Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. Past trading of the trading model has shown turnover rates of about 200% per month.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Risk-on

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers will also receive email notices of any changes in my trading portfolio.

Trump’s challenge

Now that Donald Trump is the President of the United States, the real work of his administration begins. In inauguration speech, he invoked the spirit of Horatio Alger as a way to take America to new heights:

Finally, we must think big and dream even bigger. In America, we understand that a nation is only living as long as it is striving…

Do not allow anyone to tell you that it cannot be done. No challenge can match the heart and fight and spirit of America. We will not fail. Our country will thrive and prosper again.

Ray Dalio of Bridgewater Associates was optimistic about this “can-do” attitude of Americans:

This new administration hates weak, unproductive, socialist people and policies, and it admires strong, can-do, profit makers. It wants to, and probably will, shift the environment from one that makes profit makers villains with limited power to one that makes them heroes with significant power.

Despite inheriting an economy that is in the late stages of an expansion, Dalio believes that the incoming president can spark a second wind of growth by reviving the economy’s “animal spirits”:

This particular shift by the Trump administration could have a much bigger impact on the US economy than one would calculate on the basis of changes in tax and spending policies alone because it could ignite animal spirits and attract productive capital. Regarding igniting animal spirits, if this administration can spark a virtuous cycle in which people can make money, the move out of cash (that pays them virtually nothing) to risk-on investments could be huge.

Bob Shiller went further and postulated a speculative stock market blow-off, followed by a crash (via The Telegraph):

America should brace for a final blow-off surge in stock markets akin to the last phase of the dotcom boom or the “Gatsby” years of the Roaring Twenties, followed by a cathartic crash and day of moral judgment, according to a Nobel prize-winning economist.

Prof Robert Shiller said the psychological “narrative” behind Donald Trump is powerful and likely to carry Wall Street to giddy heights before the aging business cycle finally rolls over.

“I think there will be a Trump boom for a while. Stocks look high, but they are not yet super-high. In 2000 the (Cape Shiller) price-earnings ratio was over 45 and we may see a repeat of that,” he told The Daily Telegraph.

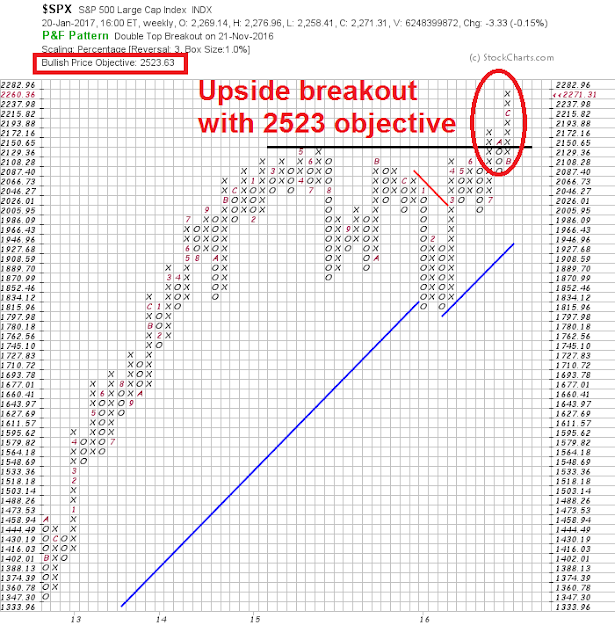

For investors, the stakes are high. Under this scenario, a Trump inspired “animal spirits” revival could spur the SPX to its point and figure target of 2523 or more.

The question is, can Trump spark the “animal spirits” to Make America Great Again?

A mature expansion

Despite Trump’s rhetoric about a revival of an America that’s on its knees, he inherits an economy that is growing and in the late stages of an expansion. This chart of initial jobless claims, normalized by population, shows that initial claims are at or near all-time lows.

Unemployment has been falling in the wake of the crisis of 2008, and it is at levels consistent with rising wages and rising inflationary pressures. These are further signs of a late cycle expansion, which is usually followed by the start of a Fed tightening cycle that ends in recession.

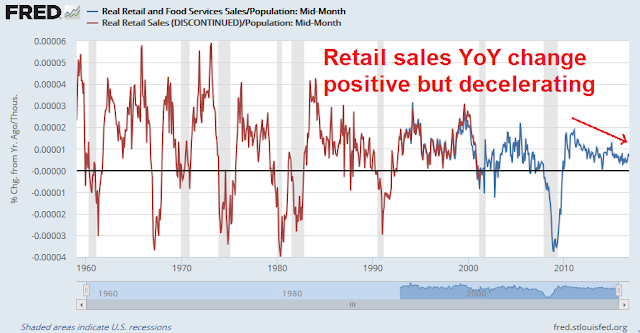

In addition, retail sales are robust, but decelerating, which is another indication of a late cycle expansion.

A second wind?

The counterfactual to these rosy economic statistics is the discontent that elected Donald Trump. True, the job picture has improved considerably since 2008, but the quality of jobs haven’t returned. For much of Main Street America, the “animal spirits” in the form of business dynamism has been missing. Economic Innovation Group found that most of the counties that swung from Obama to Trump in the election experienced a decline in business dynamism:

It appears that business closures helped the president-elect poach counties that had voted for President Obama twice before. Of these 209 counties, roughly 75% saw more businesses close than open from 2010 to 2014. It’s important to note that these counties ran the gamut from affluent to distressed; highly educated to below average; overwhelmingly white to majority-minority. In spite of their many differences, a decline in business dynamism is where the vast majority found common ground.

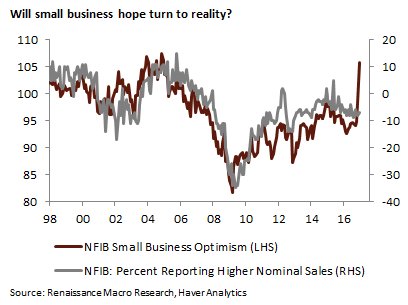

In the wake of Trump’s electoral win, Small business confidence has soared, though we have yet to see the revival in actual sales (see last week’s post Main Street bulls vs. Washington bears).

View through Main Street’s prism, Trump`s triumph has woken the economy’s dormant “animal spirits” out of hibernation.

Economic “animal spirits”

There are other ways of defining “animal spirits”. If we were to think about the idea of “animal spirits” like an economist, we might think of it in the monetary framework of:

MV = PQ

Where M = money supply, V = velocity, P = price, and Q = quantity

In other words, GDP (= Price x Quantity of goods and services) is a function of money supply growth and monetary velocity. While monetary theory held that V is constant over time, that hasn’t been true in practice. As the chart below shows, M1 money supply growth has been positive, which indicates that Fed policy remains acccommodative. However, monetary velocity has been falling dramatically, which has offset the Fed’s stimulus efforts through lower interest rates and several rounds of quantitative easing.

If the economy’s “animal spirits” were to revive, then one sign would be a rise in monetary policy. That hasn’t happened yet, though monetary velocity is a quarterly data series that is slow to update and therefore that data set is reported with a lag.

Investment’ “animal spirits”

If we were to think about “animal spirits” from an investor’s viewpoint, it would be in the form of investor sentiment. As the chart of AAII sentiment shows, weekly readings are volatile and noisy. The 52-week moving average of the bull-bear spread (blue line) shows that long-term investor sentiment remains at depressed levels.

Indeed, this chart of the relative performance of high beta stocks against low-volatility stocks, which were the investment darlings of last year, shows that risk appetite is starting to revive. However, sentiment is nowhere near levels that could be described as frothy or a crowded long.

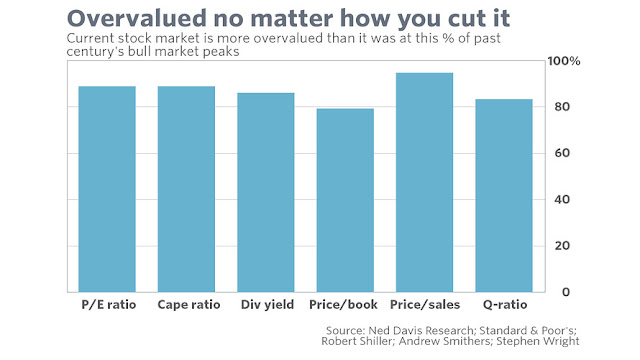

Recently, Mark Hulbert warned about valuation headwinds for stock prices and argued that stock prices were overvalued on a variety of metrics.

While I don’t necessarily agree with Hulbert’s assessment (see Top-down meets bottom-up: How expensive are stocks?), the one element that has been missing in this market cycle is the presence of excessive bullishness as one of the prerequisites of a market top. If investor “animal spirits” were to revive and we see a blow-off top, then that requirement would be complete.

Animal spirits: The bull case

So where does that leave us? The bull case is based on preliminary evidence of the revival of “animal spirits”. Ed Yardeni is optimistic:

A week after his election victory, I concluded that incoming President Donald Trump could succeed in stimulating economic growth, so I raised my real GDP forecast for 2017 from 2.5% to 3.0%. Since then, I’ve been keeping track of all the signs showing a revival of “animal spirits” in surveys of consumer and business confidence.

His YRI Weekly Leading Index, as well as the ECRI Weekly Index, have been surging.

Jim Paulsen of Wells Capital Management is showing a similar level of cautious optimism. The chart below depicts a composite of investor, small business, and consumer confidence, all of which have surged to new cycle highs.

Paulsen went on to ask if investors are positioned for the next possible upleg:

Indeed, both investor and business confidence have probably spurted to unsustainable levels recently. Although both may decline somewhat again, given the impressive confluence of factors (shown above) which have recently formed to provide a foundation for this renewed optimism, it seems possible that overall private player confidence might remain much stronger during the balance of this recovery.

Investors may want to ruminate a bit on whether they are prepared and positioned for a potential second “confidence driven leg” to this economic and financial market recovery?

Animal spirits: The bear case

The bear case is based on the assertion that much of the factors behind the “animal spirits” consist of mostly smoke and mirrors.

Consider, for example, Ed Yardeni’s observation of a rise in growth expectations. As the chart below of forward 12-month EPS from Factset shows, investors need to distinguish between the cyclical effect of a growth revival, and the “animal spirits” effect. Forward EPS had already been rising well before the election, so what we are observing might be a cyclical effect, rather than a second wind of growth based on improving business dynamism.

As for Trump’s claims of bringing jobs back to America, Josh Brown observed that corporate executives have learned to play the game:

Either before or after the tweet is sent about your company, you make a trip to Trump Tower on Fifth Avenue or to Mar-a-Lago (which will be the new combination White House / Camp David, by the way) and you parade ostentatiously before the bank of TV cameras. “Look at me! I’m down with the President’s agenda!”

Then a half hour later, you come down the golden elevator with the man himself, who holds an impromptu Q&A with you, as part of his end of the deal. Announcements of new jobs are made. New factories. New initiatives that will be undertaken, ASAP. Then he goes back up in his golden elevator for the next meeting and you get another 10 minutes of face time with the news crews. You grin optimistically, knowing that you and your company are off the Twitter shit list for awhile.

Mission accomplished.

It’s an old playbook, imported from the east. More on that in a moment.

One of the obvious things going on here, at least to the business world, is that much of this is just another reality show. There’s truth to these corporate pronouncements, but there’s plenty of artifice as well. It’s a pageant of sorts, designed for the consumption of the masses. To which I’d say, so what? If it gets the job done, let the man put on his show. Just don’t get overly excited about any sort of national transformation.

Business goes on as before. It really is all smoke and mirrors.

Resolving the bull and bear cases

So what’s the answer? Can Donald Trump spark the “animal spirits” in the economy? The jury is still out. Here are some observations from Avondale’s company notes:

The optimism is palpable

“The optimism for positive change here at Bank of America and among our customers is palpable and has driven bank stock prices higher. We will have to see how these topics play out, but we are optimistic.” —Bank of America CEO Brian Moynihan (Bank)There’s a lot of optimism but not a lot of action

“there’s more optimism and positive commentary for a lot of our business customers. But we haven’t seen a significant change in utilization or actually take down of credit yet. So while the talk is there, the actual action is not yet shown itself.” —US Bank COO Andy Cecere (Bank)“What I’m cautious about is nothing has actually happened yet, other than there has been a move in rates, right, and it changes sentiment. And I think we need to start seeing some of confirmations get through. We need to see real progress on tax reform. We need to see real progress on infrastructure, spending bills of state and local, and then all of a sudden, this thing takes flight, but right now, it’s just people talking about it.” —PNC CFO Rob Reilly (Bank)

For the last word, I conclude with a CNBC interview with Ray Dalio. Notwithstanding his tremendous optimism about the “can-do” attitude of Americans, Dalio believes that the market had largely discounted the obvious changes, such as the Trump tax cuts. Now there are more questions than answers with regards to policy implementation, such as how Trump’s fiscal plan gets turned into legislation, as well as geopolitical questions like as Sino-American relations.

In the coming weeks, we will undoubtedly see some of the bumps in the road that will create uncertainty, raise the risk premium, and spook the markets. The latest BAML Fund Managers Survey shows that fund managers are deathly afraid of a protectionist backlash, or US policy error (annotations in red are mine).

Indeed, assertive language like this on trade on the White House website will undoubtedly unnerve investors:

President Trump is committed to renegotiating NAFTA. If our partners refuse a renegotiation that gives American workers a fair deal, then the President will give notice of the United States’ intent to withdraw from NAFTA.

In addition to rejecting and reworking failed trade deals, the United States will crack down on those nations that violate trade agreements and harm American workers in the process. The President will direct the Commerce Secretary to identify all trade violations and to use every tool at the federal government’s disposal to end these abuses.

We will see next week how much of these fears have been discounted by the market.

The week ahead

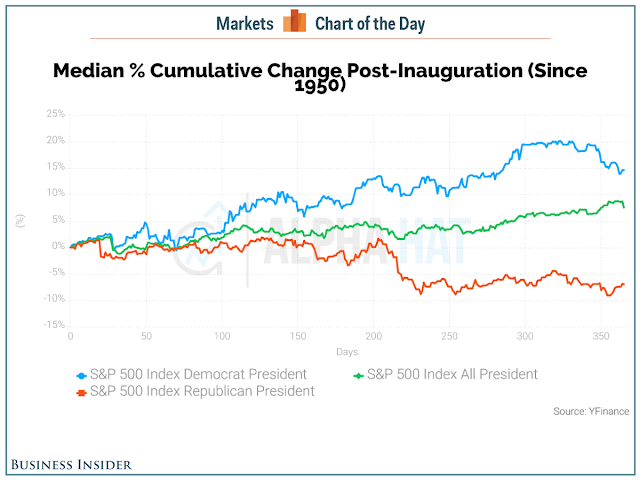

Looking to the week ahead, the stock market will face its first test under a Trump administration. At a minimum, can it at least conform to the inauguration pattern as outlined by Alpha Hat (via Business Insider)? Historically, the market typically rallies for about two weeks after inauguration, followed by a February correction. Longer term, however, Republicans president markets have tended to underperform.

The market action on Friday did not give any strong clues. The hourly chart of the SPY shows that the market broke down through and uptrend on Thursday, but rallied to (barely) regain the trend line. At this point, it’s unclear whether the breakdown below the trend line was a false break.

My inner investor remains long the market. His base case scenario calls for a shallow correction in Q1, followed by a rally later in the year. Market internals appear to be setting up for a period of sideways consolidation or pullback (see The contrarian message from rotation analysis).

My inner trader still has a small short position in the market, but he will close that short should the market break out to new highs.

Disclosure: Long SPXU

Thank you, Cam. Would appreciate any comments you have on precious metals in the present environment. Thank you for your excellent work

Cam I think the market is not focusing on two issues. One is market related. There is a heavy short position in the VIX futures and the VXX. Any short term correction will cause a tremendous spike in these two instruments leading to a cascading decline. The first major support is about 5% from these levels. So, the risk at a minimum is 5% about 2150 on the S&P 500.

The other issue is more Trump’s personality. As is evident he tends to shift the blame on different institutions. Today, he is at “war with the press”. I can envision a time if he does not get his way he will pick a fight with congress and his party Republicans. Some of them are coming up for elections in two years. More disconcerting is a fight with the Federal Reserve and its interest rate policy which would has an impact on the U.S. dollar. Based on these considerations volatility is going to increase dramatically. More so now as the VIX is very low. The trend yet might remain up but the swings might get wilder.

Cam, did you close that short yet?