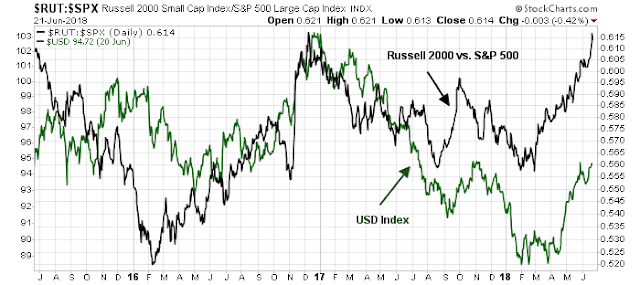

However, small cap outperformance can be partly explained by their USD exposure. The correlation between the size factor and the USD is evident in the chart below.

While correlation isn’t causation, there are valid fundamental reasons for this relationship. Large cap companies tend to be more global in nature, and therefore more sensitive to fluctuations in exchange rates. A rising USD hurts large cap earnings, but domestically oriented small caps earnings improve on a relative basis.

From a technical perspective, some caution is warranted on the USD. The USD Index is currently testing a key resistance level, while exhibiting a negative RSI divergence.

Under such bearish USD circumstances, investors are cautioned to give some second thought to the continued outperformance of small cap stocks.

Great deep dive into small cap factor. Thanks

Cam

Rally in the $ may be due to QT and/or rise in US treasury rates. If the $ rally dissipates here (see graph above), would it imply ten year treasury to rally causing yields to fall?