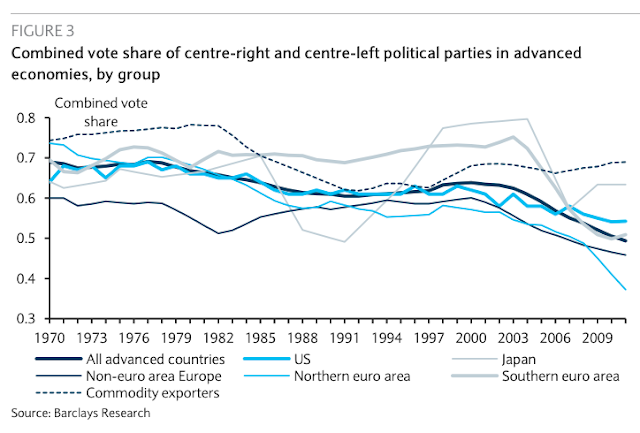

As the American elections approach their final denouement in two weeks, it’s time to look ahead to a number of political dark clouds forming in Europe. FT Alphaville recently highlighted research from Barclay’s showing the collapse in support of establishment parties around the world.

The support for anti-establishment and protest parties and candidates have been on the rise – and these individuals represent threats to upset the current political status quo. After the US election in November, we have to look forward to the Italian referendum on December 4, the start of Brexit negotiations in early/mid 2017, the French election, and the German election. All of these events have the potential to tear Europe apart.

I believe that fears over the political disintegration in Europe may be overblown. Arguably, we could be seeing a near-term peak in the support of the protest vote in 2016 and 2017.

The pain in Spain

The first piece of good news came from Spain. After 10 months of impasse, the opposition PSOE abstained in a vote to allow Mariano Rajoy’s PP to form a minority government. Spain had undergone two elections in the last year and was at risk of a third one in the face of deadlocked electoral results, but this compromise allowed the country to have some form of political direction again. Even without a government, Spanish GDP growth was outperforming the euro area:

But the deficit is still above target and action is needed to bring it under control. This could not be done without a government in place.

Score this as a narrow win for the establishment.

The Italian referendum

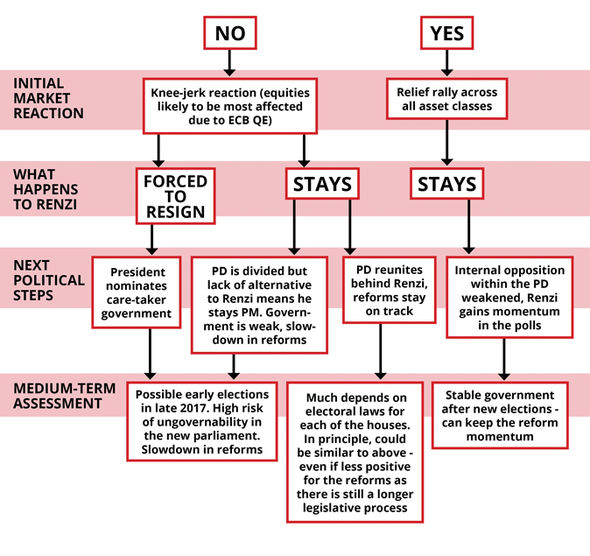

Next up, we have the potential disruption caused by the Italian constitutional referendum, which is scheduled for December 4. Italian PM Matteo Renzi called for a national vote to reform the constitution in order to make Italy more governable. This way, his and future governments can minimize the endless political deadlocks that Italy has experienced in the post-war era. Rezni further raised the stakes by stating that he would quit if the “No” vote prevailed, which would open the door to the Euroskeptic Five Star Movement coming to power. Such an electoral failure has the potential to throw the Eurozone into another crisis (think Greece magnified by ten). The combination of a wobbly Italian banking system and an anti-establishment populist party will undoubtedly spook the markets. HSBC has sketched out the possible outcomes of the referendum with this chart (via Daily Express):

The latest betting odds from Ladbrokes shows an implied probabilities of “No” at 54% and “Yes” at 46%. The outlook appears bleak.

Peak populism?

However, the future may not be as dire as it seems. Even if Renzi were to lose the referendum, the Five Star Movement may not form the next government. In the past few years, we have either seen a collapse in the anti-establishment vote as a country approaches the brink (Le Pen in France, Trump in the US), or the failure of reform programs put forth by Euroskeptic parties.

For example, consider the experience of SYRIZA in Greece. SYRIZA was elected twice in consecutive elections on an anti-European platform. The (then) new government underwent some difficult negotiations with the Eurogroup. During the course of the discussion, Prime Minister Alexis Tsipras gambled and called a disastrous referendum on European proposals. He won his mandate to say “no” to Europe, but eventually backed down and acquiesced to even more unfavorable terms than what was originally offered. Despite these setbacks, Greece did not leave the euro, and the world did not end.

Europe made an example of Greece. Undoubtedly other Europeans were watching.

In Italy, the Five Star Movement (M5S) made some surprising gains in local elections as its candidates won the mayoral race in Turin and Rome. Even then, the party ran into trouble. Here is the BBC`s account:

Five Star’s newly elected mayor of Rome, 38-year-old lawyer Virginia Raggi, finds herself in trouble.

She has picked an environment chief, Paola Muraro, who is currently under investigation for her 12-year period as a consultant for the city’s waste company. And sorting out Rome’s rubbish collection is one of the city’s most important jobs.

What’ is worse is this: At first Ms Raggi denied knowing about the criminal investigation. Weeks later she admitted that Ms Muraro had, in fact, told her about it in July.

Deny-and-then-admit is a damaging political combination.

The episode strikes at the heart of the Five Star Movement’s reputation.

M5S made its name through its anti-corruption promises. Now, it finds itself bogged down in the same ground as other Italian political parties routinely accused of mismanagement and corruption.

Here is The Economist’s Intelligence Unit on the political headwinds faced by M5S:

The Raggi administration has had a difficult start. The formation of the city government was delayed owing to disagreements within M5S regarding appointments, with the national leadership of the movement seen to impose its will in the end. The capital’s citizens have high expectations of Ms Raggi, so even though she only came into office at the end of June, their patience might run out quickly if she is not seen to be solving problems. Intense media attention on the continued build-up of uncollected rubbish on the streets of the city has not helped. According to one opinion poll by a market researcher, Winpoll, for the Huffington Post, an online news source, in early August, 41% of those surveyed in Rome viewed Ms Raggi’s performance as positive and 59% did not.

Ms Raggi will be keen to avoid the fate of Federico Pizzarotti, the mayor of Parma and M5S’s first leader of a major municipality. In 2012 Mr Pizzarotti came into office under similar circumstances to Ms Raggi: Parma had been chronically mismanaged by previous administrations and was on the verge of a municipal debt crisis. The M5S mayor, previously an IT consultant with no experience in government, quickly became a symbol for Mr Grillo and his party. However, despite implementing a number of reforms and making headway towards improving Parma’s accounts, Mr Pizzarotti eventually fell out with Mr Grillo and Mr Casaleggio. Owing in part to his investigation for allegedly abusing his office, Mr Pizzarotti was expelled from M5S in May 2016. He currently remains in office and denies any wrongdoing. Given the higher profile of Ms Raggi’s role, M5S’s national leaders will be keen to avoid airing any tensions with her administration so publicly. A perception that Ms Raggi has done too little to change Rome, like Mr Pizzarotti in Parma, could eventually be damaging for M5S at the next general election, but in our view it is unlikely that any missteps will be enough to benefit Mr Renzi and the PD before the referendum.

Like SYRIZA, M5S has demonstrated a spotty record in actually being able to govern once it’s in power. The experience in Rome and Parma could be viewed with skepticism by the Italian electorate should Renzi lose the referendum and fresh elections are called.

Brexit chaos: pour encourager les autres

For the ultimate in the success of the protest vote, we have to look not further than the mess called Brexit. In the wake of the referendum, prime minister Theresa May has signaled a “hard Brexit” in her recent speech to the Conservative Party faithful:

Whether people like it or not, the country voted to leave the EU. And that means we are going to leave the EU. We are going to be a fully-independent, sovereign country, a country that is no longer part of a political union with supranational institutions that can override national parliaments and courts. And that means we are going, once more, to have the freedom to make our own decisions on a whole host of different matters, from how we label our food to the way in which we choose to control immigration.

European directives will be replaced by British law:

The final thing I want to say about the process of withdrawal is the most important. And that is that we will soon put before Parliament a Great Repeal Bill, which will remove from the statute book – once and for all – the European Communities Act.

This historic Bill – which will be included in the next Queen’s Speech – will mean that the 1972 Act, the legislation that gives direct effect to all EU law in Britain, will no longer apply from the date upon which we formally leave the European Union. And its effect will be clear. Our laws will be made not in Brussels but in Westminster. The judges interpreting those laws will sit not in Luxembourg but in courts in this country. The authority of EU law in Britain will end.

As we repeal the European Communities Act, we will convert the ‘acquis’ – that is, the body of existing EU law – into British law. When the Great Repeal Bill is given Royal Assent, Parliament will be free – subject to international agreements and treaties with other countries and the EU on matters such as trade – to amend, repeal and improve any law it chooses. But by converting the acquis into British law, we will give businesses and workers maximum certainty as we leave the European Union. The same rules and laws will apply to them after Brexit as they did before. Any changes in the law will have to be subject to full scrutiny and proper Parliamentary debate. And let me be absolutely clear: existing workers’ legal rights will continue to be guaranteed in law – and they will be guaranteed as long as I am Prime Minister.

Bloomberg set out a chart of the relationships between European countries and their obligations. Under Theresa May’s vision for Britain, the UK start from the beginning and it be totally out of any and all treaty obligations with Europe.

Is it any wonder why the markets got spooked? In the wake of those statements, Nicola Sturgeon of SNP has called for another Scottish independence referendum in the event of a “hard Brexit”. In case anyone thought that the UK could easily conclude a successful trade agreement with the EU, the failure of the Canada-EU free trade agreement (CETA) over Wallonia objections represents a cautionary tale of how difficult trade deals are to negotiate. As a final insult, the lead EU negotiator has called for the talks to be conducted in French.

Forget a “hard Brexit”, Politico reported that a “dirty Brexit” is on the table after the latest European Council meeting;

At just after 1:30 a.m., Tusk appeared, bleary eyed, to explain the silence. “There will be no negotiations until Article 50 is triggered by the U.K., so we did not discuss Brexit,” he said.

Yet he couldn’t resist setting out the EU’s equally hardline position — no restrictions on free movement of people as well as goods, capital and services within Europe’s single market. “The basic principles and rules, namely the single market and the indivisibility of the four freedoms, will remain our firm stance.”

In other words: say what you like about taking back control of immigration, May, we hold all the cards in this negotiation.

Behind the scenes, EU officials have been given equally firm instructions.

Senior diplomats have been told to prepare for the possibility of no agreement being struck at all after two years of talks, two EU diplomats told POLITICO. On Thursday, David Davis, the Brexit Secretary, said that without a deal, the British economy could fall off a “cliff edge.”

If Europe wanted to make an example of Greece, it intended to make a even greater example of the UK, pour encourager les autres.

Is the European electorate watching?

Back from the brink

As chaos reigns, there are ways for both the Italian and British governments to claw their way out of the holes that they find themselves in. The WSJ reported that Matteo Renzi’s government approved a budget that raised its deficit targets, in defiance of EU guidelines:

Italy’s government on Saturday approved a 2017 budget plan that aims to avert tax increases as Prime Minister Matteo Renzi faces increasing pressure ahead of a national referendum over constitutional changes…

With the plan approved Saturday, the Italian government raised its budget deficit target to 2.4% of gross domestic product this year and to 2.3% in 2017, from its previous targets of 2.3% and 2.0% respectively, which could bring Italy into conflict with European Union rules aimed at reining in member states’ deficits.

Megan Greene interpret this move as typical European brinkmanship. Renzi is in effect telling Europe, “Either deal with me, or you’ll be dealing with the Five Star Movement next.”

Meanwhile, Canadian political scientist David Welch speculated that Theresa May’s latest initiatives are setting up the Brexiteers to fail:

Ms. May opposed Brexit before the referendum and has given no indication that she has since converted to the cause. Like any savvy politician, she cannot simply ignore the express will of the voters, but she knows as well as anyone that Brexit would be bad for Britain – and particularly bad for Theresa May. She has no interest in going down in history as a footnote to David Cameron’s folly, the overseer of Britain’s diminution, and possibly even the person who destroyed the United Kingdom, if Scottish voters prove sufficiently unhappy with the best deal London can strike with Brussels to vote to leave Britain and remain in the EU.

If Ms. May is preparing the groundwork to stay, she is doing it brilliantly. By stretching out the timetable as far as possible without raising anyone’s suspicions, she has given ample time to let Brexit buyer’s remorse gel. Bankers and major foreign investors such as Nissan have begun to signal their readiness to leave. Local councils are beginning to tally EU funds they will lose. Scottish nationalists are stirring.

Meanwhile, Ms. May has set up key Tory Brexit supporters to fail by giving them thankless cabinet assignments: Boris Johnson (Foreign Secretary), David Davis (EU Exit Secretary) and Liam Fox (International Trade). As time passes, it will become increasingly clear that none can hope to deliver what they promised the voters in June.

Don’t be surprised in March if, instead of triggering Article 50, Ms. May calls a snap election asking for a mandate to be released from her Brexit obligation. Striking a stateswomanlike pose, she could persuasively argue there is no good Brexit deal to be had and that Brexit voters, sold a bill of goods by the likes of UKIP’s Nigel Farage, voted in June on the basis of incomplete and inaccurate information and have a right to sober second thought. She could avoid the risk of a second referendum by correctly noting that a general election is the traditional means by which British governments seek mandates from the electorate. And she may be able to offer up a sweetener in the form of a “better deal” from Brussels than Mr. Cameron was able to muster.

The scenarios that I have laid out are highly speculative, but they are typical of the sturm und drang of European theatre. (That’s why the actors in this theatrical performance involved are politicians – they play politics.)

In the end, the worst case analysis may not be that dire. In fact, this may be precisely the sort of catharsis that the European electorate needs to see that anti-establishment and Euroskeptic parties may not offer the solutions they truly desire. In fact, those roads lead to disasters like the SYRIZA capitulation and Brexit chaos.

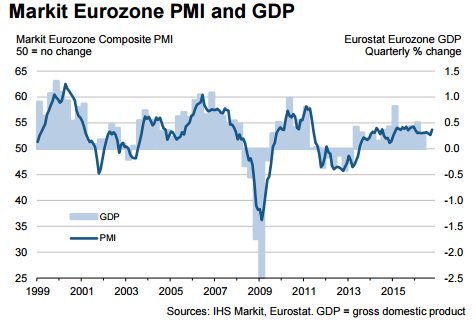

In the meantime, Markit reported that its Eurozone Composite PMI rose to a 10-month high and beat market expectations. Growth is surprising to the upside.

The European elites have everything under control (for now). All is right in the world.

From a European’s point of view, this is a first-class analysis of the situation here. The quality of your articles continues to be quite impressive, Cam — thank you.

Totally unrelated question / request for a write-up: do you have any opinions on the mid-term perspective of treasuries you could share? Since I use TLT (and its leveraged cousins) as a hedge I would be highly interested in your point of view.

Sure, in the last 100 years, there have been (I think) only three years when both stocks and bonds went negative. On the other hand, some people are saying This Time Is Different, since we have never before experienced negative interest rates.

Sorry, I don’t have much in the way of insights on USTs.

I appreciate your analysis. While in market impact terms your analysis may or may not be correct, I think you’re missing a key piece of the puzzle to at least consider. Dissatisfaction in the developed world among average voters is a trend on the rise. It is in reaction to lost jobs, negative real income growth for nearly two decades, concerns about immigration policies, and a sense that the elite is governing without the consent of the governed. It is larger in Europe where the elite truly is not even elected, but it exists in the US and Japan as well. I don’t think political gamesmanship is going to solve this dissatisfaction beyond the term discussed. Nor is it clear that picking poor new representatives will dilute it. Until the dissatisfaction of the average voter is resolved, it is quite possible that this movement at the voter level will continue to grow and surprise the elite periodically just as BREXIT and SYRIZA votes did.

I understand the angst that you refer to. In fact, ZH has a article that captures the alienation well: http://www.zerohedge.com/news/2016-10-25/how-half-america-lost-its-fking-mind

In Europe, however, we have had a history of the electorate edging back from the brink. As an example, Marine Le Pen, and before her that her father J-M Le Pen, has captured second place in the French presidential election for decades. When it came the crunch, the French have stepped back from their protest vote and opted for the other candidate.