I was reviewing RRG charts on the weekend (click here for a primer on RRG charting) using different dimensions to slice and dice the market. When I analyzed the regional and country leadership, I was surprised to see that the dominant leadership were all China related (note that these ETFs are all denominated in USD, which accounts for currency effects).

From a global and inter-market perspective, this is bullish for the global reflation trade.

Strength from “Greater China”

Indeed, the stock markets of China and of her major trading partners, which I will call “Greater China”, have all been performing well. All are holding above their 50 day moving averages (dma) and several have rallied to new highs.

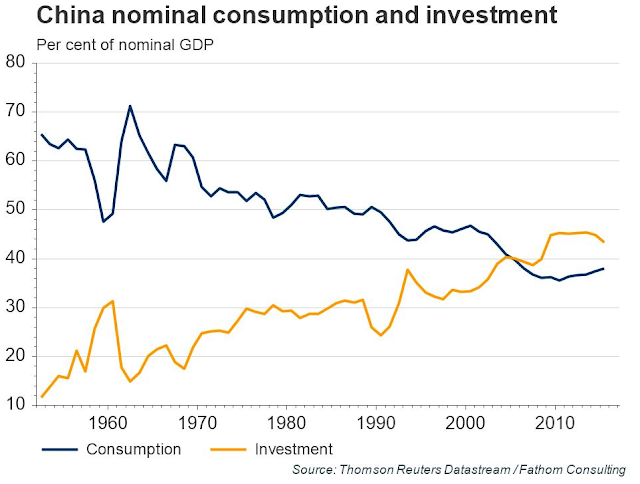

What about re-balancing the economy? Macro level data suggests that rebalancing from investment to household consumption is under way.

For a “real time” market based assessment, this chart of “new consumer China” vs. “old financial and infrastructure” China pairs trades also shows the ascendancy of the New China.

What doom and gloom?

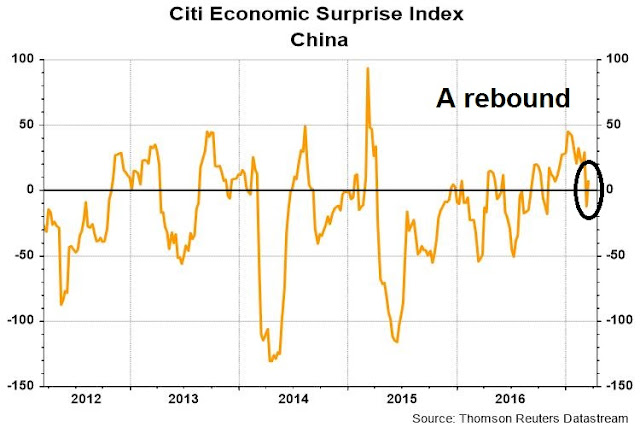

There have been a number of negative stories written about China recently, from myself included. But the data seems to be turning around. I had highlighted tanking China Economic Surprise Index (ESI), which measures whether macro reports are beating or missing expectations. China’s ESI appears to be enjoying a rebound.

Tom Orlik at Bloomberg observed that property prices are picking up again. If they continue to rise, it could spur higher growth estimates.

To be sure, Callum Thomas recently highlighted the leading effect of interest rates on Chinese property prices. Based on this chart, property prices are likely to plunge in late 2017.

For now, the reflationary party is in full force. Undoubtedly the Chinese leadership wants to hold everything together until their autumn meeting when Xi Jinping can consolidate power. Problems like falling real estate and their effects on an over-leveraged financial system can wait another day.

There is still time to party.

Good commentary today from a seasoned China watcher;

http://www.georgemagnus.com/china-has-regained-economic-stability-but-clues-are-in-the-weeds-of-finance/

Trouble brewing, but may not boil over for 2-3 years.

I agree completely. China isn’t going to blow up today, at least not before the Party Congress.

On the other hand, I’m not sure if the Day of Reckoning can be pushed out to 2-3 years. We could get an “accident” as soon as next year.

Why do we keep talking about REflation when, in fact, we mean INflation ?

This “reflationary” movement is nothing other than inflation. When we correct for real value of the money there will be nothing left.

China used to talk about the “paper tiger”. It seems to be turning out a “paper money” effect.