Mid-week market update: On Monday, the major market averages successfully tested their 50 day moving averages (dma) and bounced. Does this mean that the correction is over?

Not so fast. There are several indications that the market still has unresolved business on the downside for Monday’s test to be a durable bottom. First of all the SPX remains in a short-term downtrend, and the breach of that downtrend line is the first test of this rally.

Unfinished business

The first clue of unfinished business comes from the CNN Money Fear and Greed Index. The Fear and Greed Index has not fallen to levels where it bottomed in the past three years. While every bottom is different, these readings suggest that the market needs a final flush, or panic, before calling an intermediate term bottom.

As well, other measures of short-term market breadth are not behaving well. This chart of Twitter breadth from Trade Followers shows that bullish breadth remains in a downtrend. Where is the positive divergence? Market bottoms normally don’t look like this.

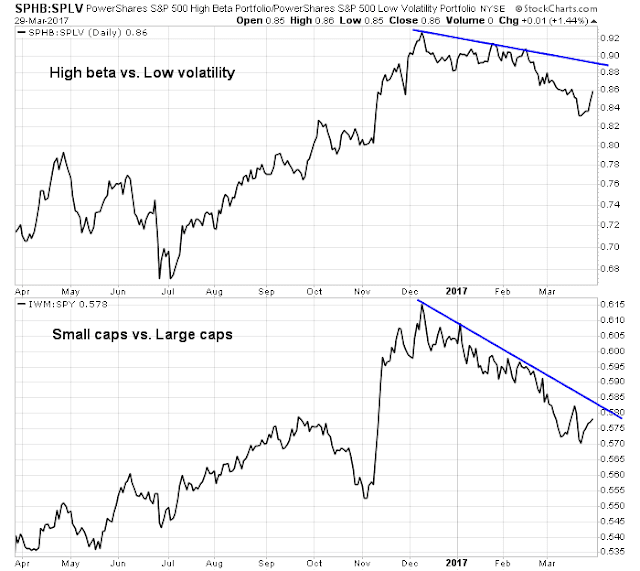

My internal metrics of risk appetite have improved, but they remain in downtrends.

Finally, on a very short-term basis, this measure of market breadth from Index Indicators nearing overbought territory. How much upside is left?

In conclusion, intermediate term indicator are not consistent with readings seen at the bottom of a correction. Short-term indicators are near overbought. While overbought markets can get more overbought, the risk-reward ratio is tilted in favor of the bears. In all likelihood, the final bottom to this correction has not been seen yet.

Disclosure: Long SPXU, TZA

Thanks, Cam:

I reeled in my fish early this afternoon.

Any comment on this analysis? She divides financial history into 3 periods of globalization and sees a lack of returns from stocks (she doesn’t say this here but I’ve read her before) for the next decade. She is generally very conservative-bearish and has said 1% – 2% per year is all investors can safely look forward to.

I can’t really speak to her thesis on the retreat of free trade, as the details in the article are rather thin. However, I would agree that we are in a low return environment.

Notwithstanding any headwinds from falling global trade, consider the following:

1) 10-year UST yield 2.4%

2) By the book, equity risk premium is 5-6%

So a 50/50 mix will give you an expected return around 5%.

If you were to add in any headwinds, such as fees, lower equity risk premium due to overvaluation, falling global trade, etc., your expected return falls even further.

From an asset allocation perspective, there is nowhere to hide. This is a low return environment. If you take too much risk, you are more or less guaranteed to get hurt.

Here’s the link. https://jugglingdynamite.com/2017/03/30/globalization-now-in-third-secular-retreat-since-late-1800/

Here is the latest from Robert Shiller: https://nyti.ms/2nEbISr

It would be interesting to get your take. I do not see his analysis providing much in the way of advice except to be cautious.

Remember Shiller’s comment about PE10 being predictive of 10-year returns, but says nothing about 1-year returns.