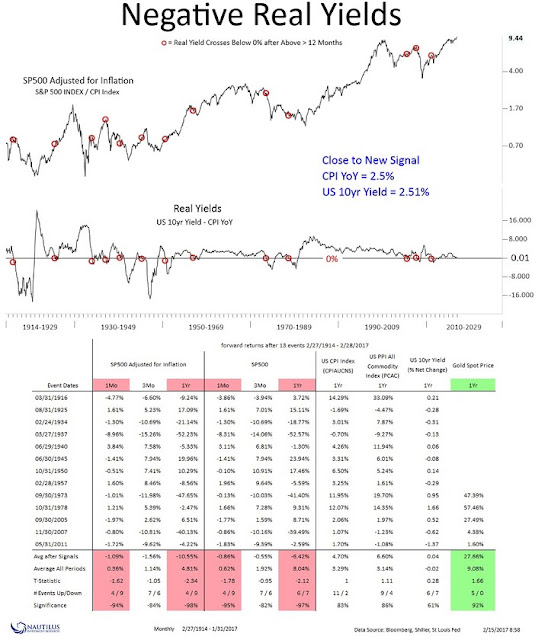

A reader asked me my opinion about this tweet by Nautilus Research. According to this study, equities have performed poorly once the inflation-adjusted 10-year Treasury yield turns negative. With real yields barely positive today, Nautilus went on to ask rhetorically if the Fed is behind the inflation fighting curve.

Since the publication of that study, The January YoY CPI came in at 2.5%, which was surprisingly high. The higher than expected inflation rate pushed the 10-year real yield into negative territory. So is this a sell signal for equities?

Well, it depends. The interpretation of investment models often depends a great deal on their inputs. In this case, the questions is how does we adjust for inflation? Do we use the headline Consumer Price Index (CPI), core CPI, which is CPI excluding volatile food and energy prices, or some other measure?

As I go on to show, how we adjust for inflation dramatically alters the investment conclusion for a variety of asset classes, like equities, gold, and the USD.

As is the case in the application any quantitative model, the devil is in the details.

Real yields and equity returns

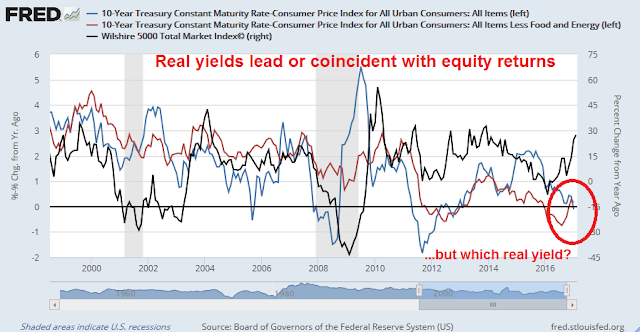

Consider the evidence. As the FRED chart below shows, history shows real yields indeed either lead or are coincidental with equity returns. If we adjust for 10-year Treasury with headline CPI, the outlook is equity bearish. On the other hand, adjusting with core CPI leads to a bullish conclusion.

Which inflation measure should we use?

Real yields and the USD

There is a more direct empirical relationship between real yields and the level of the US Dollar. As real yields rise, it puts upward pressure on the USD. So which inflation rate should we use?

Real yields and gold

Historically, the price of gold has been inversely correlated with the USD. Since gold is thought of as an inflation hedge, it is therefore no surprise that low real yields are gold bullish and high real yields are bearish (note the inverse scale for the gold price, right axis).

Our intermediate term outlook for these asset classes therefore crucially depend on the correct interpretation of the inflation adjustment factor. Do we use headline CPI, or the less volatile core CPI?

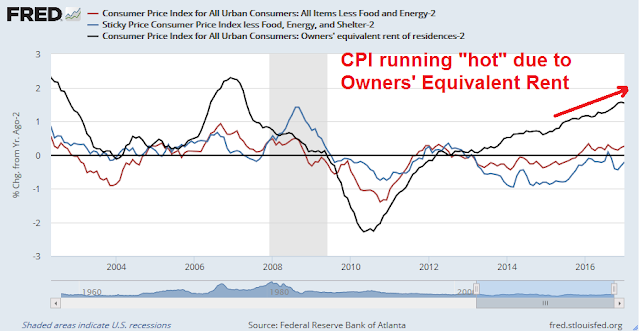

A “hot” CPI print

The CPI print last week came in ahead of expectations. YoY CPI was 2.5% (vs. 2.4% expected), and core CPI was 2.3% (vs. 2.1% expected). As I showed in my previous post (see Watch what they do, not just what they say), most of the strength in CPI was attributable to rising Owners’ Equivalent Rent (OER), which comprises of 25% of the weight of CPI and 31% of core CPI, according to the latest BLS figures. (Note that the chart subtracts 2% from each CPI metric so that we can easily see whether each is above or below the Fed’s 2% inflation target.)

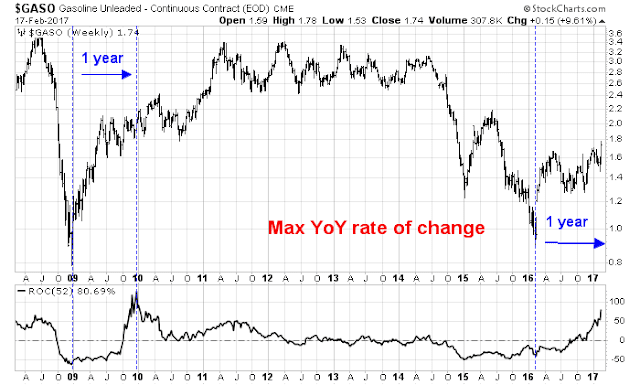

Much of the recent boost to headline CPI compared to core CPI is attributable to surging gasoline prices. As the chart below shows, YoY gasoline prices are due to peak and headline inflation should start to moderate in the months ahead.

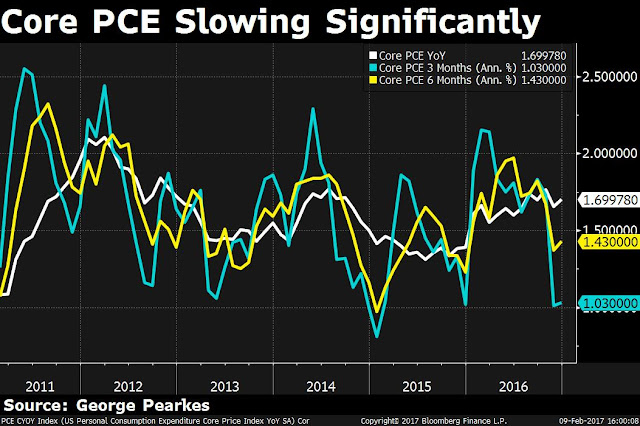

After dissecting the components of CPI, my conclusion is that inflation remains tame after stripping out the more volatile components and OER, which can be ignored for the purposes of this analysis. I have also highlighted past analysis from George Pearkes that core PCE, which is the Fed’s preferred inflation metric, has been slowing.

In conclusion, investors shouldn’t panic about negative real yields based on an erroneous interpretation of inflation. Unless conditions change dramatically, the intermediate term outlook for the USD and equities is bullish. Conversely, gold bulls will face headwinds from positive real yields.

This chart is of the Inflation Surprise Indexes of several key counties and regions. They operate like the CITI Economic Surprise Indexes. U.S. and Canada are undershooting forecasts while Europe is showing a great deal of upward surprises. If anywhere is getting behind the curve, the Euro microscopic rates versus inflation is the place.

https://product.datastream.com/dscharting/gateway.aspx?guid=332519cb-bf14-4c37-b4c7-fdc6d943da3d&action=REFRESH

Keep the link, it updates dynamically.