A long time reader sent me this Seeking Alpha article entitled “Monish Pabrai Has Created An Index Fund Built To Outperform”, which described a “passive index fund” built using the following three investment themes deployed in three portfolio buckets:

- Share buybacks: Companies that are buying back their own shares

- Selected value manager holdings: The holdings of 22 selected value managers, based on their 13F filings

- Spin-offs: Companies that were recently spun off from their parent

It’s difficult to have a detailed opinion on the pros and cons of this fund. That’s because the article only described what this “index fund” would hold, it did not describe the portfolio construction method, or how much of each stock it would hold. So it`s impossible to understand the risk profile of the fund, the size of its factor exposures, as well as its sector and industry exposures.

All the marketing hype aside, this investing approach is really a re-packaged form of factor investing, otherwise known as “smart beta”. Therefore investors who buy into such a vehicle should expect similar kinds of results as “smart beta”, though in a multi-factor format.

1980’s technology

The approach outlined in the “index fund” is nothing new. I remember deploying similar kinds of investment themes in institutional equity portfolios as a bottom-up equity quant back in the 1980’s and 1990’s. This was later re-packaged as “smart beta”.

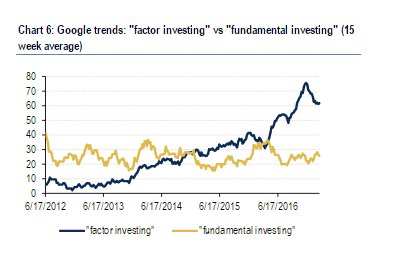

Certainly, smart beta factor investing is becoming more and more popular, Just look at the Google searches (via BAML).

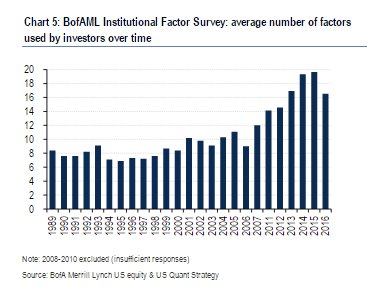

The number of factors in multi-factor models have grown, as quantitative managers have embraced greater complexity.

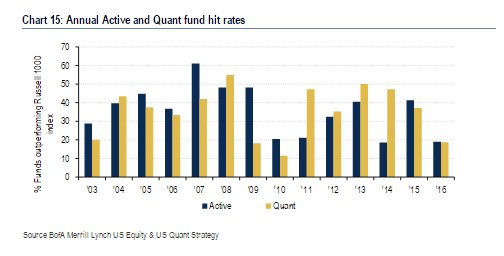

On the other hand, it isn’t clear at all that quant managers have outperformed traditional active managers.

I see a crowded trade here. Everyone is looking at the same data. Everyone is using the same databases. Equity quant funds briefly blew up in August 2007 (see Are Quants the victims of their own success?).

When these factors become well known and overly exploited, they don’t fail. Rather, they go through an up-and-down cycle, much like the value/growth cycle. If the factor possesses a valid investment thesis, then patient investors who are willing to look through the cycle should experience superior returns. In the short term, however, consider Michael Batnick’s description of the ups and downs of the “low volatility” strategy:

And investors did what they have been doing since the beginning of time. In the first chart, when low-vol was doing well, $1,354,750,000 poured in, and then when the tide came out, so did investors, pulling out $1,737,700,000, around 20% of total assets.

Factors for all seasons?

The genesis of factor investing came from the early “anomalies research” of finance academics. Back in the 1970’s there was a big debate over the Efficient Market Hypothesis (EMH). The prevailing thinking at the time was you couldn’t beat the market. All the information that is known about a stock is already known to the market, so how could anyone gain an advantage?

Then came a whole slew of “anomalies” literature. Academics found that you could construct a well diversified portfolio of companies with low price to book ratio, high dividend yield, small caps, and so on, and each of these portfolios would beat the market. That became known as the value anomaly, the small cap anomaly, etc. EMH defenders replied that these studies were flawed, because risk was mis-specified in the studies.

It didn’t matter. Eventually finance professionals picked up on academic research, and quantitative investing was born.

Back in those days, investment professionals naively thought that the alpha from these anomalies would last forever, but they didn’t. Value worked very well, until it got overly exploited. The market then went through a series of value-growth cycles where each style became dominant.

The same thing happened with other factors. Price momentum worked, but only in bull markets. In bear markets, the market would gouge your eyes out if you bought price momentum (see The Trend is Our Friend: Risk Parity, Momentum and Trend Following in Global Asset Allocation).

There are no factors for all seasons! That’s the simple lesson for equity quants. However, intelligent quants who are market savvy can still exploit factor anomalies by combining bottom-up factor based stock picking techniques with an assessment of the macro-economic conditions and economic cycle.

The CFA Institute recently published a book entitled Factor Investing and Asset Allocation: A Business Cycle Perspective that is required reading for anyone interesting in this topic. While the book advocates factor rotation, or picking factors, the process is more art than science. There is no magic bullet, but factor rotation can yield alpha if properly implemented.

Incidentally, my own Ultimate Market Timing Model is an implementation of that investment philosophy. The essence of my model is to stay long equities and try to sidestep recessions, which are bull market killers. Once the macro models start to see a recession on the horizon, use the trend following models from technical analysis to time entry and exit points.

Great piece Cam.

Love it.

Very interesting. Thanks.

Interesting analysis, in particular because of the reference to Taylor rule.